The Latest News on Student Loan Forgiveness

18 Min Read | Aug 31, 2022

Six months in and 2022 is shaping up to be a year of uncertainty and worry for Americans when it comes their personal finances. Money issues from the end of 2021 like rising inflation followed people into the first quarter of 2022. Then, in the second quarter, inflation climbed to 40-year highs while housing prices continued their rapid rise—fanning the flames of economic insecurity and putting pressure on Americans who were just trying to keep up with their bills.

The latest edition of The State of Personal Finance 2022 examines how Americans are handling their financial struggles and what they’re doing to change habits and brace for what they believe might come next. Based on research Ramsey Solutions has done over the last 18 months, we can see a definite upward trend in all the different ways Americans are struggling with money.

In connection with the theme of financial struggles, the study also looks at the fast-shifting job market (which is still feeling the effects of The Great Resignation), as well as people’s overall outlook on the real estate market, and perceptions of legislation for student loan debt.

The most recent information in this study, which pertains to the second quarter of 2022, will be featured first, followed by the first quarter findings.

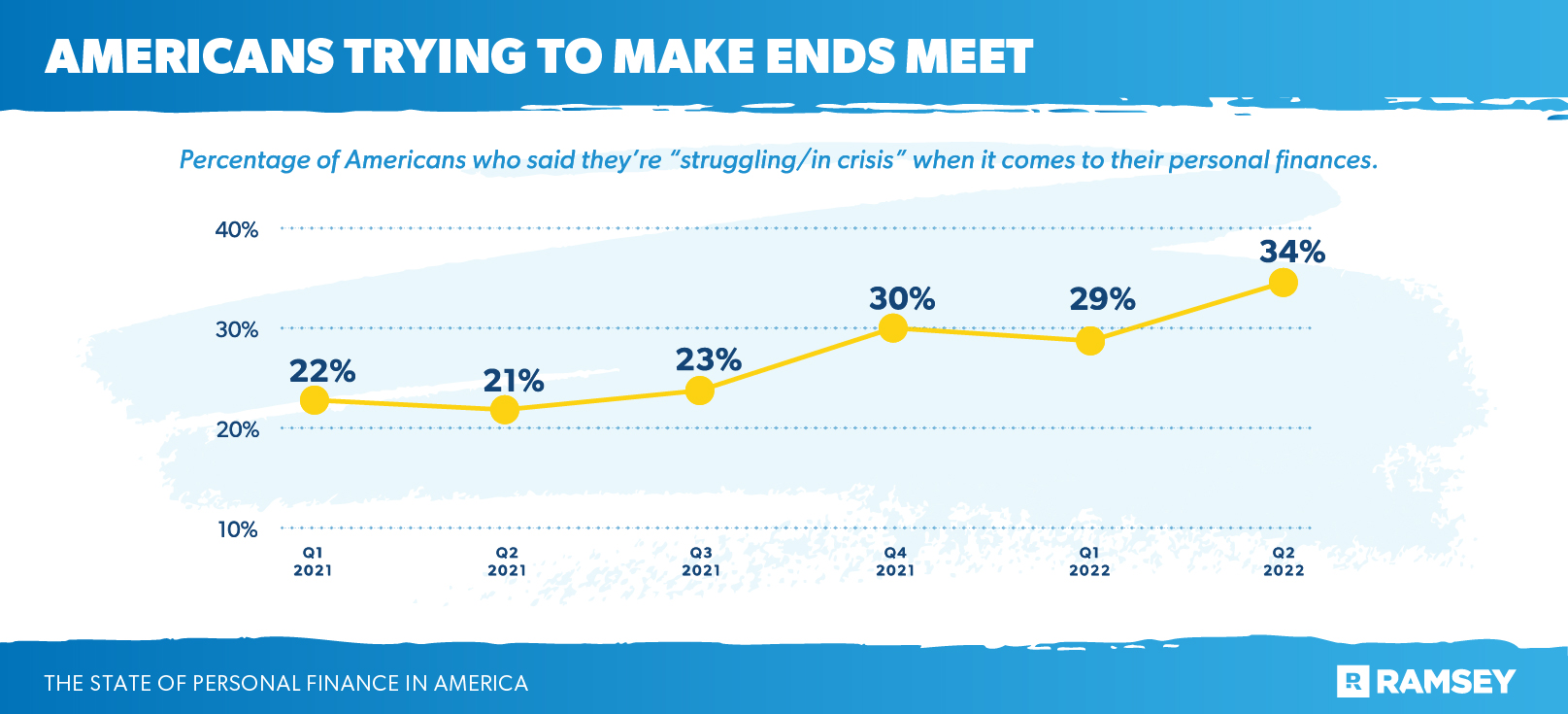

The daily struggle with money became more difficult for many Americans in the second quarter of 2022. One in three said they’re either struggling or in a crisis with their money. And the trend is moving steadily upward with a 12-point increase from the first quarter of 2021.

Over half (56%) of Americans said they had at least some difficulty paying their basic bills overall, while the number of people saying they struggled to pay for necessities like food and housing is on the rise. About 44% had trouble paying for food, up about 13 points from 18 months ago. Six in 10 renters said their housing costs were a strain (up 15 points) while nearly half (49%) of homeowners with mortgages found it hard to make their monthly payments, up six points from Q1 2021.

Younger Americans had the most trouble covering the basics when compared to their Baby Boomer parents and grandparents. Over 60% of Gen X, Millennials, and Gen Z (64%, 64%, and 67% respectively) faced difficulty paying their bills, compared to only 39% of Baby Boomers. About half of the younger generations (55% of Gen Z, 49% of Millennials, and 56% of Gen X) said they had trouble paying for food compared to only about a quarter of Baby Boomers (24%). Gen Z struggled the most with their mortgage payments (77%), and Gen X had the most difficulty paying rent (72%).

As with most things, debt made these issues even worse. People with debt had more trouble keeping their bills paid (66%) than those without debt (43%). The same was also true for paying a mortgage (53% vs 36%), rent (64% vs 57%), and for food (52% vs 32%).

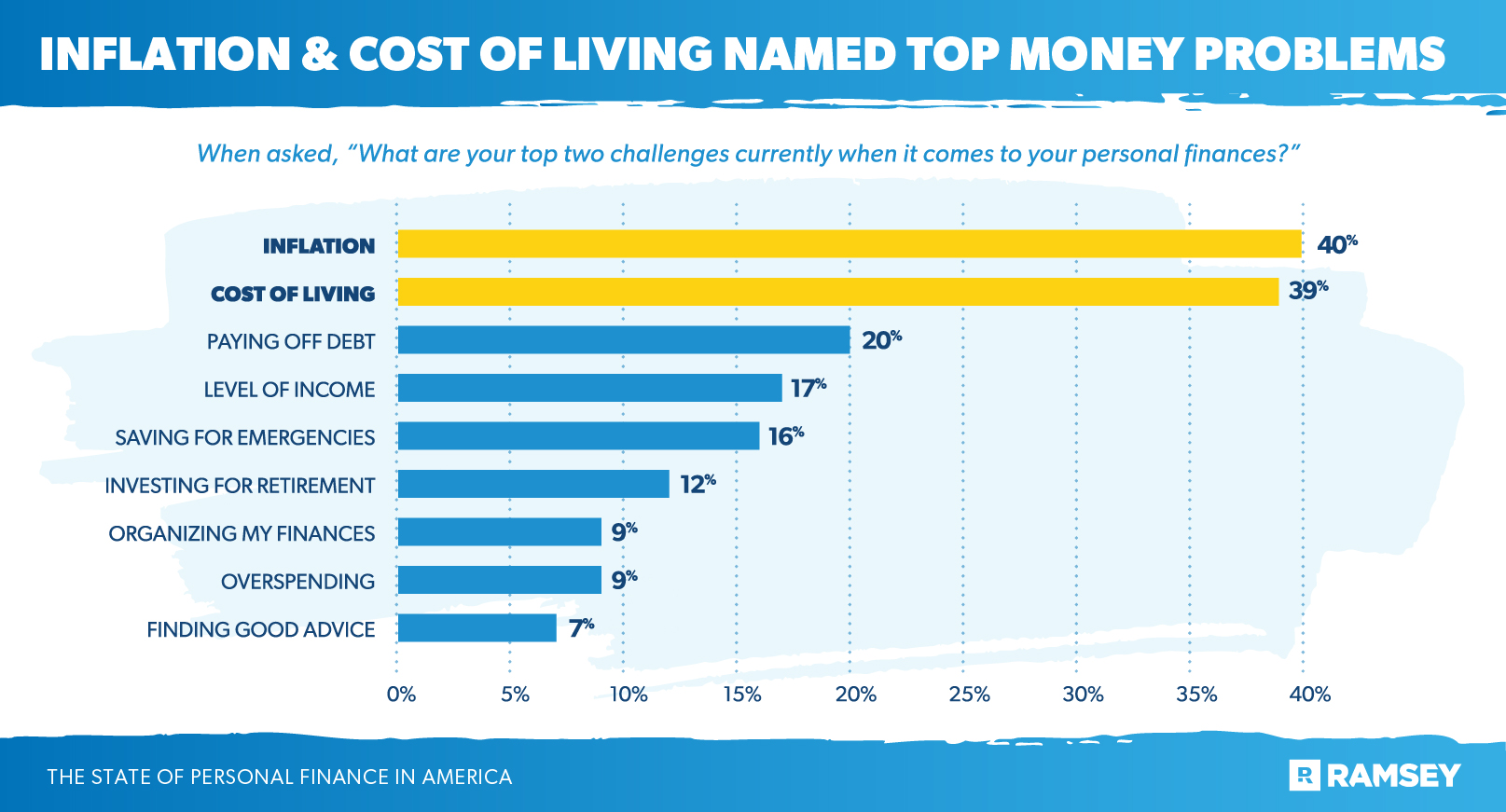

Americans’ two biggest challenges in paying for these basics were inflation (40%) and the cost of living (39%).

Consumers felt the effects of inflation the most with 85% saying it had at least some effect on their finances—up three points from last quarter. Inflation’s impact on Americans’ budgets has been trending up for the last three quarters.

As inflation continues to sap Americans’ spending power, most cut back on expenses to make ends meet, starting with travel. Seven in 10 said they cut back on their travel plans in the second quarter, continuing the trend from the first quarter. Other adjustments include not purchasing an item they had originally planned to purchase (41%) and reducing their monthly savings amount (33%) or debt payment (25%). Almost a quarter (22%) said they cut back on how much they’re putting away for retirement.

The money challenges of the last quarter encouraged many to keep better track of their money. Nearly three-quarters (73%) reported changes in their spending, saving, budgeting, or other money-related behaviors. Almost one-third (32%) said they started budgeting in some way.

Americans also found other ways to make their budgets work—some more helpful than others. 20% said they took on a second job or a side hustle to boost their income. 27% began selling items they had around the house. 25% said they used a credit card for a purchase they would normally pay for with cash. And 15% took on new debt to pay bills.

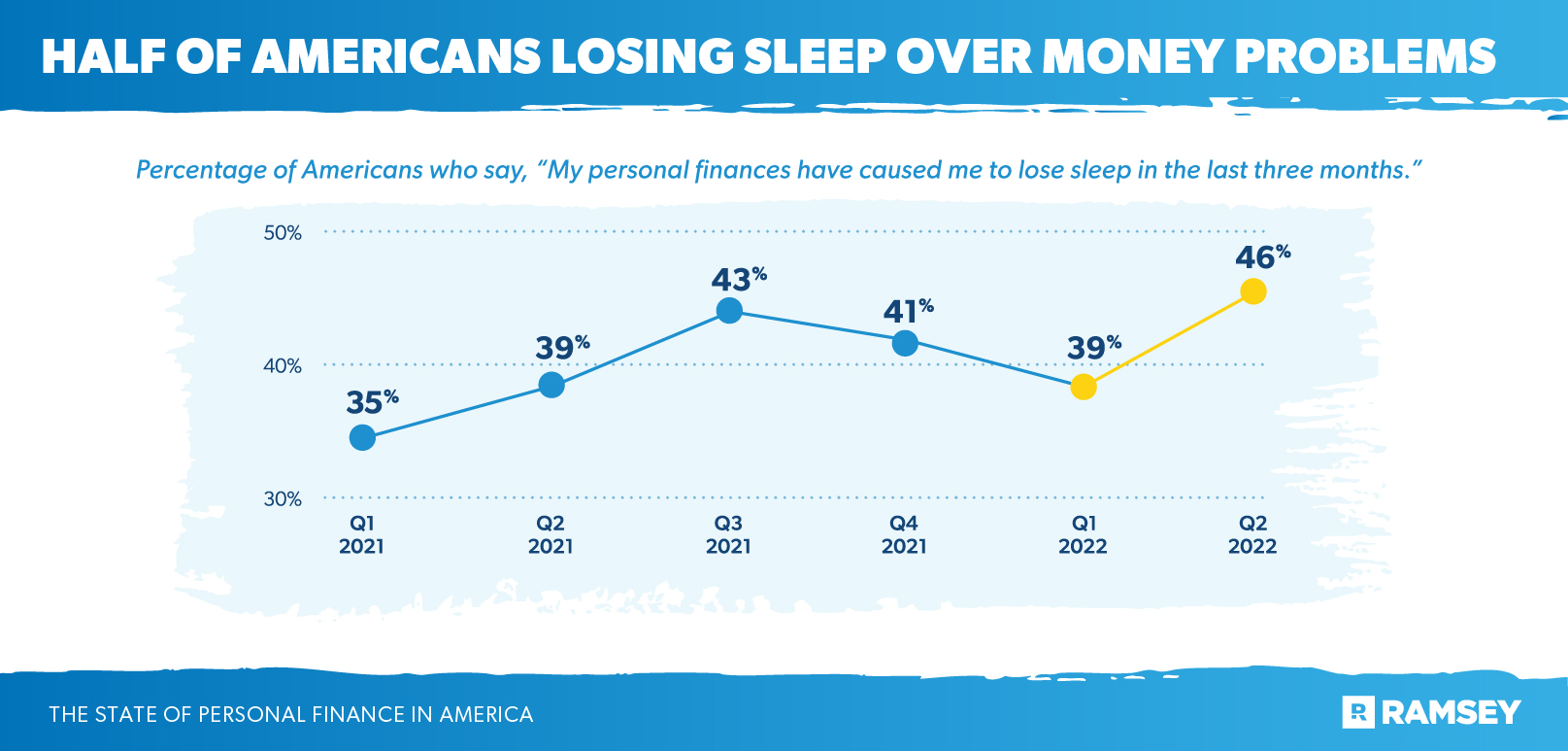

As the number of people struggling to pay for their basic needs grows, worry and anxiety about money are also on the rise. Nearly six in 10 Americans (59%) said they worry about their general finances daily—a 15-point increase from 18 months ago. Almost half (46%) have lost sleep in the last three months worrying about money, which is an 11-point increase from 18 months ago. And 59% believe they can’t get ahead with their finances—living paycheck to paycheck and not saving very much as a result.

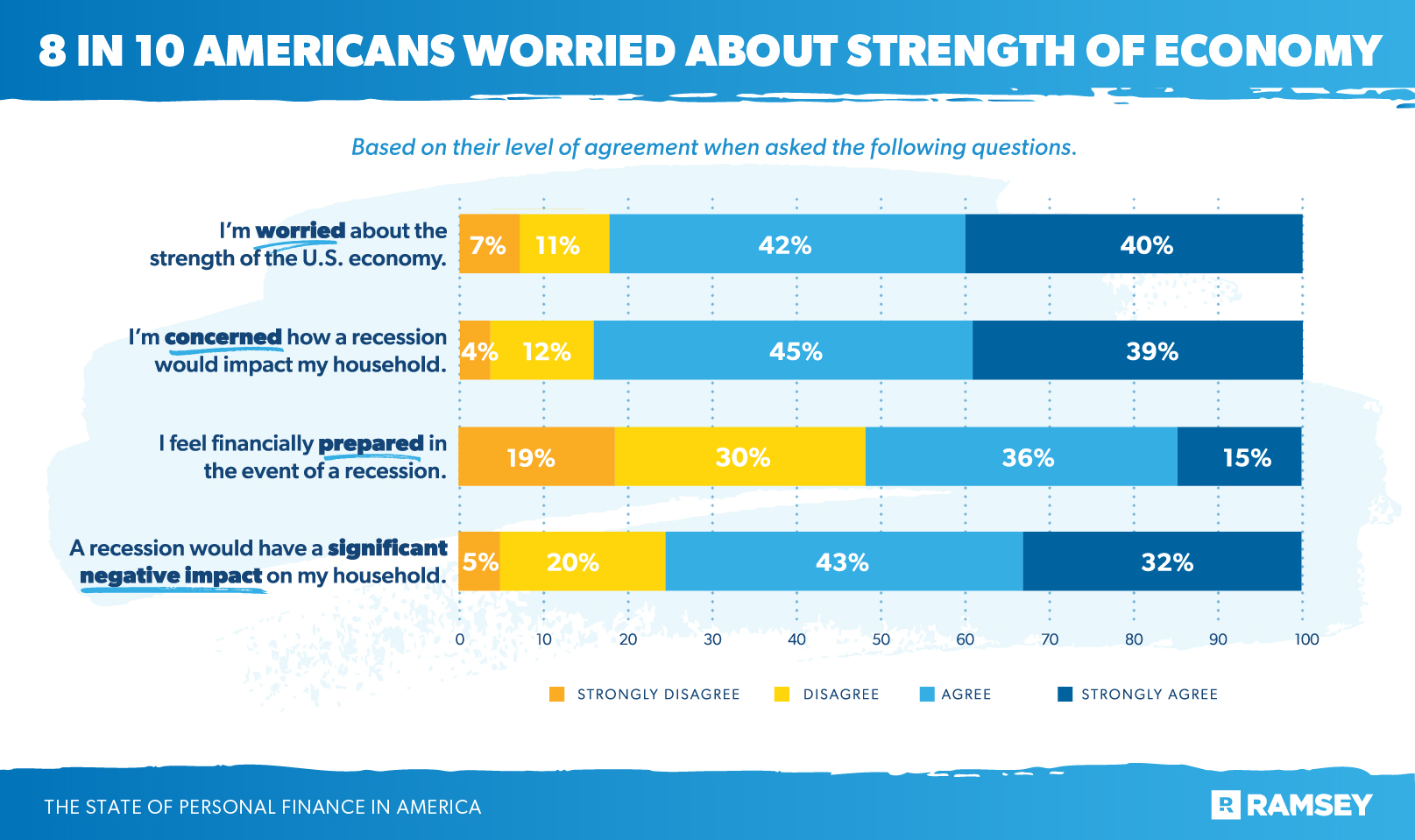

The reality of many Americans’ financial situation and the resulting stress and anxiety are reflected in their feelings about the economy overall—especially when it comes to a possible recession. More than eight in 10 Americans (82%) are worried about the strength of the economy.

Not surprisingly, another eight in 10 Americans (84%) are also concerned about how a recession will impact their household, with 75% saying a recession would have a significant negative impact. A little over half (51%) said they’re financially prepared for a recession.

Here again, the burden of debt plays a big role in American’s outlook. People who were debt-free were less likely to say a recession would have a negative impact on them (66%) compared to those who had debt (82%).

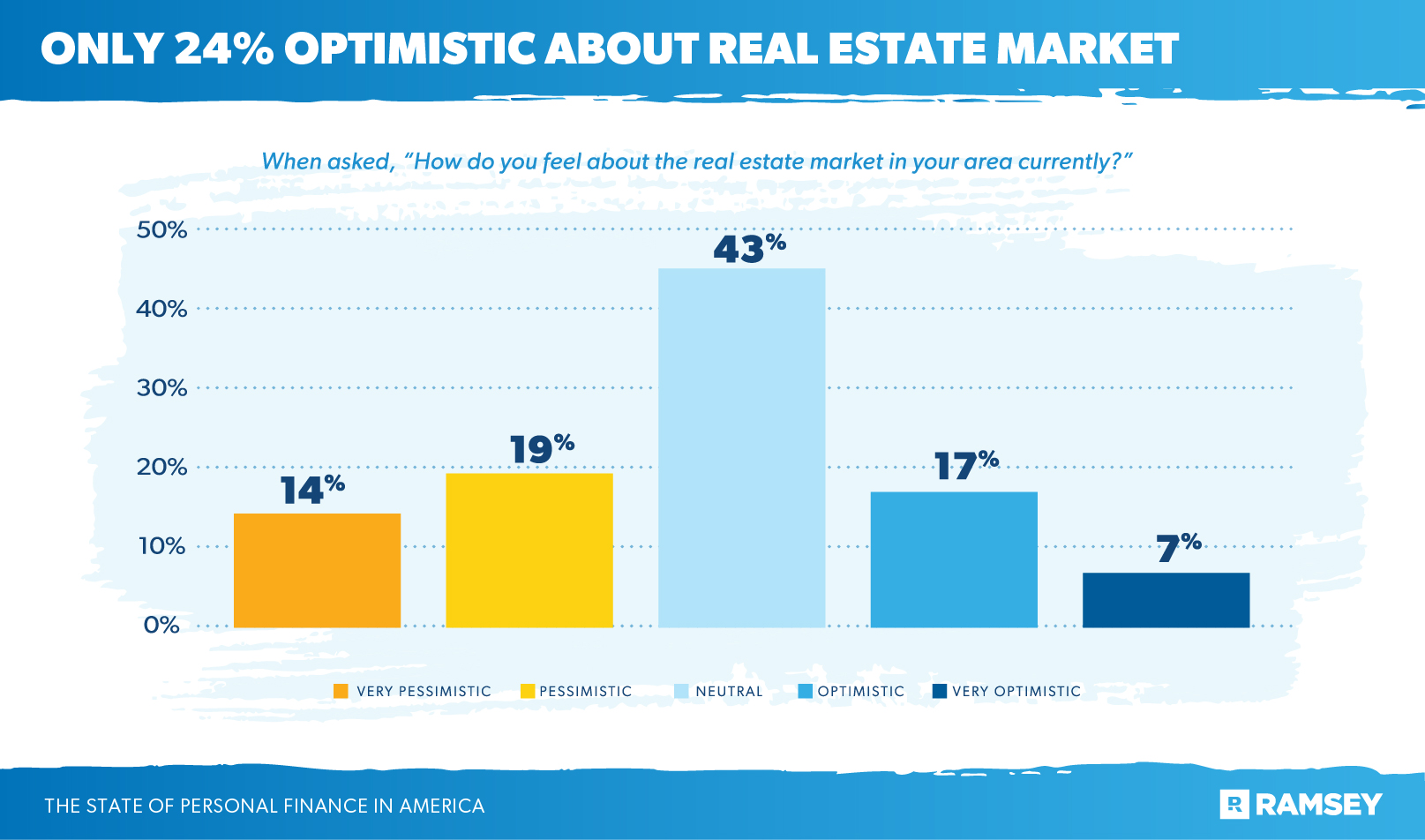

Americans’ uncertainty and stress around the country’s current economic situation carried over to their outlook on the real estate market. Most Americans were pessimistic about real estate—with only 24% saying they were optimistic about the market in their area. Half (51%) said the American dream of owning a home isn’t possible for most adults right now.

Digging deeper, 65% of Americans said it’s more difficult to own a home today compared to past decades. The significant and steady price increases in the housing market over the last two years are a main factor in people’s pessimistic perceptions, with 61% saying now was not a good time to buy a house and almost three-quarters (73%) believing housing prices will increase even more over the next year.

In a reversal of the overall generational patterns in this study, Baby Boomers were the most pessimistic generation about the real estate market. 77% said home ownership is difficult, which was significantly higher than the younger generations (59% of Gen Z, 54% of Millennials, and 66% of Gen X). 71% of Boomers didn’t think it was a good time to buy a house—compared to 55% of Gen Z, 50% of Millennials, and 65% of Gen X.

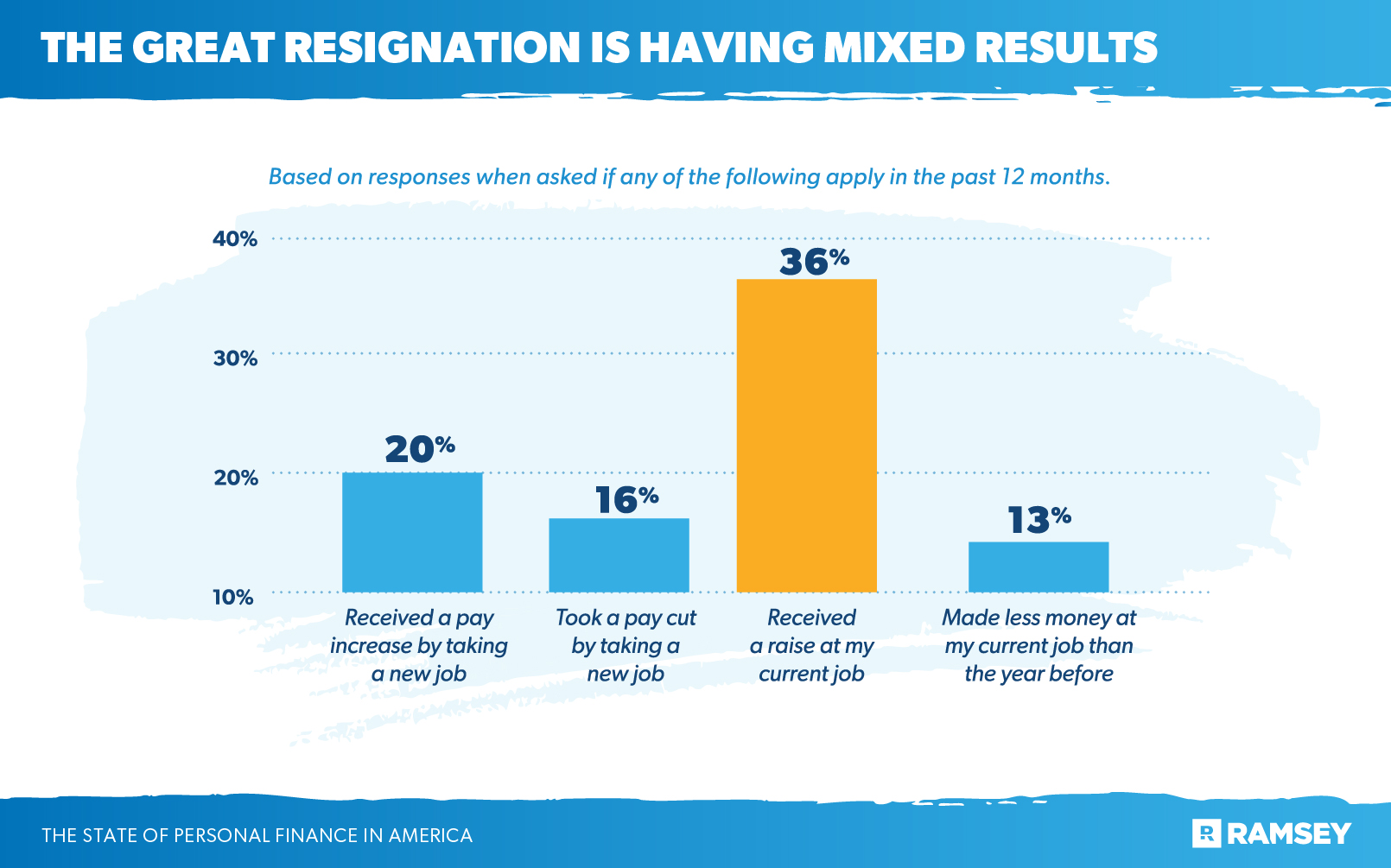

Despite (or perhaps, because of) concerns about the country’s economic situation, the Great Resignation is still a major force in the American job market. Well over half (57%) of Americans were considering leaving their current job, and just over a quarter (27%) took the plunge and changed their jobs in the past 12 months.

However, there’s another side to the career coin: The new jobs Americans are landing don’t always improve their personal financial situation. Of the people who changed jobs in the past 12 months, 20% said they received a pay increase while 16% took a pay cut to land a new job.

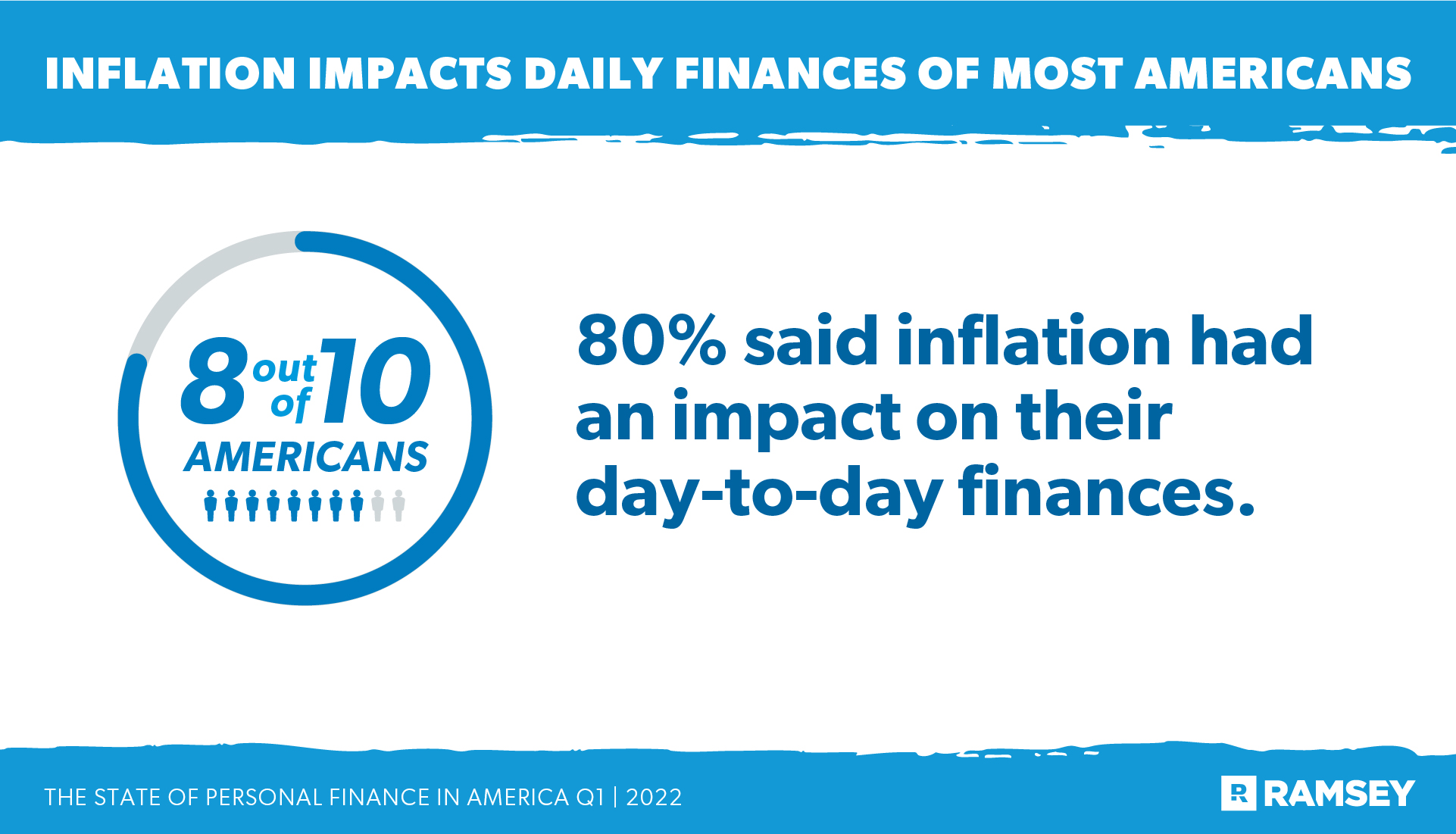

The shadow of rising inflation continued to play a major role in the financial decisions of most American consumers. The sharp increase in prices led to a nearly 10% increase in the number of people who noticed the effects of inflation this quarter over last quarter, with people feeling the most pain at the gas pump and the grocery store. Eight in 10 said inflation had an impact on their day-to-day finances. And one-third reported that inflation made a significant impact on their financial decisions.

People were also finding ways to supplement their take-home pay to cover the increased costs. 13 percent said they got a side hustle or second job on top of their regular full-time job in response to inflation. And one in 10 took on new debt to cover rising costs.

As with most things, debt made the effects of inflation even worse. Those with consumer debt were nearly twice as likely (40%) to say inflation had a significant impact on their day-to-day-finances compared to those who are debt-free (23%). Because of the rising prices caused by inflation, one in four people with debt cut back on the amount they put toward paying off their debt, and one in five relied on credit cards to buy something they would normally pay for with cash. However, one in four have also started budgeting to track their spending.

The stress caused by increased spending due to inflation also led to increased anxiety among consumers. A majority (60%) said they were anxious about how they were going to pay for the things because of inflation.

With prices rising on everyday goods and services, consumers looked for ways to lessen the impact on their family’s budgets by really thinking about the ways they spend money. Four out of five Americans said inflation significantly changed the way they shop for groceries, with 39% saying they cut back on non-essential grocery and food items. Nearly one-third said they either delayed or cancelled a future purchase.

Compared to last year around the same time, people spent more on groceries, utilities, and transportation in Q1 of 2022. On the other end of the spectrum, people spent less on non-essential items like eating out, entertainment, and travel—though the number of people spending less on those items was decidedly fewer. For example, in the top spots on both ends, 57% said they spent more on groceries, but only 33% said they spent less on eating out.

Inflation also impacted summer vacation spending plans. While six in 10 were planning to travel this summer, half are increasing their travel budget or completely changing their travel plans to offset higher prices. Despite the increase in gas prices, 12% more people plan to drive to their destinations rather than fly.

Even though people have changed their spending habits to combat inflation, impulse buying remained common. More than a third of consumers in America admitted to making at least one impulse purchase in the last three months—the majority of which were food items found while shopping in a store. Nearly one quarter of consumers made impulse purchases on social media, with 30% of Millennials in particular admitting to these types of purchases.

Impulse buying habits also have a psychological component. Most people who made impulse purchases (60%) said they felt guilty about it—and 53% regretted making the purchase. Sixty-four percent (64%) said they were likely to make impulse purchases when stressed. However, among people who budget their money, 85% said budgeting helped control their impulse spending.

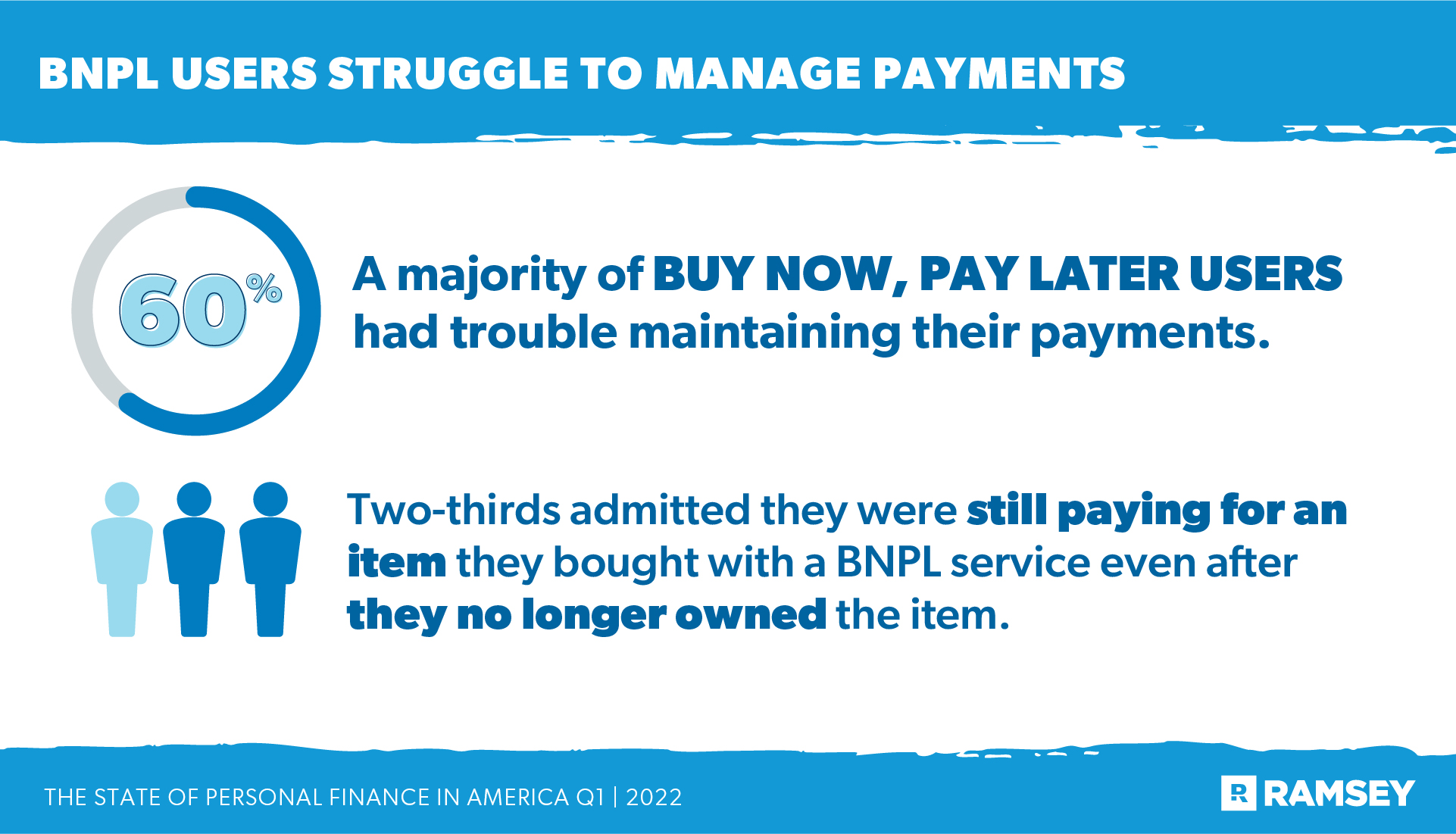

The popularity of buy now, pay later (BNPL) services remained steady despite increased inflation, with the number of people who used them hovering at around 21%. A majority of BNPL users (79%) preferred the service over using a credit card. But a majority (60%) also had trouble managing their payments. Two-thirds admitted they were still paying for an item they bought with a BNPL service even after they no longer owned the item.

The beginning of the year also brought launch of the 2021 tax season. Of the people who had filed their 2021 taxes at the time of the survey, seven in 10 expected to receive a refund.

In a possible reaction to the uncertain financial times, 47% said they plan to save their refund. And half said they would use their refund to cover bills—either paying everyday expenses or paying down debt.

In this time of financial uncertainty and worries about inflation, people are looking for sources they truly trust for advice on what to do with their money. The most popular sources of financial advice in the first quarter of 2022 were family (33%) and friends (25%). Four in 10 said they don’t have anyone to turn to for financial advice. Younger generations (Gen Z and Millennials) especially lacked trustworthy financial sources, with about half of them saying they had no one to turn to.

Consumers, especially the younger generations, increasingly looked to content on social media for financial advice. One third said they implemented financial advice they found from someone they follow on social media. YouTube had the most influence in all generations and was as popular as an actual financial advisor as a trusted source of financial advice. Gen Z was the most likely to get money advice from YouTube (43%), followed by Millennials (37%), Gen X (20%), and Baby Boomers (6%).

Americans’ interest in cryptocurrency continued to rise steadily. One in four investors said they had purchased crypto—up two percentage points from the previous quarter, and up 15 percentage points from the same time last year. Millennials lead the pack in crypto interest (40%), followed by Gen Z (37%), Gen X (23%), and Baby Boomers (2%).

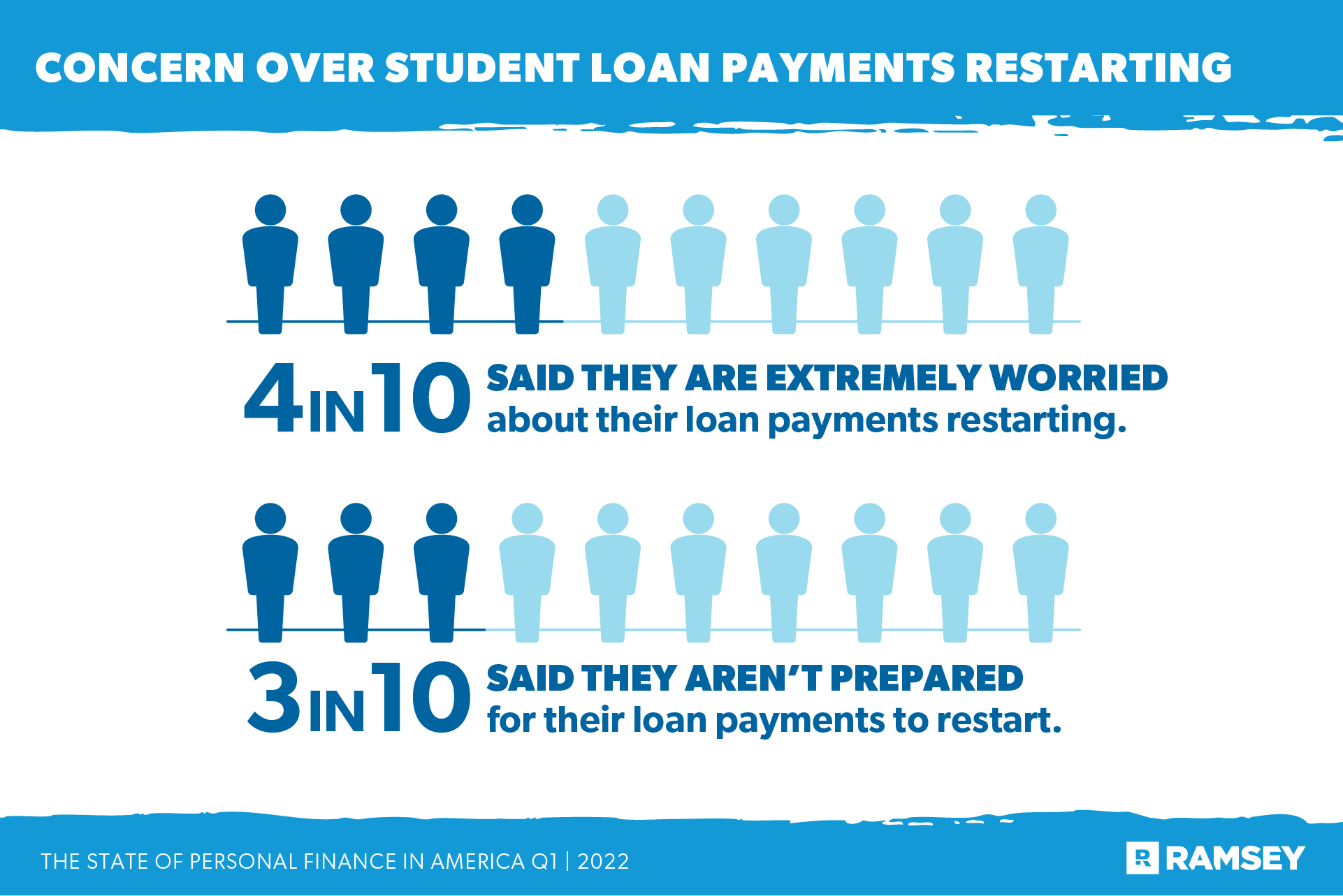

Outstanding student loan debt was also a source of financial stress for Americans in Q1. Three-fourths of those who took out student loan debt are still paying on their loans. But, since the start of the COVID-19 pandemic in March of 2020, federal student loan payments have been paused by the federal government. With the pandemic getting further and further in the rear-view mirror, those payments were scheduled to restart in May 2022. Then the government extended the moratorium through August 2022.

The Q1 State of Personal Finance survey was conducted before the government announced the most recent extension of the moratorium. At that time, four in 10 people with student loan debt said they were extremely worried about their loan payments restarting. And three in 10 said they weren’t prepared to start making payments again. Most borrowers (77%) are holding out hope that at least some of their student loan debt will eventually be forgiven.

The 2021 Great Resignation brought on in the wake of the COVID-19 pandemic didn’t seem to lose any steam going into 2022. Less than half of Americans (40%) were extremely satisfied with their jobs, and half were considering changing their jobs—a result consistent with the last two times Ramsey Solutions surveyed this question in The State of Work and The State of Financial Wellness studies. There was also very little difference in current levels of satisfaction between those who changed jobs and those who didn’t. Among the generations, Gen Z (65%) and Millennials (60%) were the most likely to consider changing jobs.

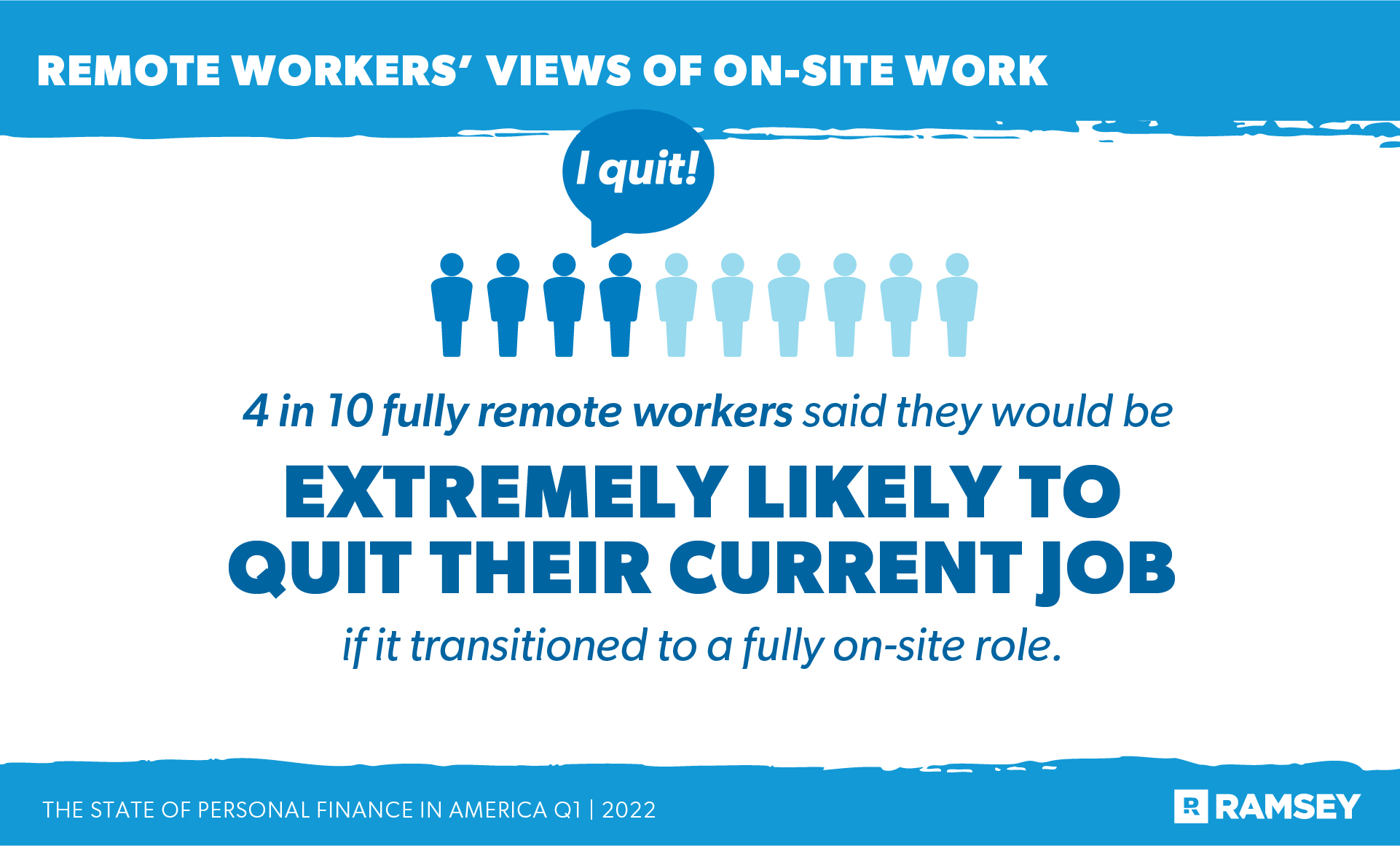

Many employees are facing a change in their work situation as companies plan to transition workers back on-site work. Forty-five percent (45%) of fully remote workers said their employer plans to return employees to an on-site location soon. While a slim majority still listed their primary working environment as fully on-site (52%), those who have been working from home had grown accustomed to the freedom it brought them, and most would like to see that way of working continue. In fact, four in 10 fully remote workers said they would be extremely likely to quit their current job if it transitioned to a fully onsite role.

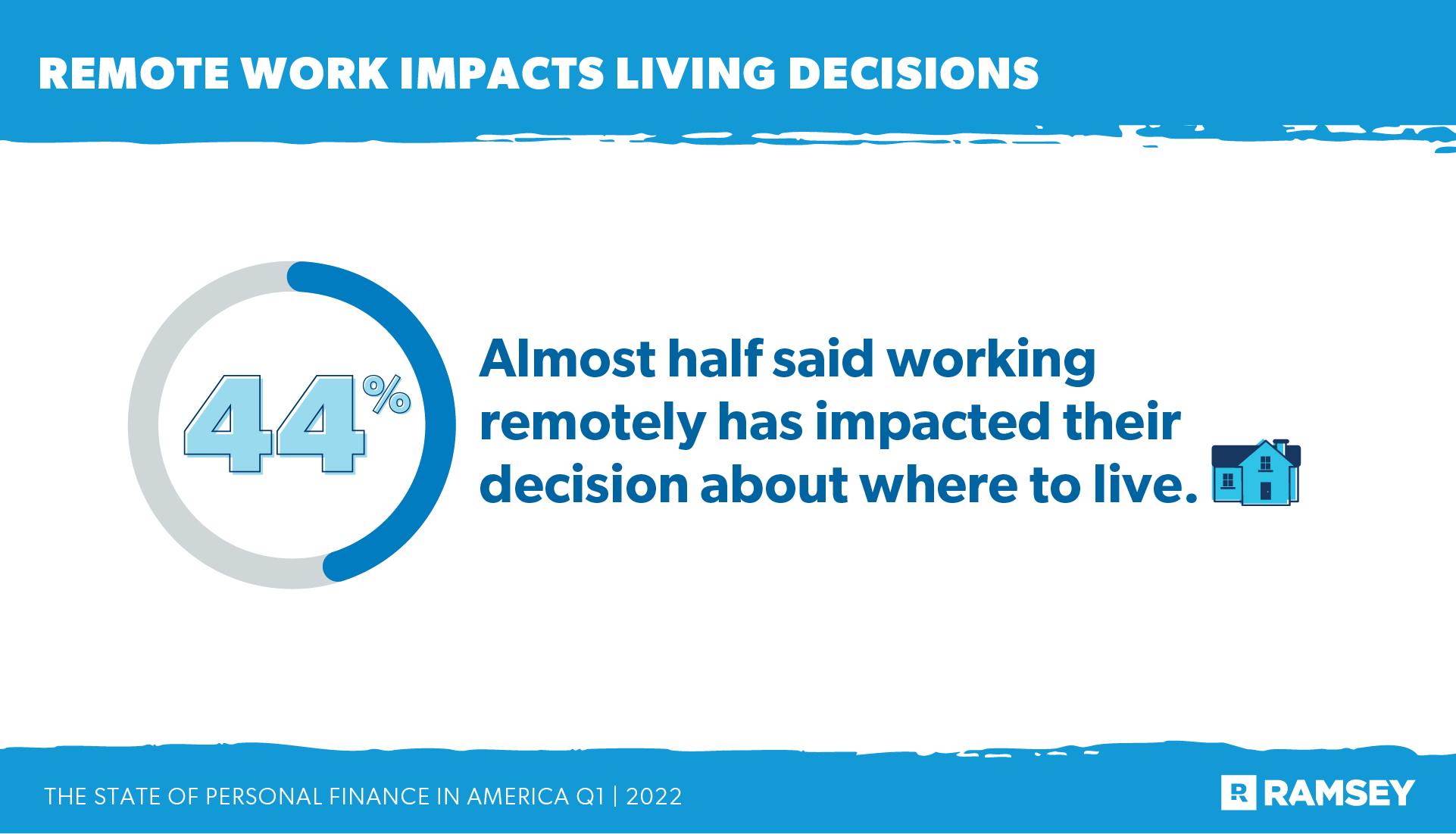

The remote working trend has also influenced the real estate market, as job location is now less of a factor when people are deciding where to live. Almost half (44%) said the ability to work remotely has impacted their decision about where to live, and over one-third (37%) said they moved away from where their job was based because of their ability to work from home.

However, with the real estate market’s surging prices and mortgage interest rates rising, there is also a lot of uncertainty. A majority of both buyers (46%) and sellers (43%) reported being pessimistic about the real estate market.

The current state of personal finance in America is full of worry—part of an upward trend over at least the past 18 months. Inflation concerns have cast a big shadow over everything—making consumers nervous on many financial fronts like grocery shopping and vacation planning. Many are finding it stressful to pay their bills and are cutting back, with some losing sleep in the process. The worries have especially hit Gen Xers, who are struggling the most in the current economic climate compared to their Baby Boomer parents are grandparents.

From the job market to real estate and student loans, a big cloud of mystery hangs over the air, with most consumers hunkering down and adjusting their spending accordingly. The country’s bearish economic situation has contributed to Americans’ pessimistic perception of the housing market. Half of Americans believe the American dream of owning a home might be beyond their reach, and more are convinced now is not a good time to buy a house. But despite a continued rise in inflation, there is still only slightly less spending on non-essentials.

The State of Personal Finance study is a quarterly research study conducted by Ramsey Solutions with 1,001 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from March 28 to April 5, 2022 (Q1), and from June 30 to July 8, 2022 (Q2), using a third-party research panel.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

The latest release of The State of Personal Finance from Ramsey Solutions takes a look back at 2021 to see how Americans’ attitudes, opinions and behaviors changed around their money.

Nope, you’re not the only one sitting around wondering, Why is everything so expensive? It’s time to combat inflation.

Learn the habits and traits of millionaires, in the largest original research study ever with over 10,000 participants by Ramsey Solutions.

©2022 Lampo Licensing, LLC. All rights reserved.