Bruce Bennett

Bruce Bennett

Dallas-based Sunoco LP (NYSE:SUN) is the biggest fuel distributor in the US. It operates through 2 segments, Fuel Distribution and Marketing, and All Other.

The Fuel Distribution and Marketing segment purchases motor fuel from independent refiners and major oil companies and supplies it to independently operated dealer stations, distributors and other consumer of motor fuel, and partnership-operated stations, as well as to commission agent locations.

The All Other segment operates retail stores that offer motor fuel, merchandise, food service, and other services that include car washes, lottery, automated teller machines, money orders, prepaid phone cards, and wireless services. It also leases and rents real estate properties.

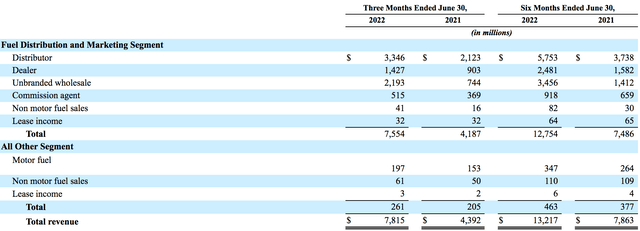

The Fuel Distribution and Marketing segment had ~97% of SUN’s sales in Q2 ’22, with revenue up 80%, due to higher prices, and additional volume from acquisitions.

SUN 10Q Q2 ’22

SUN 10Q Q2 ’22

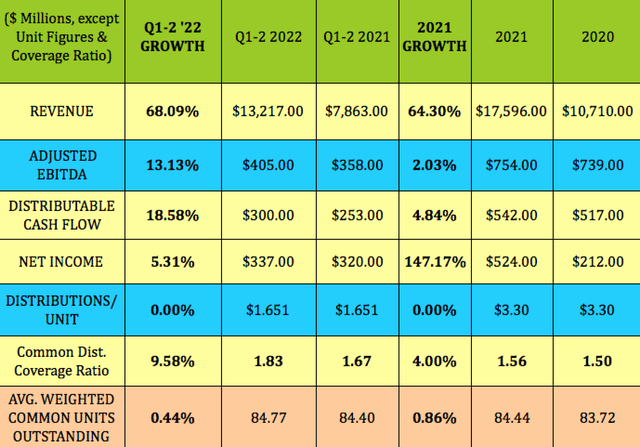

Revenue grew 68% in Q1-2 ’22, slightly more than in full year 2021, when it rose 64%. Q1-2 ’22 EBITDA rose 13%, and DCF grew 18.6%, which improved common unit distribution coverage by 9.58%, to a very strong 1.83X figure, vs. 1.67X in Q1-2 ’21. The unit count remained flat.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

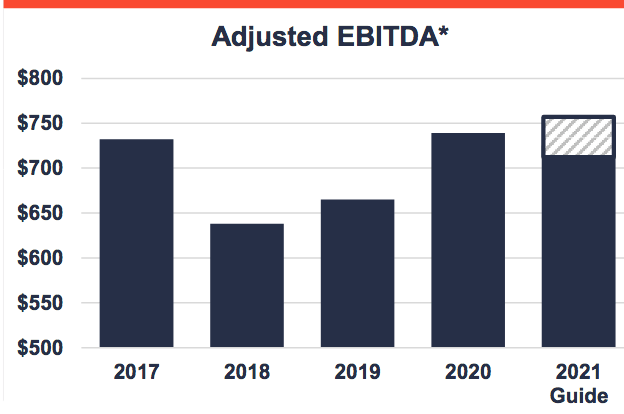

After pivoting to concentrate more on fuel distribution, SUN has had a steady growth in Adjusted EBITDA over the past few years.

SUN site

SUN site

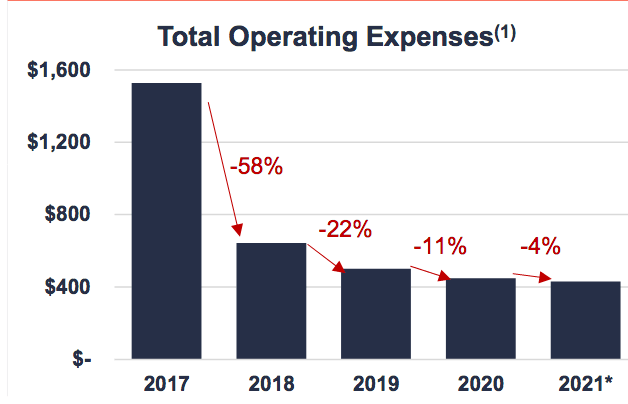

Management has also been steadily improving SUN’s Operating expenses since 2018:

SUN site

SUN site

Management reaffirmed its updated full year 2022 adjusted EBITDA guidance of $795M to $835M, which implies 10.7% growth for 2022 vs. 2021. If the unit count remains flat, SUN’s 2022 common distribution coverage should improve vs. 2021.

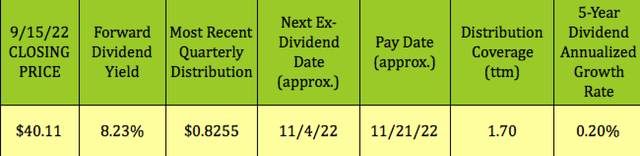

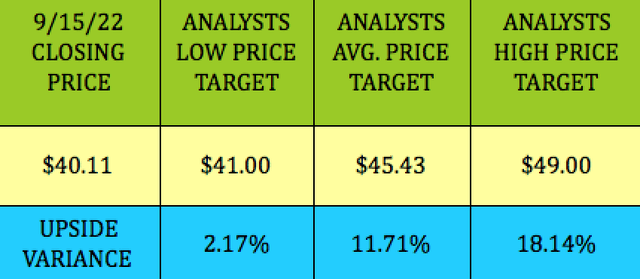

At its 9/15/22 $40.11 closing price, SUN yields 8.23%. Management has kept the quarterly distribution steady, at $0.8255 since Q3 2016, hence the minimal 0.20% 5-year dividend growth rate.

SUN should go ex-dividend next on ~11/4/22, with a ~11/21/22 pay date.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

SUN issues a K-1 at tax time.

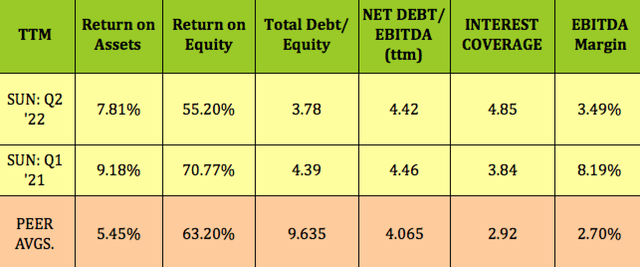

ROA, ROE and EBITDA all declined vs. Q1 ’21 figures, management has been paying down debt, as evidenced by the lower 3.78X Debt/Equity leverage, which is lower than the peer average. Interest coverage improved by ~100 basis points, to 4.85X, much stronger than the 2.92X peer average.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

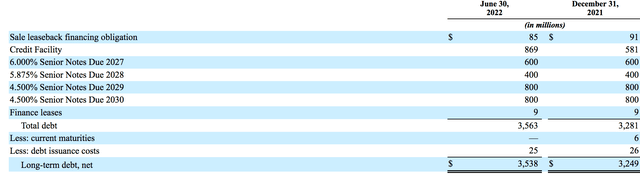

SUN’s The Credit Facility is a $1.50 billion revolving credit facility, expiring April 7, 2027. There was availability of $631M on the facility, plus Cash of $168M, giving SUN liquidity of $799M, as of 6/30/22.

SUN site

SUN site

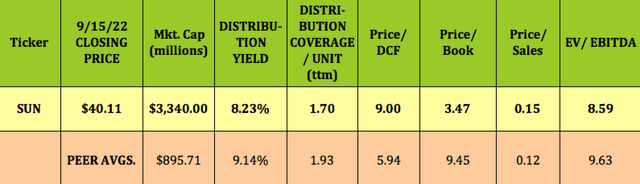

At its 9/15/22 $40.11 closing price, SUN is valued at a premium Price/DCF of 9X, vs. its peer average of 5.94X. However, it is much cheaper than average on a Price/Book basis, at 3.47X, vs. the 9.45X peer average, and somewhat cheaper on an EV/EBITDA basis.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

SUN received an upgrade from Neutral to Buy, with a $44 price target, from Mizuho Securities in late June 2022.

At $40.11, SUN is ~12% below analysts’ $45.43 average price target, and 2% below the $41.00 lowest target.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

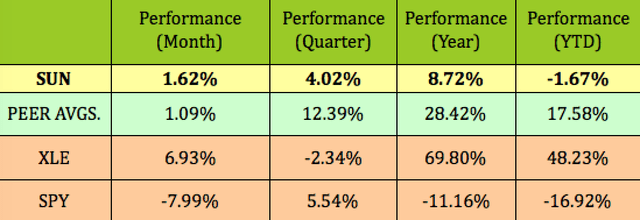

SUN has held up better than the S&P 500 over the past year and so far in 2022, but trails the broad Energy sector and its peers by a wide margin.

Hidden Dividend Stocks Plus

Hidden Dividend Stocks Plus

While SUN has outperformed the market so far in 2022, its lagging performance vs. the broad Energy sector implies that there are other sub-industries with more market support.

If you’re interested in other high-yield vehicles, we cover them every Friday and Sunday in our articles.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on diverse, undercovered, undervalued income vehicles, and special high yield situations.

There’s currently a 20% discount, and a 2-Week Free Trial on offer.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won’t see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Find out how our portfolio continues to beat the market by a wide margin in 2022.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

“Hidden Dividend Stocks Plus”, a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world’s markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.