lithiumcloud/iStock via Getty Images

lithiumcloud/iStock via Getty Images

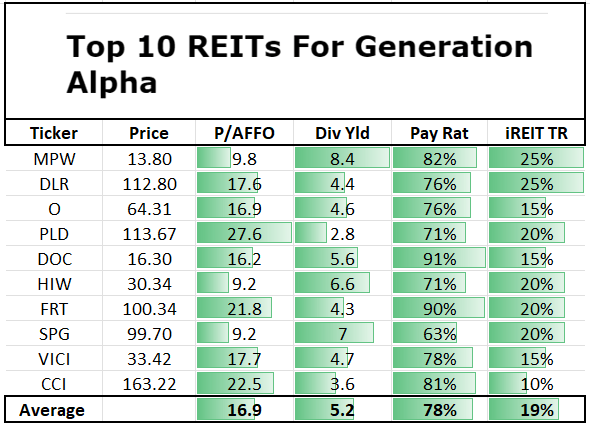

This month, I’ve been publishing a generations-focused real estate investment trust (“REIT”) series. As in, which real estate investment trusts would work best for each determined age bracket.

I started out with Gen Z, since that was a direct request and the inspiration for this study. Plus, my kids are all Gen Z by most definitions – though Lauren, my oldest, could possibly be a millennial. So I have a clear vested interest in those teenagers and young adults doing well.

Then again, I’m all about my baby boomer readers doing well, too. The same goes for millennials.

And as for Gen X?

Well, that’s me. So you’d better believe I consider which REITs would work best for that bracket.

I really thought I was done after writing that last piece. I mean, that’s pretty much all the groups that can invest right now.

But what about one that can’t?

By that, I mean the fresh round of babies beginning to show their faces to the world: Generation Alpha. While I wouldn’t yet trust them to choose the best stocks…

That doesn’t mean they can’t benefit from you choosing some for them. In fact, they can benefit the best from REITs and other dividend-paying companies.

Any money invested now – with the dividends then being reinvested every month or quarter – has the greatest amount of time to grow.

By the time they hit college age, they could be sitting on a nice amount of cash. And if they can keep that money until retirement?

Well, let’s just say they could be set for life.

Generation Alpha: That’s a pretty awesome name, in my opinion.

Alpha, for those of you who don’t know, is the first letter of the Greek alphabet. As such, it’s synonymous with a fresh start or beginning.

You’ve also no doubt heard someone referenced as an alpha personality. That’s a dominant individual. A leader. A standout.

And when you’re creating something, usually tech related, the first version of that product – the one that serves as a basis for everything else – is called alpha. So, no matter how you look at it, this word is a big deal.

Therefore, it doesn’t surprise me one bit that my grandson Asher belongs to such a promising group. You can just look at his face and see something special there.

Yes, I know I’m his grandpa and therefore more than a little prejudiced. But really…

I can’t help but think that Generational Alpha in general can be a gamechanger. Who knows how many movers and shakers are being born even in this moment… or learning how to crawl… how to walk… or say their first words.

They might be perfectly fine relying on their mama and papa’s money now (and their grandparents’ as well). But once they hit the age where they can enter the workforce, stunning everyone around them with their breakthroughs, they’re going to require more than that.

Am I laying it on too thick? Again, I know I’m a doting grandpa.

But even if these kiddos do “nothing more” than live healthy lives that touch those around them…

They’re going to need money. And, unfortunately, lots of it.

Generational Alpha is inheriting a lot as-is. A lot of money issues, that is.

We all know our cost of living today is greater than it was when Generation Z was in diapers. The difference is even greater when you look back to the dawning of millennials.

And it only gets worse from there.

A Business Insider article from way back in 2015 – when Generation Alpha was only five years old – opined on “how much cheaper everything used to be.” It began with:

“Your dollar used to go a lot further.

“In 1955, McDonald’s fries went for $0.10. Today, a small fry will cost you $1.29.

“That price change is at least in part due to inflation: A dime in 1955 equates to $0.89 today, according to US Inflation Calculator.”

Today, incidentally, they’re $1.39 – and quite possibly a smaller amount considering shrinkflation trends.

Moreover, due to so many factors, wage inflation isn’t keeping up with cost-of-living inflation. So the money we have is actually worth even less.

And considering current trends, I don’t expect things will be better by the time Asher graduates college. That’s why it’s so important to start them off on whatever right – or REIT – foot you can.

ASAP.

Carefully selected REITs should be able to grow both their share price and dividend contributions at a much more comparable rate than other investments. As I wrote on June 3 in “Protect Your Nest Egg With These Inflation-Resistant REITs”…

“REITs tend to outperform during periods of rising and unexpected inflation.” Also, “This contracts with bonds and other stocks’ modest or negative inflation sensitivity.”

I added how “We believe that now is the perfect time to own REITs,” an opinion that hasn’t changed since. And I doubt that will change going forward into Generation Alpha’s future either.

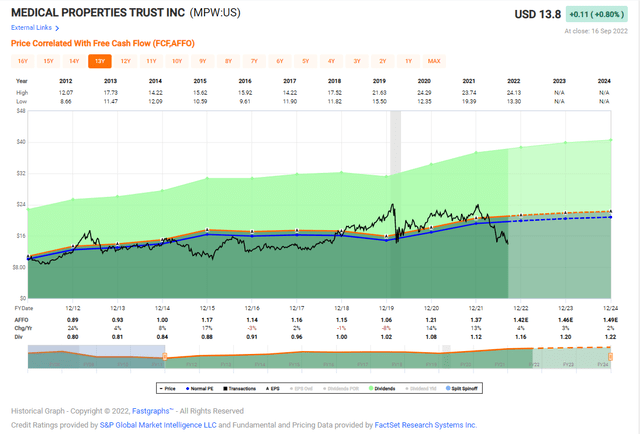

MPW is a healthcare REIT specializing in the ownership of hospitals. As of Q2-22, the company owned 447 properties that are leased out to 54 different operators. These properties lie within 32 states here in the U.S. and throughout 10 countries overall, including Australia, Colombia, Portugal, Italy, Spain, Switzerland, and Finland.

One of the largest operators is Steward, and because of this exposure, shares in MPW have sold off rather dramatically. As most know, Steward is privately held, so financials are not available to the public.

Recently, iREIT on Alpha did a deep dive on Steward and we concluded that:

“[E]ven if Steward went belly up, the denser markets provide clarity with regard to another operator stepping in to take them over. The weaker facilities could remain dark, and based upon our granular analysis, we believe that just a handful of properties would cease to pay rent.”

MPW shares are now trading at $13.80 per share with a P/AFFO of 9.82x, far below the normal range of 13.2x. There are no direct peers, but other healthcare REITs like Omega Healthcare (OHI) and Physicians Realty (DOC) are trading at an average at 10.8x and 16.2x respectively.

MPW’s dividend yield is 8.4% and well-recovered (82% based on AFFO). Hospitals are mission critical assets, and MPW is well-positioned to grow its dividend, regardless of the short-term price correction. This Gen Alpha pick is a no-brainer, as iREIT forecasts returns of 25% or higher over the next 12 months.

FAST Graphs

FAST Graphs

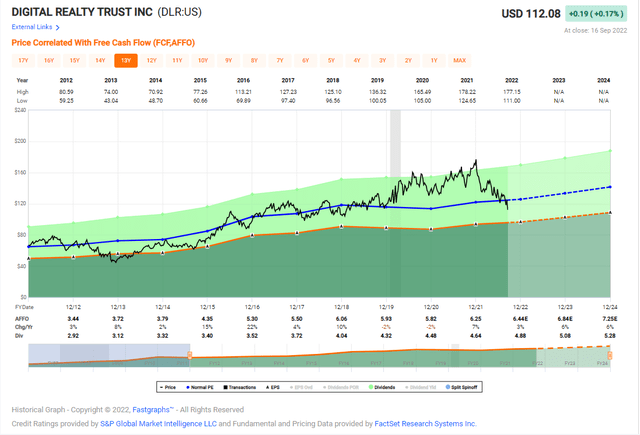

DLR is a data center REIT with a global portfolio that spans over 4,000 customers in 50 different metro areas, and the company is the 8th largest publicly traded U.S. REIT. Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to their customers.

DLR has maintained an excellent balance sheet, rated BBB with a weighted average debt maturity of nearly six years and weighted average coupon of 2.2%. Nearly 90% of debt is fixed rate and 99% and the debt is unsecured, providing the greatest flexibility for capital recycling. Jordan Sadler, Sr VP at DLR recently pointed out,

“…what’s happened now is these smaller players like CyrusOne and CoreSite, QTS, they have been recapitalized with significantly more leverage than the previous structures, cost of capital has gone up, availability of debt has gone down, and at the same time, the cost of development has risen. And so, unless these investors are willing to take lower returns, price needs to go up or demand needs to go down and we are not seeing the demand go down.”

DLR and Equinix (EQIX) are the only pure-play listed data center REITs, and they are much-better positioned.

Dividend safety is also critical to our selection process, and DLR has a track record of paying and growing dividends for over 15 years in a row. The payout ratio is ~75%, which provides an ample buffer for future dividend increases.

Analyst are forecasting the company to grow AFFO per share by 6% in 2023 and in 2024, which provides added comfort and prospects for enhanced total returns.

Shares are attractively priced at $112.80, with a P/AFFO of 17.6x, compared with the normal multiple of 20.3x. The dividend yield is 4.4% and well-covered at 76% (based on AFFO). We consider this one a steal right now and we are maintaining a Strong Buy with a 12-month Total Return forecast of 20% to 25%.

FAST Graphs

FAST Graphs

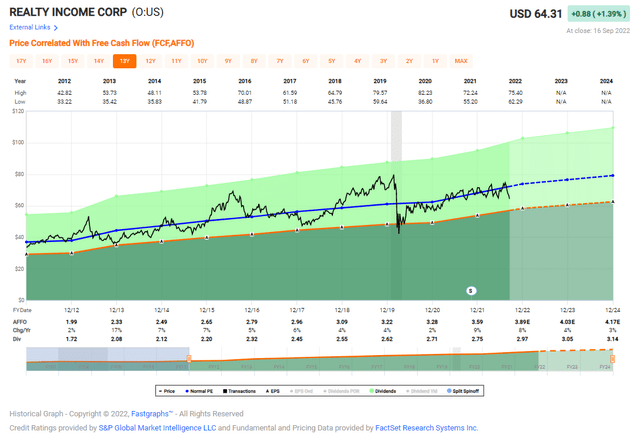

O is a net lease REIT that owns 11,427 commercial real estate properties in 50 states and Europe. The company has been known for owning top notch real estate in the U.S., and in recent years the company has taken advantage of this expertise, combined with low rates across the Atlantic, to build out a European portfolio as well.

At the end of the second quarter, O owned more than $5 billion worth of European real estate investments, increasing its overall diversification.

Overall, 43% of Realty Income’s tenants carry investment grade credit ratings, providing peace of mind during markets like this when more and more investors are talking about an impending recession.

O also maintains a fortress balance sheet (A3 with Moody’s and A- with S&P) – one of only seven S&P 500 REITs with to A3/A- ratings or better. This means that the company significant liquidity ($3.25 billion) and low borrowing costs that support enhanced financial flexibility.

With all of that in mind, you’d think that the market would be willing to pay a premium for O shares; but, as you can see below, O is currently trading at a discount to its long-term average P/AFFO multiple.

Realty Income shares are down by ~10% during the last month and this sell-off has pushed the blended P/AFFO ratio attached to shares down to 16.9xx, compared with the normal P/AFFO multiple of 18x. The dividend yield is 4.6% and well-covered. We maintain a BUY with a 12-month Total Return forecast of 15%.

FAST Graphs

FAST Graphs

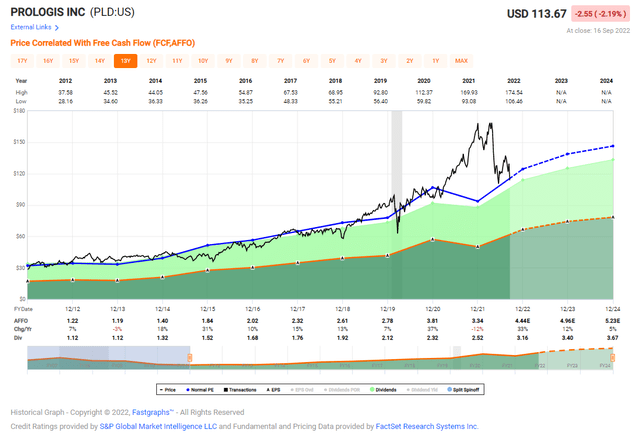

PLD is an industrial REIT that was founded in 1983 and owns over 1 billion square feet of space on four continents (19 countries). On July 13th, the company announced it was merging with Duke Realty (DRE) in a deal in a $26 billion all-stock transaction.

PLD noted it plans to hold about 94% of Duke’s assets and will divest assets in one key market. Overall, PLD management believes the deal will result in about $310–$370 million of accretive cost savings from an administrative and operating leverage standpoint right away, and $375–$400 million in annual earnings and value creation over the longer term. In year one, PLD expects to see $0.25 per share in FFO accretion, with AFFO coming out neutral.

The deal adds 1,228 acres to PLD’s land bank and 165 million square feet of industrial assets. Duke’s buildings have a 98.4% occupancy ratio, so the move will provide reliable cash flows from the start. The merger also provides Prologis with nice exposure to markets in the Southeast, the New Jersey coast, and Southern California.

PLD also has a significant “wide moat” cost of capital advantage, which is reflected in iREITs perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

Shares are now trading at $113.67 with a P/AFFO multiple of 27.6x (in-line with normal) and a dividend yield of 2.8% (71% payout ratio based on AFFO). iREIT forecasts shares could return 20% over the next 12 months.

FAST Graphs

FAST Graphs

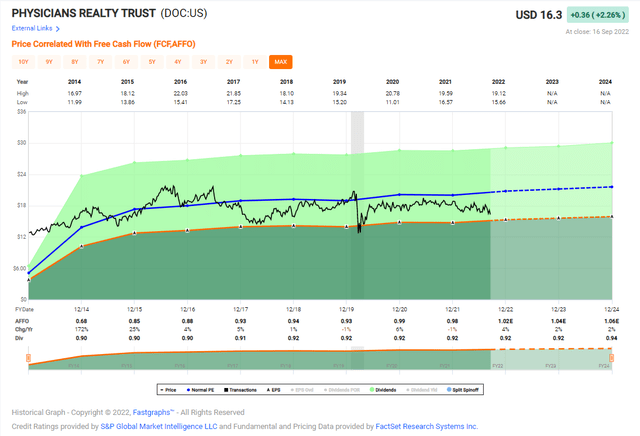

DOC is a healthcare REIT that owns 291 medical office buildings, leased with a 95% occupancy rate with a 65% investment grade tenancy. The company targets investment-grade tenants occupying the best assets in the industry, with a focus on outpatient transition in terms of care.

DOC’s investment yield in new properties is usually around 5-7.5% – acceptable for the segment, and for returns. The company is geographically diversified, with a focus on the eastern part of the U.S. – less on the west. The top geographies are Atlanta, Phoenix, Dallas, Louisville, and Minneapolis. All excellent geographies.

DOC has a BBB rating and has a very attractive debt maturity – virtually nothing before 2025, and then it’s just the revolver. Most of the company’s notes aren’t due until 2027 and beyond.

There are levers or qualities that make DOC an attractive player in the industry and give the company significant pricing power. The upsides are related to the company’s properties and the market trends we currently see.

DOC tends to trade about at a 15-17x P/FFO. Given the high degree of predictability and quality to the company’s portfolio, we don’t see a material issue with such a valuation.

Shares are now trading at $16.30 with a P/AFFO multiple of 16.2x, compared with the 6-year range of 20.8x. The dividend yield is 5.6% and although a tad high (91%), the company continues to reduce it, although there has been no dividend growth.

We would like to see dividend growth in 2023, yet we like the long-term prospects as we believe shares could return 20% over the next 12 months. DOC is an easy addition to the Gen Alpha portfolio.

FAST Graphs

FAST Graphs

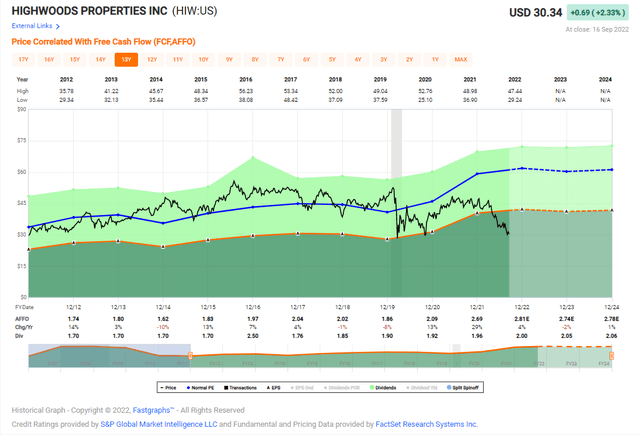

HIW is an office REIT that primarily focuses on the attractive southeast with exposure in areas like Nashville, Atlanta, Raleigh, Tampa, and Orlando, which together account for around 80% of the company’s overall geographic mix of properties.

HIW tends to focus on, as much as its geographical exposure allows this, the top overall real estate markets.

With its focus on Raleigh, Nashville, Charlotte, Orlando, Atlanta, and Tampa, it focuses on 5 out of the ten 2022 top real estate markets and is extremely focused on growing real estate markets and has outpaced or averaged the annual growth in real estate by markets for the past 10 years.

HIW also announced plans to exit the Pittsburgh market and redeploy capital into Dallas. Essentially, this means that the Carolina-based REIT is doubling down on the Sunbelt – a prudent move given population and office employment growth

HIW is BBB rated with a well-laddered debt schedule. The earliest significant maturities do not come until 2026-2028, giving the company ample of time and room to move. The company works with an average weighted interest rate of 3.4%, leverage of 5.3x to annualized EBITDAre and a 39.5% debt + pref/gross assets.

Shares are now trading at $30.34 with a P/AFFO multiple of 9.2x, compared with the normal multiple of 21.3x. The dividend yield is 6.6% and well-covered (71% payout ratio based on AFFO). iREIT forecasts shares could return 20% or higher over the next 12 months.

FAST Graphs

FAST Graphs

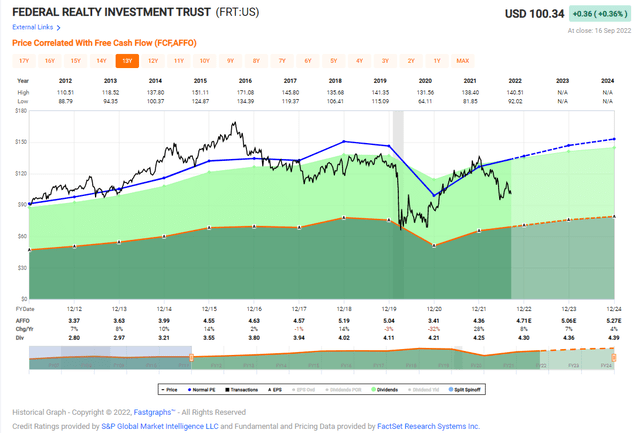

FRT is a shopping center REIT that owns 105 properties (3,100 tenants) and 25 million square feet with approximately 3,400 residential units.

During Q2, FRT generated FFO per share of $1.65, which was a 17% increase over the prior year. Comparable property operating income (POI) was up 8% as well, with the portfolio maintaining a 92.0% occupancy rate, which was up 240 basis points from prior year.

FRT has a BBB+/Baa1 credit rating. 93% of the company’s debt has a fixed interest rate, and free cash flow is expected to return to pre-pandemic levels in 2023, which will further help pay down its outstanding debt.

Analysts forecast AFFO to grow by 8% in 2022 and 7% in 2023, which means the dividend should continue to grow beyond its record of 55 years in a row.

Shares of FRT currently trading at $100.34 with a P/AFFO of 21.8x (compared with the normal P/AFFO of 28x). The dividend yield is 4.3% with a payout ratio of 90% (based on AFFO per share). iREIT believes that shares could return 20% to 25% over the next 12 months.

FAST Graphs

FAST Graphs

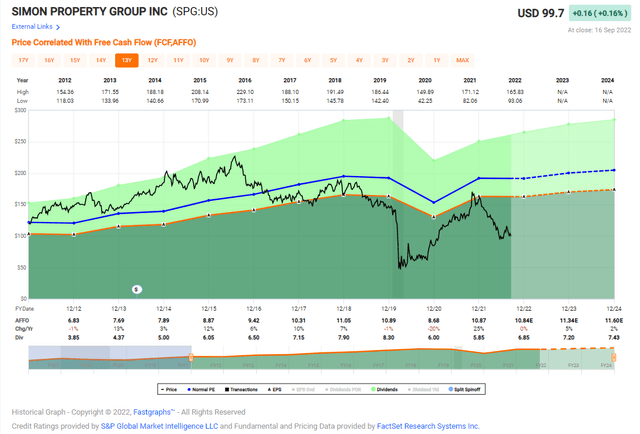

SPG is a mall REIT that owns an interest/ownership in 199 income-producing properties in the U.S., consisting of 95 malls, 69 premium outlets, 14 mills, 6 lifestyle centers, and 15 other retail properties in 37 states plus Puerto Rico.

SPG also owns a majority noncontrolling 80% interest in TRG (Taubman Realty), which in turn has interest in 24 regional, super-regional, and outlet malls across America and Asia.

Additionally, SPG has international exposure. The REIT owns interest in 33 properties in Asia, Europe, and Canada, and also owns a 22.4% equity stake in Klepierre SA (OTCPK:KLPEF), one of the premier real estate businesses in France and Europe.

SPG also has a fortress balance sheet which has credit ratings of A3 from Moody’s and A- from S&P, and this is a major advantage for the company and one reason why they dominate the sector with the highest-rated portfolio.

SPG shares are also cheap, trading at $99.0 with a P/AFFO multiple of 9.2x, compared with a longer-term average of 17.x. The dividend yield is 7.0% and well-covered (63% based on AFFO). Analysts are forecasting growth of 5% in 2023. Once more, we see value here, with our 12-month total return forecast of 20% to 25%

FAST Graphs

FAST Graphs

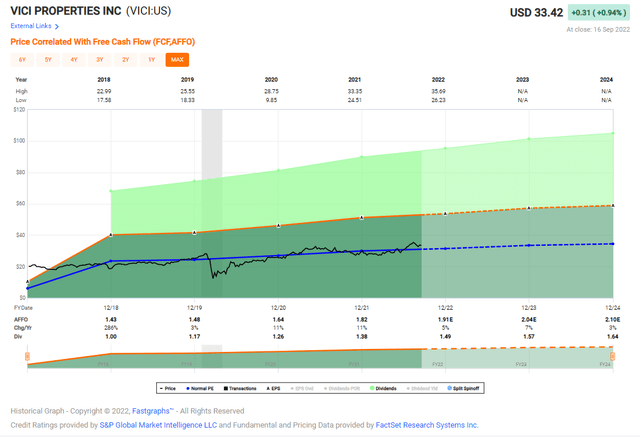

VICI is a gaming REIT that owns 43 properties with 100% rent collection to date through the COVID-19 pandemic.

In just 5 years (since VICI was formed), the company has grown Adj. EBITDA from $690 million to around $2.6 billion. The train has left the station, as VICI’s high-quality portfolio is spread across 43 properties that generate resilient and stable cash flows (100% rent collection to date through the ongoing COVID-19 pandemic).

We consider the gaming properties “Mission Critical” based on the regulatory environment that creates high barriers to entry and limits the tenants’ ability to move locations, contributing to VICI’s 100% occupancy rate. VICI is now the largest triple net lease REIT and one of the top four-wall REITs by LTM Q2’22 Adj. EBITDA.

VICI has generated a whopping $29 billion of capital markets activity since formation and that could not have been accomplished had it not been for the disciplined management team.

The company has an investment grade rated balance sheet that broadens access across capital markets, and we would not be surprised to see the company expand into Europe in the future.

Shares are now trading at $33.42 and a P/AFFO multiple of 17.7x. The dividend yield is 4.7% (payout ratio is 78% based on AFFO) and iREIT forecasts shares to return ~15% over 12 months.

FAST Graphs

FAST Graphs

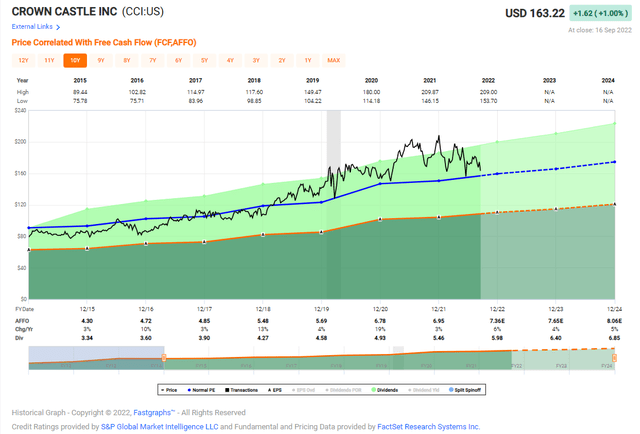

CCI is the second largest cell tower REIT with a market cap of $77.6 billion.

CCI is the nation’s largest provider of shared communications infrastructure, with a portfolio that consists of more than 40,000 cell towers, approximately 115,000 on-air or under-contract small cell nodes, and more than 80,000 route miles of fiber—giving the company a presence in every major U.S. market.

As new generations roll out and more cities adapt, you can see how CCI has continuously increased their rental revenue each and every year since 2001.

CCI has a quality balance sheet, with a net debt to EBITDA rating of 4.9x. The company has a credit rating of BBB- and currently pays an annual dividend of $5.88, which equates to a dividend yield of 3.3%. Over the past five years, CCI shareholders have enjoyed a dividend growth rate of 9%.

CCI shares trade at $163.22, with a P/AFFO of 22.5x (just above the normal multiple of 22.0x). The dividend yield is 3.6% and shares have dropped below our FV price (by 5%), which makes the company a Buy. However, I’ll wait a bit before I add to my grandson Asher’s portfolio, but we like this one for our watch list.

FAST Graphs

FAST Graphs

This concludes our generation series (for now), and we will be posting all of the portfolios at iREIT on Alpha. It has been a lot of fun working on this series and I hope you have enjoyed it.

As a new grandfather, I am especially interested in helping young Asher establish investing skills at an early age, so when he’s old enough I can explain how hospitals, office buildings, malls, shopping centers, casinos, cell towers, and many other property sectors generate alpha!

Besides, it’s kind of cool that I have the most followers on Seeking Alpha (over 103,000) and I’m now targeting Generational Alpha investors…

Until next time… Happy SWAN Investing!

iREIT

iREIT

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research (“WMR”), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 102,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of MPW, DLR, O, PLD, DOC, HIW, FRT, SPG, VICI, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.