Andrew Toth

Andrew Toth

Co-produced with Treading Softly

Did you know that the Walking Dead is still on? Don’t be surprised if you didn’t know it was. Its overall viewership has dropped over the years, as most TV shows do over time. The original series is coming to a close, while the spinoffs carry on.

Even if you weren’t a fan, you are likely aware of the general premise of the series. The dead come back to life as “walkers” who operate like zombies of old, and they want to eat your flesh.

We’re not talking about AMC Entertainment (AMC) or investing in them today.

I want to talk about another Walking Dead investment, known as a “death pledge.” You might know it by its common name – mortgages.

The term mortgage comes from the French morte which means dead, and gage, which means pledge. Your mortgage is a death pledge. Not that you must pay it until you die – although many of us feel that way when signing all those darn documents at closing – but that the deal itself dies when the debt is repaid. When you repay your mortgage, the lien on your house goes away and the mortgage company no longer has an ownership claim on your home.

These debts are the walking dead. They are expected to die at prescribed times and can die early if pre-payment occurs.

Like other types of debt, there are a wide variety of ways to invest in mortgages. You can buy real estate investment trusts (“REITs”), funds, or invest directly via your chosen brokerage – if you have enough cash!

Most investors do not buy individual mortgages, but mortgage-backed securities – essentially large pools of mortgages from which the income and interest rights are sold off in smaller pieces to many investors.

Even though the principal owed is stable, mortgage prices are sensitive to interest rate changes and economic conditions. Mortgages that trade on the secondary trading market will trade higher or lower on the outlook of the economy and interest rates. All these factors can complicate investing in them, but it also means that they can be “mispriced” and subject to overreactions by the market. When the market overreacts to the downside, it is the best time to be buying.

Let’s look at two opportunities to invest in these walking dead loans!

One easy route to gain exposure to a large swath of mortgages is via MREITs, these REITs invest in MBS, then mix in leverage in an attempt to juice returns. They are known for large dividends, but also large swings in book value due to leverage. One such investment we like to buy is Annaly Capital Management, Inc. (NLY).

We are frequently criticized for not prioritizing the book value of NLY over its dividends. For some investors, book value is the primary metric they consider. They will sit on the sidelines, investing who knows where, while they wait for the price to be less than book value.

The problem?

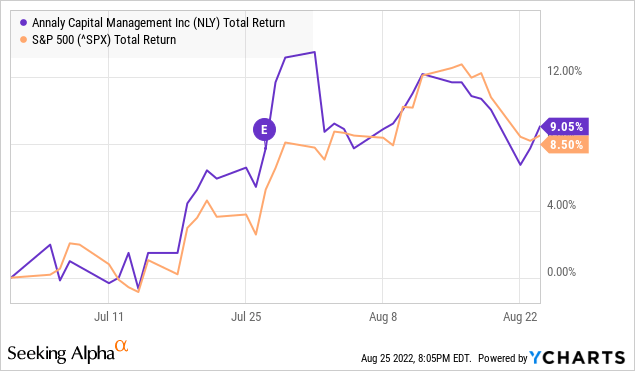

At the bottom for Annaly Capital, they were still trading at a premium to book value. What happened when they released their earnings, confirming that book value was well below the market’s price? The price went up:

Trading the trends in book value can be profitable. If you can predict what it is on those crucial dates that will be reported, you can make a short-term profit when the market reacts to the news it might not be expecting. Then again, the same could be said of absolutely any investment. If you can guess what direction the stock will move today, you can make a profitable trade. There are day traders who attempt to make a living doing just that, but most people who attempt it dramatically underperform in the long run.

At HDO, we take a much longer view. We are very comfortable holding a stock for 3-5 years or longer. In the course of any significant length of time, a stock will have periods of outperformance and underperformance. Stock prices move; it’s what they do. Since we first added NLY to the Model Portfolio, it has paid out $2.98 in dividends, and we expect it will be able to maintain or increase its current rate of payment over the next several years. Over that holding period, book value went up, came down, went up again, and has now come down again.

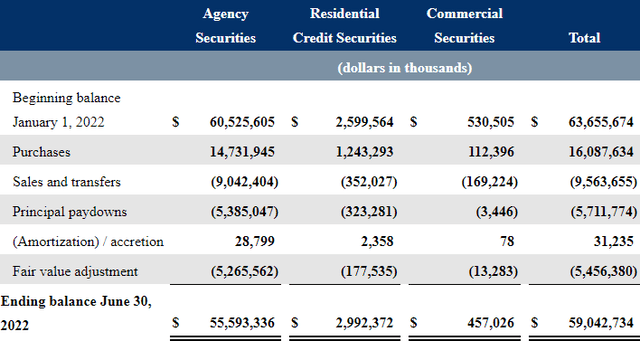

When NLY’s book value (and share price) were coming down, we didn’t panic. We know that this is a temporary move, not permanently lost capital. How can we be so sure? Let’s look at NLY’s portfolio changes over the first half. (Source: NLY 8-K.)

NLY 8-K

NLY 8-K

Note that NLY had $60.5 billion in agency MBS. They sold $9 billion and received $5.4 billion in principal repayments. Essentially all of those funds were reinvested with $14.7 billion in purchases. In other words, NLY was not a net seller of agency MBS. The face value of NLY’s holdings increased.

Remember, the face value of agency MBS is guaranteed. If NLY holds until maturity, it will receive 100% of par value no matter what happens to the loans. If the borrower defaults, the agencies will buy it back at par. If the borrower prepays, they are prepaying at par.

Whether the MBS is priced at a premium or a discount in the market, the end result is the same: NLY will ultimately receive par. The day NLY buys an MBS, they know they will receive par. NLY’s strategy is not to move in and out of MBS. It is an agency mREIT, and agency MBS will always make up a substantial portion of its assets.

Book value declined, but the earnings power of its existing MBS remained unchanged. The earnings power of new investments has increased dramatically. Mortgage rates have gone up significantly, that’s what NLY is paid. Mortgages are where their revenue comes from. Higher revenues are a good thing in my book!

Mortgage yields are up due to interest rate volatility and likely supply/demand. In the Q2 earnings call, NLY’s CIO observed:

…volatility in the fixed income market persisted throughout the second quarter with a continued sell-off in rates and underperformance in risk assets. Agency MBS widened 20 to 30 basis points as supply remained elevated, while on the demand side the Fed began reducing its balance sheet and banks were sellers on the quarter, leaving money managers as the primary buyer of MBS.

Supply will be declining as high mortgage rates have caused mortgage origination volumes to decline dramatically. Q2 was still benefitting from activity in Q1 as it takes time for mortgages to close and be packaged as agency MBS to be sold. When demand might rise is less predictable, but is likely inevitable with spreads between agency MBS and Treasuries the highest since the Great Financial Crisis.

Will MBS prices recover to 2021 highs? We hope not. The longer MBS prices stay lower, the more money NLY will make. Book value can do what it wants. Other investors can try to chase it around. We’ll just sit back, collect our dividends, and reinvest in NLY when the price is low.

America First Multifamily Investors, L.P. (ATAX) is having a truly phenomenal year. Management announced they intend to maintain supplemental dividends throughout the rest of the year.

ATAX makes its money by buying Mortgage Revenue bonds. Unlike MBS, these bonds are not issued by big banks or mortgage originators, but by local municipalities. They are tax free due to this. An MRB is tied to the mortgages of multi-home buildings and allows municipalities to finance the construction of affordable homes. As the mortgages on these buildings are paid, ATAX gets their revenue.

Historically, ATAX has aimed to distribute 100% of CAD (cash available for distribution). CAD came in at $0.76/unit and $1.74 in the first half – this is huge. For comparison, ATAX’s CAD was $1.92 for the entire year. ATAX’s distributions year to date only add up to $0.90 despite hiking the “regular” distribution 12% to $0.37 and paying a $0.20 supplement in Q2.

By our math, ATAX has $1.02 in undistributed CAD in the first half. This does not include the $0.48 in CAD that ATAX reported from closing another property sale in July. During the earnings call, management stated they expected supplemental distributions for the remainder of the year. They did not state what the size of those distributions would be. We expect that either the supplements will be materially higher than $0.20/quarter or that ATAX will pay a special distribution at year-end, possibly both.

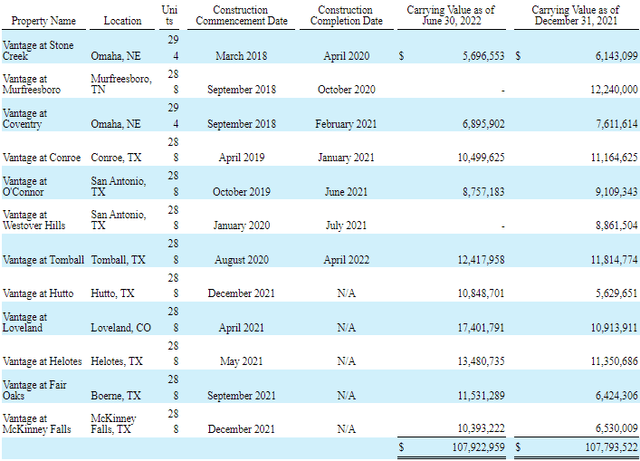

In short, we expect ATAX’s distributions at the end of the year to be materially elevated thanks to the wild success at their Vantage joint venture this year. Vantage has sold 5 properties year to date and has another 4 properties where construction has been completed. We believe it is likely that 2-3 of them will be sold this year.

ATAX

ATAX

The Vantage joint venture also has an additional five properties that have been under construction and will be completed for next year. 2022 has been an above-average year for sales as the JV had excess properties taken off the sales market due to COVID. ATAX continues to put capital back to work in this strategy. In the earnings call, ATAX discussed plans to consider expanding this same strategy into different states.

For investors, this means that this year we can expect distributions to continue to be extraordinarily high for the next two quarters. The $0.37 distribution likely represents a good baseline of what we can consider “recurring” for 2023 and beyond. The bulk of that is covered by ATAX’s more predictable mortgage bond business, which is also the portion of the business that produces tax-exempt income. Note that we anticipate that all supplemental and special distributions will be taxable, so the portion of ATAX’s distribution that is tax-exempt will be a smaller portion than it has been historically (as a percentage of total distributions).

We would be happy to buy ATAX at current prices just for the regular distribution. ATAX has proven over the years that its core business provides very attractive and stable returns. With bond yields rising, ATAX will be able to reinvest capital at higher yields than they have been able to for several years. Like many bond funds, ATAX has seen pressure on book value, but as we’ve discussed, declining bond prices lead to higher total returns in the future.

The Vantage properties are the cherries on top. And this isn’t just a lone cherry sitting on top of a soft serve sundae. This is a whole handful of cherries with chocolate sauce and sprinkles!

Note: ATAX is a partnership that issues a K-1 tax form.

Shutterstock

Shutterstock

Unlike Rick or Darryl, you don’t need to risk your life to take down a few walkers and survive. No, you can benefit from the walking dead and receive excellent income from them month after month.

A mortgage is often the largest single investment an individual will make in their lifetime. It is an investment for themselves and their family, based on the expectation of future income to repay the loan.

NLY and ATAX provide two excellent routes to access a wide swath of mortgages and benefit from the diligent repayment of these loans. NLY provides exposure to agency-guaranteed single-family residential mortgages, while ATAX provides us exposure to mortgages on apartment properties. We enjoy NLY and ATAX due to their attractive yields and expected performance looking forward.

While disagreement abounds, we will be collecting our income and watching as the MBS pricing moves upwards, sideways, or downwards knowing our MBS holdings via NLY and ATAX will be redeemed at PAR upon maturity.

In retirement, it’s best not to try to be the smartest gambler in the room. Others like to pride themselves on doing the two-step and dodging in and out of questionable investments trying to squeeze the best possible returns from the market. Doubtlessly these individuals will misstep and suffer large losses. Newsletters and services vanish over time, and new ones emerge, touting a “new” method. Dividend investing is a tried and true means to generate excellent retirement income without the added stress.

That’s why I stick to it. Want less stress? Give it a try.

If you want full access to our Model Portfolio and our current Top Picks, join us for a 2-week free trial at High Dividend Opportunities (*Free trial only valid for first-time subscribers).

We are the largest income investor and retiree community on Seeking Alpha with over 6000 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +8%, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio’s grow even while living off of their income! 4500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

Click here to find out more!

In addition to being a former Certified Public Accountant (“CPA”) from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I am also a Certified Mortgage Advisor CEMAP, a UK certification. I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, and on FXEmpire.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

1) Treading Softly

2) Beyond Saving

3) Philip Mause

4) PendragonY

5) Preferred Stock Trader

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities

High Dividend Opportunities (‘HDO’) is a service by Aiko Capital Ltd, a limited company – All rights are reserved.

Disclosure: I/we have a beneficial long position in the shares of ATAX, NLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, Preferred Stock Trader, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.