JONGHO SHIN

JONGHO SHIN

Written by Nick Ackerman. A version of this article was published to Cash Builder Opportunities on August 16th, 2022.

Trinity Capital (NASDAQ:TRIN) announced a secondary offering of shares a couple of weeks ago. That had the shares crashing at the opening of the following day. This is a common reaction to this fairly regular event for BDCs and REITs both. As TRIN is a position I own already and wanted to add more to, here is why I bought shares but also sold at the money put options.

The shares sold through the secondary offering for TRIN were sold above their NAV, so at a premium which is accretive and should be accretive to earnings. This is natural for BDCs as this is one of their main ways to grow their assets. Last year we initiated a position in TRIN. I’m taking this opportunity to add by buying shares directly and selling some puts.

Upon the news, I bought shares of TRIN the next day after the crash at around $15.07. However, I also sold some puts as a way to potentially extend my position even further.

The puts I sold at a strike price of $15 are right at the money. In this case, it might seem a bit more unusual than the types of trades we enter. This one is right at the money with basically no downside protection. The reason for this is because the way I viewed it is I was buying shares at this price already.

In selling puts, I’m looking to potentially increase my position even further, which I’d be happy to do. In this way, I’m bumping the breakeven of the trade down to $14.59. That’s factoring in collecting $0.41 in option premium. So that is where some of the downside cushions can come into play. I might be buying at $15 if the shares are put to me, but my cost basis will be $14.59.

That is around 3.2% lower than the current trading price of $15.07 at the time of writing. Like any other sort of corporate news event such as this, there can be some volatility for the next several days.

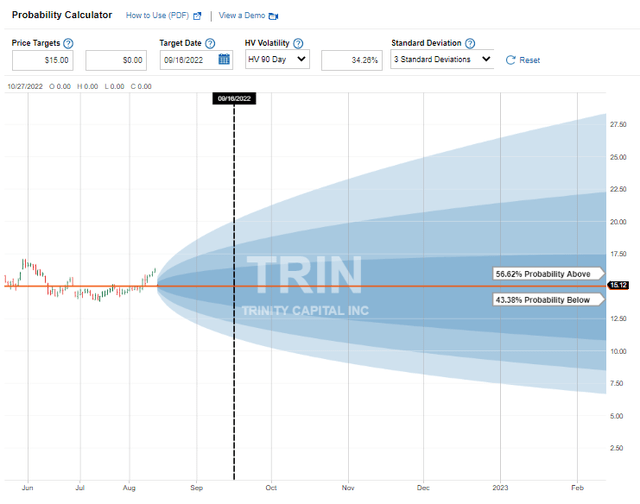

The probability of not taking an assignment of shares is still slightly a larger percentage as Fidelity anticipates a 56.62% probability that shares will be over $15.

TRIN Probability (Fidelity)

TRIN Probability (Fidelity)

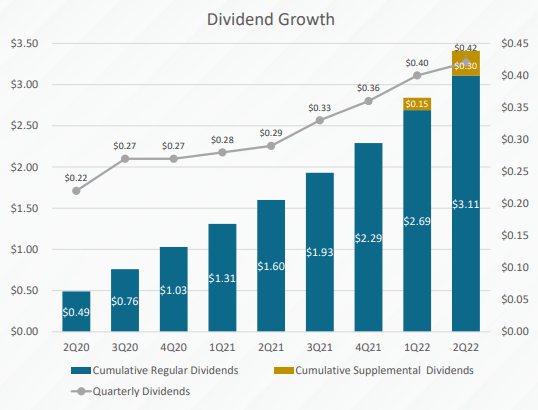

The latest earnings for TRIN put the NAV at $14.62. That was a decrease from $15.15 at the end of March 31st, 2022. As the market has been selling off, it isn’t too surprising that the underlying portfolio of TRIN has also been declining. That also factors in their regular dividend of $0.40 paid in the quarter as well as a supplemental $0.15.

TRIN Dividend History (TRIN Investor Presentation)

TRIN Dividend History (TRIN Investor Presentation)

The coverage of that distribution is also looking quite appealing. They had announced NII of $0.51 for the quarter, which was an increase of 55.4% year-over-year. That’s why it’s not surprising that they have once again upped their regular dividend. The latest quarter paid $0.42 plus another $0.15 supplemental. In our previous coverage, we noted that they anticipate paying $0.15 in each quarter through the year.

That NAV is important because they sold these new shares on this secondary offering at $15.33. That means it was above the NAV, and that means it is accretive to NAV and should be accretive to earnings. Now that yields are rising, they can put it to work in higher-yielding instruments.

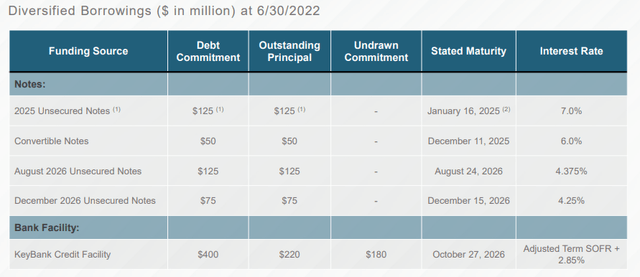

Additionally, they also noted that they were looking to pay down some of their credit facility. That means potentially reducing their reliance on floating rate debt and relying more heavily on their fixed-rate leverage.

Trinity intends to use the net proceeds from this offering to pay down a portion of its existing indebtedness outstanding under its KeyBank Credit Facility, to make investments in accordance with its investment objective and investment strategy, and for general corporate purposes.

TRIN Borrowings (TRIN Investor Presentation)

TRIN Borrowings (TRIN Investor Presentation)

They raised another $50 million in the 2025 notes in July.

One final note on the secondary offering is that they are essentially selling shares all the time. This is through their at-the-market offerings. That’s made possible when shares of a BDC are trading at a premium. These announced secondary offerings are just doing this in all one shot. These ATM offerings are also beneficial to long-term shareholders since they are done at a premium.

On November 9, 2021, the Company entered into an open market sale agreement (the “2021 Sales Agreement”) with Jefferies LLC, as sales agent and/or principal thereunder, pursuant to which the Company can issue and sell, from time to time, up to $50 million in aggregate offering price of shares of its common stock by any method permitted by law and deemed to be part of an “at-the-market” offering (as defined in Rule 415 under the Securities Act) (the “ATM Program”). During the six months ended June 30, 2022, the Company issued and sold 176,148 shares of its common stock at a weighted-average price of $16.56 per share and raised $2.9 million of net proceeds after deducting commissions to the sales agent on shares sold under the ATM Program. During the year ended December 31, 2021, the Company issued and sold 35,714 shares of its common stock at a weighted-average price of $16.55 per share and raised $0.6 million of net proceeds after deducting commissions to the sales agent on shares sold under the ATM Program. The Company did not have the ATM Program prior to November 9, 2021. The Company generally uses net proceeds from the ATM Program to make investments in accordance with its investment objective and investment strategy and for general corporate purposes.

As we can see, the total number of shares issued here is relatively low in the ATM. Every little bit counts, though, and cents can add up to dollars in our pockets.

The NII being sufficient to cover the regular distribution is great to see. The amount of coverage and continually rising earnings so far could suggest further dividend increases going forward. They have really been building out their portfolio. The fear of venture capital slowing down hasn’t slowed this BDC down, it would seem. That is despite what we are seeing in the NAV decline with the latest quarter.

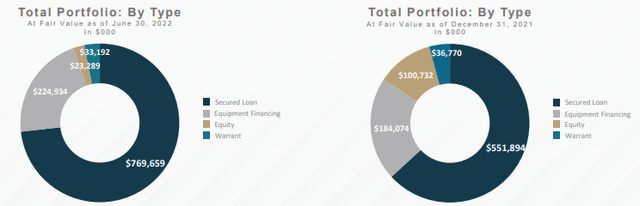

Additionally, their portfolio has shifted in the latest quarter to include only a sliver of equity that it had at the end of 2021. That should mean more regular income generation going forward as loans are more predictable in what they are paying out.

TRIN Portfolio (TRIN Investor Presentation)

TRIN Portfolio (TRIN Investor Presentation)

I wouldn’t want them to abandon equity investments if the opportunities come up. Those equity positions are the types of investments that generate those supplemental. A BDC is required to pay out almost all of its income and gains as a regulated investment company.

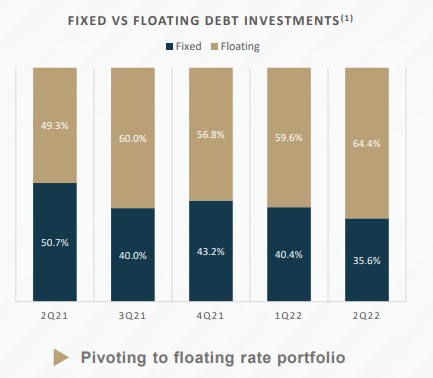

In that transition away from equity being a more significant part of the portfolio, it does mean they can position more into floating rate debt investments. Those are the types of secured loans that can benefit from higher interest rates.

TRIN Debt Investments (TRIN Investor Presentation)

TRIN Debt Investments (TRIN Investor Presentation)

With the Fed still expected to increase rates going forward, despite what we might be seeing as peak inflation, that should bode well for TRIN and overall for the BDC space. That’s why most BDCs have been holding up relatively well across the board. Of course, that is until they get this type of short-term volatility that leads to long-term opportunities.

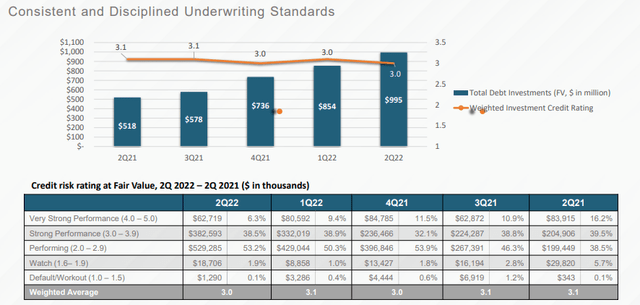

They believe that overall their portfolio is still within a “strong performance” category. The defaults category has shrunk to being almost non-existent. However, the watch category has nearly doubled with tighter financial conditions. We can expect some of this to cause a bit of a headache if economic conditions worsen. I don’t believe that is enough to make TRIN unattractive at this time. However, I would note that this is something to continue to monitor.

TRIN Portfolio Quality (TRIN Investor Presentation)

TRIN Portfolio Quality (TRIN Investor Presentation)

TRIN is selling off based on the secondary offering. I believe this is an opportunity for investors to buy directly or play the options game. This is how BDCs grow. They issue shares, raise debt, invest, pay dividends and repeat. They had another stock offering in April of this year too. The market at that time was still making new lows, so that likely isn’t a great representation of the share price we can expect to happen this time. If the market can continue to rise, this could be a short-lived dip. Similar to what we saw with Main Street Capital (MAIN) with their latest stock offering.

All this being said, TRIN could still be considered a somewhat newer publicly traded BDC. They have a longer history as a private BDC. Their focus on venture capital also makes them more of a volatile offering. In an economic slump, they could perform poorly. So I wouldn’t put all my eggs in this basket, but it seems attractive enough to allocate a smaller allocation of one’s portfolio. I also view this as a longer-term position.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.

This article was written by

Cash Builder Opportunities provides high-quality and reliable dividend growth ideas to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

—–

Who are we?

Nick Ackerman is the lead author for Cash Builder Opportunities. Nick is an avid student of the markets and has been investing in his own accounts for over 10 years. He is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. His specific focus is on closed-end funds, dividend growth stocks and option writing as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long-term financial goals.

Stanford Chemist is a scientific researcher by training who has taken up a strong and passionate interest in investing. His members appreciate the analytical and agenda-free insight and analysis that he brings to investments. He has developed his own metrics and tools for understanding closed-end funds and exchange-traded funds and how to profit from them and will seek to apply the same logical principles to Cash Builder Opportunities.

Disclosure: I/we have a beneficial long position in the shares of TRIN, MAIN, SHORT TRIN PUTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.