peshkov

peshkov

A few days ago, I wrote an article titled, I’m Doubling Down On This ‘Safe’ Bet, in which I explained

“Just last week STAR announced that it had filed an amended 13D, disclosing that a special committee of the Board of Directors of STAR and a special committee of the Board of Directors of SAFE are in advanced discussions with respect to a potential strategic corporate transaction and that they are proceeding to negotiate definitive agreements.

This is no surprise to us, as we have been suggesting for months that STAR and SAFE should merge, and now that STAR has sold its net lease portfolio, the bulk of the remaining STAR assets are non-core legacy assets ($414 million) and loans ($204 million).”

Then I concluded the article as follows,

“As I have stated on previous occasions, a merger between SAFE and STAR could be the catalyst that Mr. Market has been looking for. I like my odds here, and this is one of the reasons I’m doubling down on this SAFE bet.”

The very next day we saw this headline news:

Yahoo Finance

Yahoo Finance

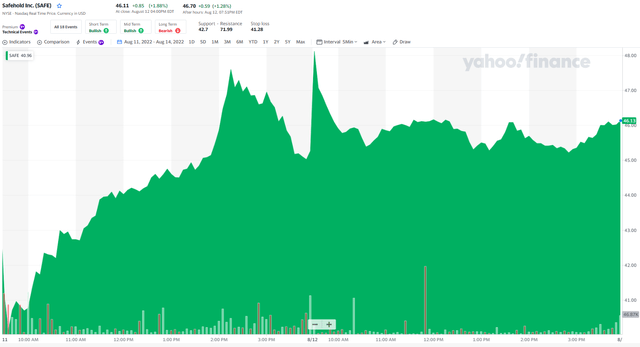

Of course, the reaction to the news was positive, as seen below:

Yahoo Finance

Yahoo Finance

Now, keep in mind, there is no need to declare a victory lap with Safehold Inc. (NYSE:SAFE) as shares are down over 42% year-to-date:

Yahoo Finance

Yahoo Finance

However, I am certainly happy to see the company internalizing with iStar Inc. (STAR), as we have contemplated this merger for quite some time. There are a number of reasons to remain bullish with this pure-play ground lease landlord so I thought I would cite them below.

MSD Partners (Michael Dell’s family office) will purchase 5.4M shares of SAFE from STAR, which STAR will use to pay down debt. MSD will also buy 100,000 units of Carat from SAFE for a total of $20M ($200/unit) – more on Carat later.

The stick deal (5.4 million shares) was at $37.00 per share which translates into a $200 million price, validated by Michael Dell’s family office. Keep in mind, MSD purchased the shares from STAR and while this transaction may seem unusual, keep in mind that Dell has a track record for investing in founder-led businesses like SAFE (run by Jay Sugarman).

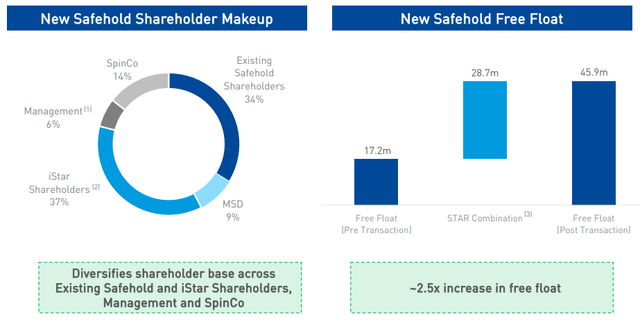

Also, included in the internalization of the external manager, SAFE will become a more “investable” stock with a broader set of investors. As viewed below, the transaction will more than double SAFE’s free float and diversifies its shareholder base.

SAFE Investor Deck

SAFE Investor Deck

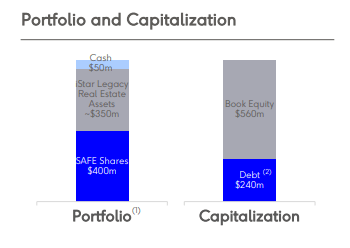

One big positive for SAFE is that the company will no longer be clouded by the complexity of its external manager STAR. And in order for STAR to remove the overhang it will spin its legacy assets into a publicly listed REIT (externally managed by SAFE).

STAR will move all remaining non-ground-lease assets and $400m of SAFE stock into SpinCo and as noted, sell 5.4m shares of STAR’s SAFE stock to MSD Partners for $200 million. As part of the internalization process, and as part of the transaction SAFE assumes $100 million L+150 Trust Preferred due 2035 from STAR and effectively issues 1.2 million of new SAFE shares to STAR.

STAR will retire its outstanding third-party debt (other than its $100 million Trust Preferred) and cash out its preferred equity. STAR will settle its long-term incentive plan (iPIP) using its existing shares of SAFE, reinforcing managements alignment.

The structure of the SpinCo will allow STAR shareholders to retain certain longer-term assets in order to facilitate a more efficient monetization.

SpinCo Overview (STAR Investor deck)

SpinCo Overview (STAR Investor deck)

In a previous CEO Ground Up interview, SAFE’s CEO, Jay Sugarman, told me,

… we try to stay in about a third of a $100 million-dollar building. And the ground lease will be somewhere between $35 to $40 million. It’ll be the most senior claim. So if you don’t pay the ground rent, you lose the whole $100 million building.

That almost never happens though, he added.

“Nobody’s going to give up their building because they don’t want to make a $50,000 payment.”

Yet at the end of a successful lease term, then, SAFE tracks the estimated value of whatever’s on top of the basis across the whole portfolio, after that, it reports the current estimates every quarter.

SAFE calls this unrealized capital appreciation, or UCA, which is currently estimated at $5.6 billion. This is a valuable component of its franchise value with the potential to grow significantly more over time.

SAFE calls this the Carat program, and you may recall that back in February SAFE closed on the sale of 108,571 units of its subsidiary that tracks and captures unrealized capital appreciation of the company’s portfolio and received a binding commitment for the purchase of 28,571 more for $24 million (representing 1.37% of the authorized units in Caret Ventures, a SAFE subsidiary).

The implied value of that deal was $1.75 billion and the investors were a group of fintech, property tech, institutional and high net worth investors, including Ribbit Capital, Fifth Wall, Zigg Capital, a large sovereign wealth fund, Kevin Durant, and Michael Rubin’s family office.

In addition to the $200 million SAFE investment, Michael Dell’s family office also said it was investing $20 million in Carat for 1.0% of the shares outstanding, that represents a valuation of $2 billion.

This is a modest pickup from the previous valuation ($1.75 billion vs $2.0 billion) but more importantly there are no redemption rights with the Dell deal, which means in all likelihood Carat will list shares as a REIT (Note: I will be writing a separate article on this topic for iREIT on Alpha members).

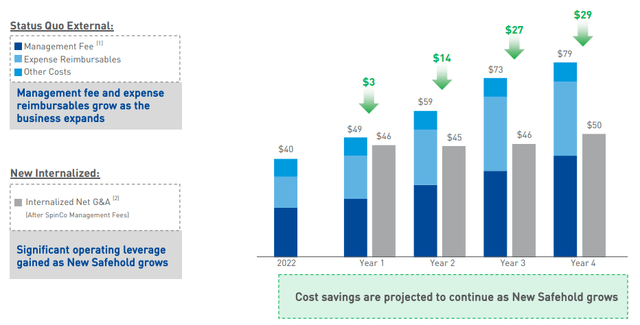

The proposed merger will allow SAFE to scale its business model for efficiently, under identical acquisition and capitalization scenarios, the internalization provides for maximum operating leverage with much new G&S cost.

SAFE Investor Deck

SAFE Investor Deck

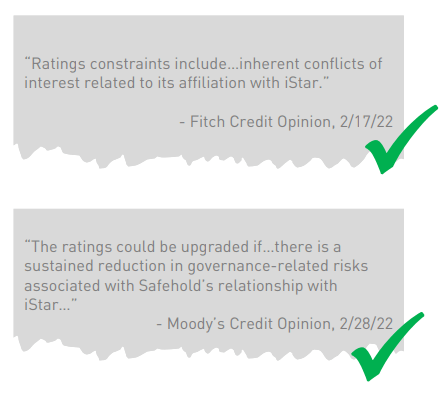

In addition, analysts are already acknowledging a better opportunity as Mizuho explained,

“We are upgrading SAFE to Buy (from Neutral) following the announcement SAFE is internalizing its external manager iStar…We view the contemplated restructuring favorably as it improves SAFE structurally while providing several financial, technical and operational benefits, which collectively justify a higher multiple. Further, we see a better entry point today with SAFE lagging the RMZ by 3,100bps YTD and with a more accommodative macro today (less inflation, interest rate risk).”

The greater float (2.5x higher pro forma) should drive higher weighting in various indices (RMZ, Russell) and improved equity costs. Also, it’s likely that SAFE gets its credit rating upgraded to A (by Moody’s) which will also lower SAFE’s debt cost.

SAFE Investor Deck

SAFE Investor Deck

You know me by now, I don’t like being political here on Seeking Alpha, as I respect everyone’s opinion. However, I thought this title was actionable and humorous…

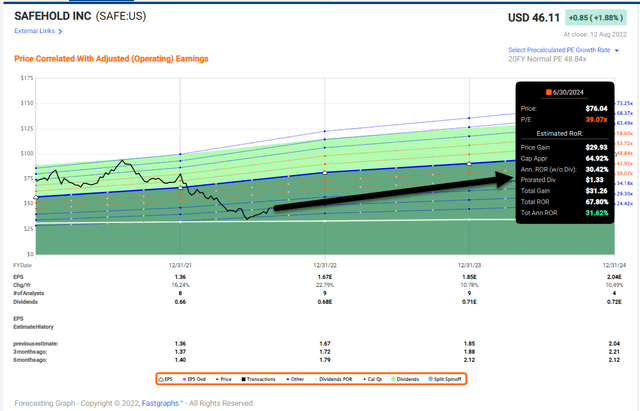

Anyway, iREIT maintains a STRONG BUY and we’re pulling the buy below target back to $60.00 based on a more conservative growth outlook (including analyst estimates).

Regardless, there’s an attractive total return outlook here and investors should also recognize there’s some execution risk (the merger is expected to close in Q4-22 or Q1-23.

FAST Graphs

FAST Graphs

As noted, I will be working on future articles related to SpinCo and Carat…

Stay tuned…

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Banks, and we recently added Prop Tech SPACs to the lineup. Direct message me about a great discount if you are a veteran or retiree.

Nothing to lose with our FREE 2-week trial.

This article was written by

Brad Thomas is the CEO of Wide Moat Research (“WMR”), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 102,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of SAFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.