Editor’s note: Seeking Alpha is proud to welcome Logan Colhoun as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Presley Ann/Getty Images Entertainment

Presley Ann/Getty Images Entertainment

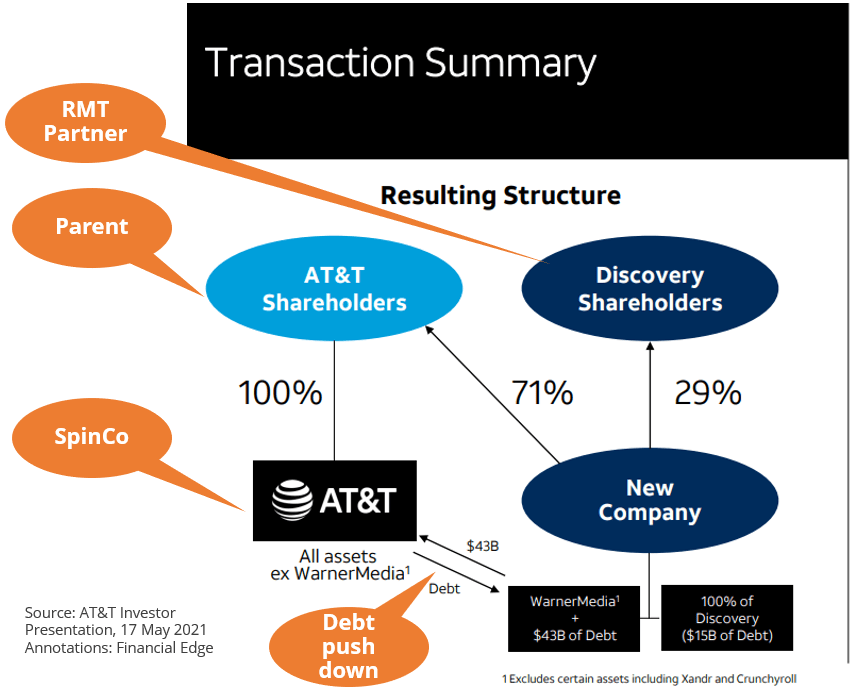

WarnerMedia was spun-off by AT&T (T) to merge with Discovery in early April of 2022. AT&T shareholders received 1.7 billion shares of Warner Bros Discovery (NASDAQ:WBD), resulting in 71% ownership, while Discovery shareholders own the remaining 29% of WBD. AT&T also pushed $43 billion of debt on WarnerMedia, joining the $15 billion of debt that Discovery already had on its balance sheet. Here is a graphic from AT&T, which may help visualize the transaction:

AT&T

AT&T

The resulting traction led to the creation of Warner Bros Discovery, which began trading at $25.50. Over the past 5 months, WBD has fallen 48% due to heavy selling pressure by AT&T shareholders. Many AT&T shareholders are looking for a stable company that pays a high dividend, which is why they invested in AT&T in the first place. However, WBD does not pay a dividend and has no plans to do so. With 71% of shares belonging to AT&T shareholders, much of the sell-off can be attributed to AT&T shareholders not being interested in a smaller, highly-leveraged, non-dividend paying company.

According to legendary value investor Joel Greenblatt, there are 3 things to look for when investing in a spin-off:

I want to dive deeper into all 3 of these, and look at how WBD matches these criteria.

Greenblatt likes to see institutions avoid spin-offs as it creates selling pressure, leading to an attractively priced investment. We already discussed that many AT&T shareholders have been selling their shares due to a lack of dividends, and the complicated nature of the transaction. So when we see strong selling pressure, this does not mean it is necessarily related to the merits of the investment. Many institutions, presumably AT&T shareholders, have been selling and decreasing their positions in WBD. As of Q2 2022, there are currently 2.4 billion shares of WBD outstanding, with institutions holding a respectable 56% of those shares. We’ve only seen 86 institutions buy new positions in WBD, while we’ve seen 1,176 institutions sell out of their positions. Additionally, 2,075 institutions have decreased their position in WBD, while only 604 have increased their holdings. This outflow of institutional money is reflected in the stock price, creating an attractive investment opportunity.

According to Greenblatt, “Insider participation is one of the key areas to look for when picking and choosing between spinoffs – for me, the most important”. In the case of WBD, not a single insider has sold since its merger, while there have been 19 insider buys. Insiders have been buying at as low as $14/share and as high as $19/share. Another quote, this time by Peter Lynch, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise”. If insiders believe that the stock is undervalued, that’s probably a pretty good indication that it is.

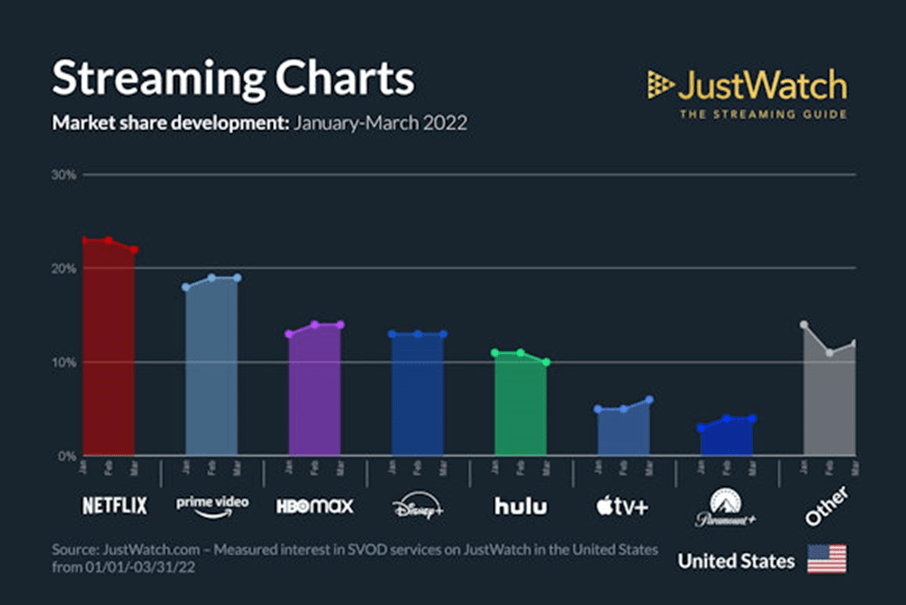

In the case of WBD, we have a long list of reasons as to what makes it a potentially great investment opportunity. WarnerMedia, the owner of HBO Max, was previously locked up in the massive conglomerate AT&T. The spin-off has allowed WarnerMedia to merge with Discovery, to form a robust media company. WBD’s studio and network businesses are high cash flow businesses, which were previously not appreciated under AT&T. In addition, the upcoming merger of HBO Max and Discovery+ will make WBD a massive player in the streaming space. Here is a graph from Q1, showing market share in the streaming service industry:

JustWatch

JustWatch

Discovery+ has low churn within the streaming industry, due to its “educational” niche. However, they lack some of the IP that HBO Max has, like DC. By merging these two services, they will likely improve churn rates, and maintain the explosive growth of HBO Max. This is just some of the value that has been unlocked following the spin-off + merger.

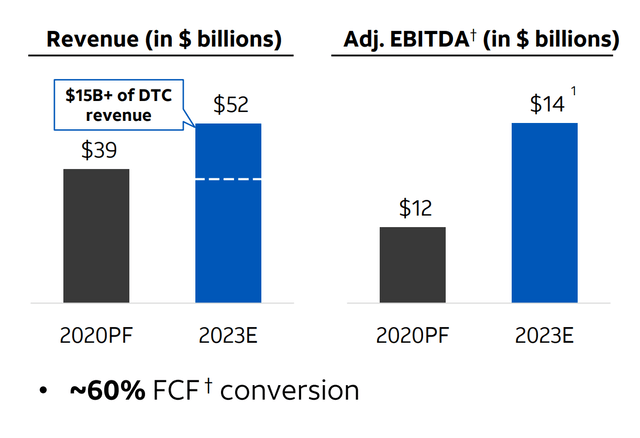

WBD shares fell nearly 17% after Q2 earnings early in August. However, this appears to be an overreaction, as investors panicked following changes to EBITDA projections. Here is a look at projections released by AT&T in May 2021, over a year ago:

AT&T

AT&T

WBD missed these projections in Q2. However, it’s simply unfair to hold management to these pre-merger projections. Here is a look at Q2 numbers:

Warner Bros Discovery

Warner Bros Discovery

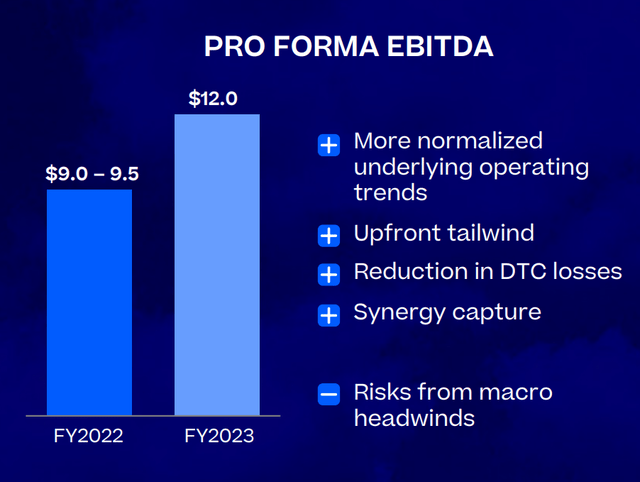

As you can see, management has projected EBITDA of $12 billion for 2023, compared to the previous projection of $14 billion. Despite the downward revision in EBITDA, FCF increased YoY to $789 million for Q2 (run-rate of $3.1 billion in FCF).

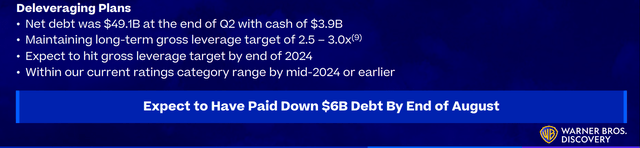

Using the recently revised EBITDA projections of $9 billion for 2022, WBD is trading at 8.8x forward EV/EBITDA ($31 billion market cap + $49 billion Net Debt). FCF projections for 2022 are $3 billion, which means WBD is trading at a forward FCF/EBITDA of 26x. Obviously, this number is quite high, but WBD has the opportunity to aggressively deleverage, as shown in its Q2 report:

Warner Bros Discovery

Warner Bros Discovery

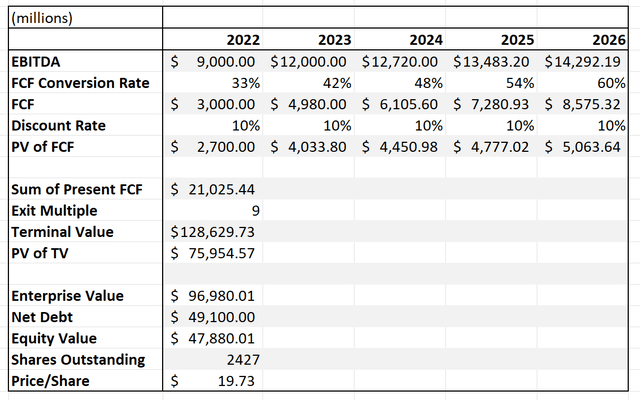

Here is a quick look at a very basic DCF for WBD:

Author

Author

In this DCF model, we used management guidance from their recent Q2 earnings call, as discussed above. Management gave $9 billion – $9.5 billion in EBITDA guidance for 2022, so I used $9 billion to go on the conservative end. Management also gave a free cash flow conversion rate of 33% – 50% for 2023, so I used 42%, right down the middle. They also gave a long-term FCF conversion rate of 60%, which is reflected in the model. The model also uses a discount rate of 10%, and an exit multiple of 9. WBD is currently trading at an EV/EBITDA of 9, and for reference, Netflix is trading at an EV/EBITDA of 16. So this model does not take possible multiple expansion into account. With all of these variables in place, the DCF came up with a share price of $19.73/share, representing roughly a 50% upside from the current $13 share price.

Additionally, with net debt north of $49 billion, the opportunity to deleverage is massive. With management committed to hitting 2.5-3x gross leverage by the end of 2024, WBD could see a considerable run-up in share price.

We see several catalysts for WBD stock, starting with the growth in HBO Max and Discovery+. The two platforms will be combined together in the summer of 2023. WBD is projecting 130 million global subscribers by 2025, coupled with growth in average revenue per user (ARPU). Breakeven is projected to occur in 2024, with a long-term margin potential of 20%+. While the network and studio divisions may struggle, WBD’s streaming service should serve as a long-term growth catalyst.

A more short-term catalyst for WBD is their potential to quickly deleverage. WBD is currently sitting on gross debt of $53 billion. Their long-term goal is a 2.5x-3.0x gross leverage ratio, calculated by dividing gross debt by LTM EBITDA. They expect to hit their gross leverage target by end of 2024, in which we projected $12.7 billion in EBITDA. This means that by the end of 2024, given our projections are close to accurate, they expect to have $31 billion – $38 billion in debt. This means that in the next two years, they plan to pay off $15 billion – $22 billion in debt. Clearly, management has the right goals in mind and should be able to make this happen. Let’s do some deleveraging calculations:

Enterprise Value Assuming Constant Market Cap 2026

Current Market Cap ($31 billion) + Projected Net Debt ( $34 billion) = TEV ($65 billion)

TEV ($65 billion) / Projected EBITDA ($14.3 billion) = EBITDA Multiple (4.5x)

Current EBITDA Multiple = 9x

(9 / 4.5) -1 = 1 = 100%

As we can see, by deleveraging, management can considerably reduce WBD’s Total Enterprise Value, which will rapidly reduce the valuation multiple and make it more attractive. As you can see through our calculations, with a constant market cap, WBD will have a $65 billion Enterprise Value by 2026. With our projected EBITDA, this represents an EV/EBITDA of 4.5x, while they are currently trading at 9x. Without accounting for any multiple expansion, this represents a 100% upside through deleveraging.

While WBD appears to be a lucrative spin-off investment, there are always risks involved, including:

We believe that WBD’s depressed price leads to the potential for asymmetric returns, given the reduced potential downside. WBD’s streaming growth coupled with the ability to deleverage offers the potential for a lucrative upside. Therefore, we believe that now is a good time to start a long position and hold until the value is fully realized (likely at least 6 months).

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.