Boarding1Now/iStock Editorial via Getty Images

Boarding1Now/iStock Editorial via Getty Images

Investment Thesis: While TUI AG has shown a strong rebound in revenue, I take the view that we will not see much meaningful upside in the stock until mid-2023.

In a previous article back in June, I made the argument that while TUI AG (OTCPK:TUIFF) has seen an encouraging rebound in revenue, this would ultimately need to be accompanied by growth in earnings and cash flow to bolster the stock over the longer-term.

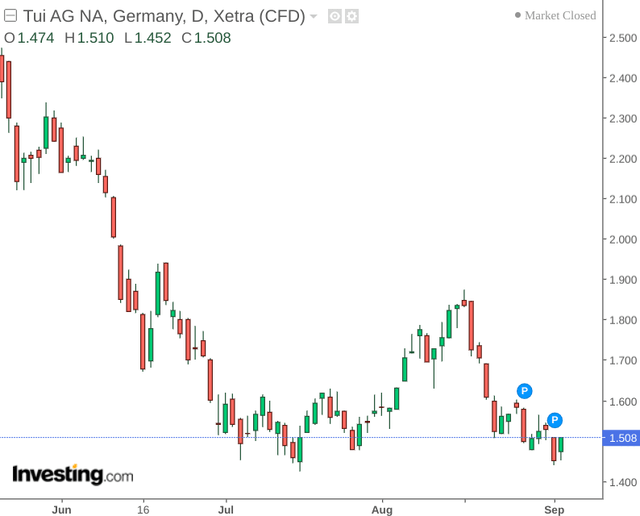

In spite of a temporary rise in August, we can see that the overall trajectory for TUI AG has been downward since June.

investing.com

investing.com

The purpose of this article is to investigate whether the stock has any scope for upside from here, taking recent quarterly results into consideration.

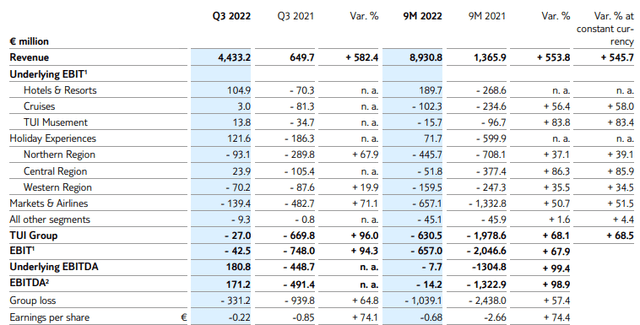

When looking at FY22 Q3 performance, we can see that while EBITDA has returned into positive territory for Q3 2022, earnings per share has still remained negative.

TUI AG: Q3 Interim Financial Report 1 October 2021 – 30 June 2022

TUI AG: Q3 Interim Financial Report 1 October 2021 – 30 June 2022

Moreover, we can see that while underlying EBIT has returned to positive territory for Holiday Experiences, the Markets & Airlines segment still saw negative growth.

The company cites the effect of flight cancellations and staff shortages as contributing to the loss – with disruption costs having increased by an estimated €75 million in Q3.

In spite of this, the company reports that Summer 2022 bookings came to 90% of Summer 2019 levels, which is encouraging.

While it is expected that the company will see a seasonal decline in travel demand for most of the winter months, TUI does report that the United Kingdom has seen volumes up by 16% to date, as compared with the total of 27% of the programme sold for Winter 2018/19. This is an encouraging start, and should we see volumes rise to 2018/19 levels, then this might help to make up for the drop in traffic we have seen as a result of flight cancellations and delays.

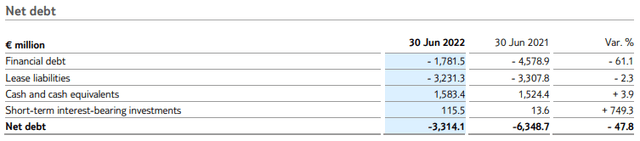

From a balance sheet standpoint, we can see that the company has significantly reduced its net debt from the same period last year, with cash and cash equivalents also up from that of June 2021.

TUI AG: Q3 Interim Financial Report 1 October 2021 – 30 June 2022

TUI AG: Q3 Interim Financial Report 1 October 2021 – 30 June 2022

This is encouraging – as it indicates that TUI AG is generating significant revenue after expenses to bolster its cash reserves and pay down net debt.

Going forward, the risk of inflation and higher energy prices could pose a significant challenge for TUI AG heading into the winter months.

For one, while higher energy costs may dissuade would-be travellers from booking holidays during the winter months, there may also be a supply-side issue whereby flights on certain routes become uneconomical as a result of higher fuel costs. In addition, while Hotels & Resorts (which form part of the Holiday Experiences segment) has seen a strong recovery, certain operators might choose to close their doors over the winter months if it is deemed that energy costs are too excessive relative to anticipated demand over this period.

From this standpoint, inflationary pressures still have the potential to induce significant volatility across the travel market as a whole, and there is a significant possibility that earnings across the company’s major segments could take a larger dip than usual, as inflation may exacerbate an already weakening demand during the low season in winter.

To conclude, I take the view that TUI AG has done well in bolstering its revenue and this has resulted in a rebound in cash flow and earnings (although earnings per share technically remains negative).

While I anticipate that Summer 2023 could be a significant growth driver for TUI given expected travel demand and the resolution of existing travel bottlenecks, I take the view that demand for the winter months remains too uncertain in the meantime. While I do not see risk of particularly steep downside at this time, I anticipate that we will not see much meaningful upside in the stock until mid-2023.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.