jansucko

jansucko

If you are tired of the huge markups at your local bullion dealer or jeweler, but want to directly own and trade precious metals, perhaps the new CyberMetals website is for you. Operated by A-Mark Precious Metals (NASDAQ:AMRK), in business since 1965, and backed by $8 billion in annual physical bullion sales to retail customers all over the world, this new online platform launched in February may be the best design yet for those avoiding paper bullion ETFs (and the difficulties of getting physical metal delivered for your stake) or lacking the capital to trade futures at an exchange like the COMEX.

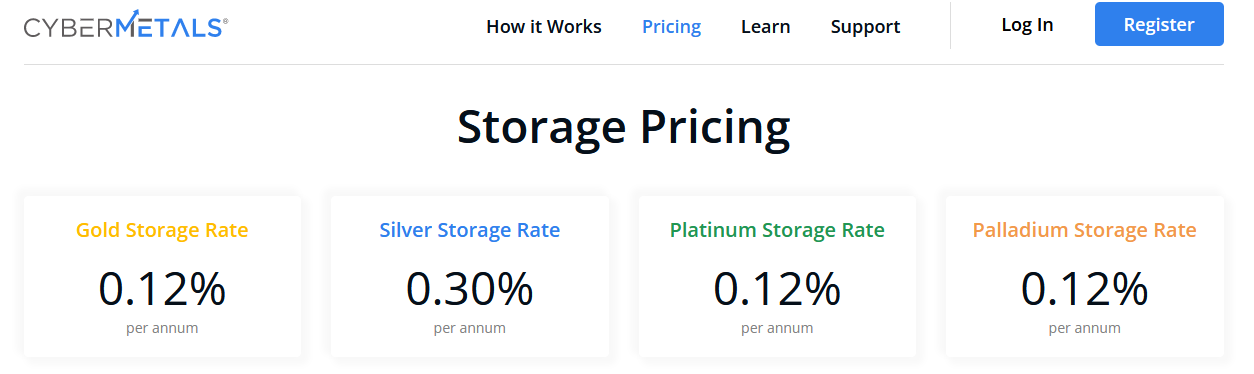

You can buy/sell metals 24/7 with minimal spreads, and either has your order delivered to your doorstep or vaulted and insured (with third-party accountants auditing your holdings) for a very small fee annually (lower than the expenses charged at many managed bullion ETFs) at locations in Dallas or Las Vegas. If you are investing less than $10,000 into precious metals, the new CyberMetals offering and cost structure may be the strongest available option to own physical gold, silver, platinum and palladium directly, in my opinion. Not having to deal with vaulting (hiding) your coins and bullion is a terrific option, with the ability to actually change your mind and have the physical metal delivered whenever you want.

CyberMetals Website

CyberMetals Website

CyberMetals Website

CyberMetals Website

CyberMetals Website

CyberMetals Website

CyberMetals Website

CyberMetals Website

Another way to profit from growth in precious metals pricing and the CyberMetals unit in future years is through a stock position in A-Mark. I hold shares in AMRK in anticipation of a major bottom in precious metals quotes and the potential for a boom in the physical bullion business, given a prolonged recession and/or high inflation are the new economic reality. We could be at the start of a period of expansion in precious metals interest similar to the 1970s boom. As cryptocurrencies turn to bust, everyone will be looking for a better way to move their wealth out of failing paper currencies like the U.S. dollar.

We have so much debt that cannot be repaid in the U.S. economy, the only way out of our leverage and IOU mess is through dramatically higher rates of inflation. This “soft default” on Treasury debt scenario was discussed a couple of weeks ago here. My argument is precious metals will again prove their worth, as they have for thousands of years, as the go-to investment when government-invented currencies decline.

The 2022 demise of cryptocurrencies will also refocus attention on the monetary metals as the main uncorrelated financial choice, functioning currency, store of wealth, no counter-party risk, premier private and portable asset surviving every type of government over centuries of history. What if a long-term demographic trend of intense buying by all types of consumers, businesses, and investors is about to begin, a function of cratering stocks and bonds? Why not look forward and invest into tomorrow’s trend today?

A-Mark is a one-of-a-kind investment to ride precious metals interest in the near future. It has “sneaky” leverage to rising bullion quotes without using much debt from: (1) its business model setting as one of the top retailers/dealers of physical metal and coins in the world through JM Bullion and a number of other dealer names; (2) its large holdings of inventory, which should climb in value with precious metals pricing, and (3) the excellent chance CyberMetals will turn into a hit with small traders and bullion buyers.

The robust rise in its stock quote since 2019 (from around $5 split-adjusted) could be a hint of even bigger gains to come. Currently, Wall Street believes business sales and profitability are about to turn lower as the pandemic-induced demand for “safe haven” gold/silver coins fades back to pre-COVID levels. I disagree and think a big turn HIGHER is on the cusp of becoming reality for the operating business and shareholder worth. The emergency monetary policy mess supporting record Treasury debt issuance (all a function of the Washington response to COVID-19 pandemic issues) may take 5-10 years to return the markets, economy and rates of inflation back to normal. And, outlier odds exist (and have grown) regarding another major black swan event hitting the markets/economy. For example, can the U.S. economy teetering near recession stand a war between Russia and America over the future of eastern Europe, or a China/U.S. conflict over Taiwan’s political status? There’s a small chance we may never return to a “normal” money printing regime, as debts and paper currency creation spiral out of control after 2022. Either way, you may want to own as much gold/silver as possible over the next decade to ride out the turbulence and protect your wealth.

If I am right, A-Mark is well prepared to capitalize on a precious metals bull market. At the end of June, A-Mark held $1.18 billion in current assets with $458 million in unrestricted inventories (representing about 60% of the equity market capitalization at $31 per share) vs. $952 million in total liabilities (about half in different forms of debt). The balance sheet setup is quite bullish, both liquid and conservative in nature. Plenty of cash and inventory is available to grow the business, including the CyberMetals unit.

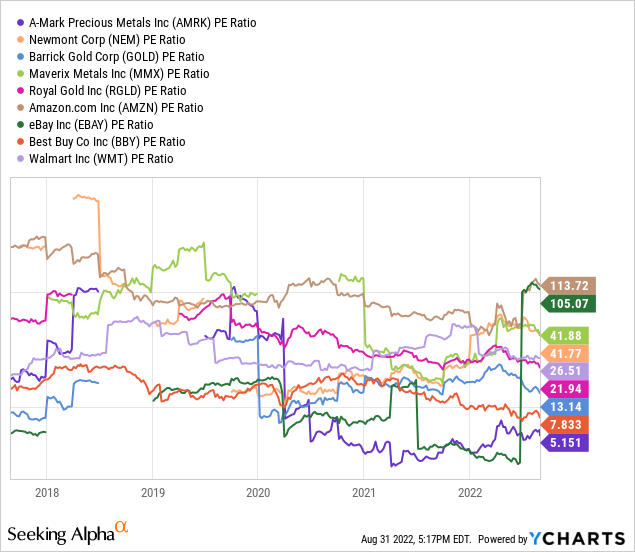

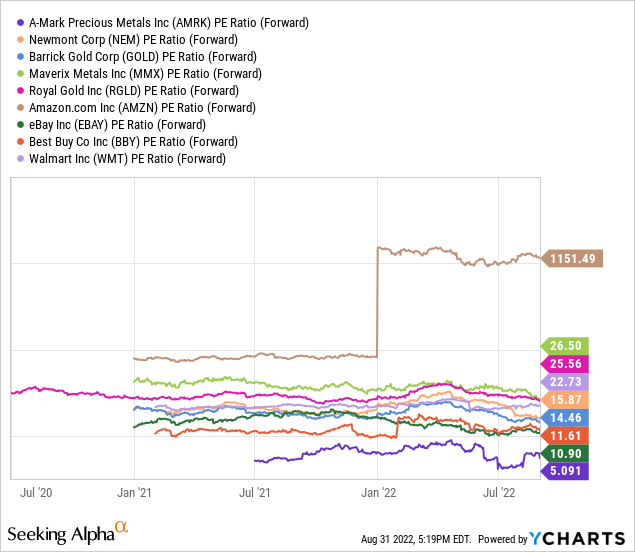

In my research, I keep returning to the high level of income generation during 2022. Wall Street seems content discounting into the stock quote a major slowdown by the A-Mark operating business, a forecast that has yet to materialize. Reviewing basic P/E ratios, both trailing and forward estimates, AMRK appears to be too cheap vs. reality. It’s hard to compare to other bullion dealers, with most serious competitors privately owned, or smaller parts of large companies. Below I am contrasting P/Es vs. the world’s largest gold miners, some mining royalty firms, profitable online sellers of goods, and successful hybrid store/online retailers. Again, A-Mark is not exactly like any of these alternatives for a business model, but I think a combination of them all gets you to the right spot for precious metals retailing margins and worth. To be honest, a P/E around 5x on trailing and forward results is a head-scratcher vs. a median average for the comparison group above 15x, especially if business trends start to pick up.

YCharts, AMRK vs. Comparison Group – Trailing P/E

YCharts, AMRK vs. Comparison Group – Forward P/E

YCharts, AMRK vs. Comparison Group – Trailing P/E

YCharts, AMRK vs. Comparison Group – Forward P/E

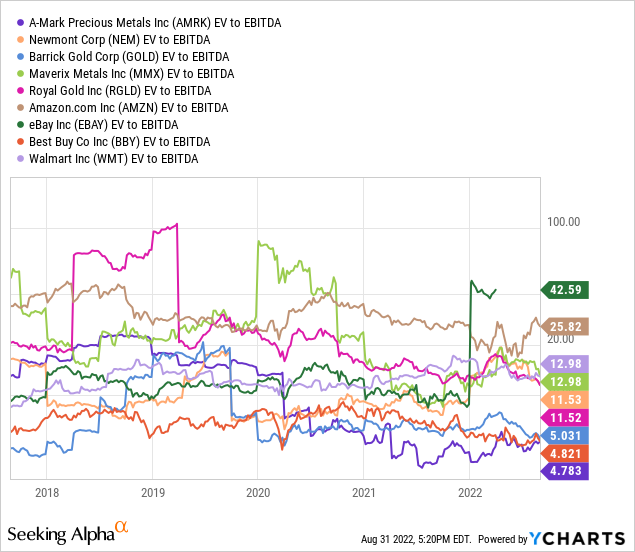

On enterprise value (equity + debt – cash) to trailing EBITDA (earnings before interest, taxes, depreciation and amortization), a ratio under 5x appears to be a real bargain vs. the median comparison group average above 11x.

YCharts, AMRK vs. Comparison Group – EV to Trailing EBITDA

YCharts, AMRK vs. Comparison Group – EV to Trailing EBITDA

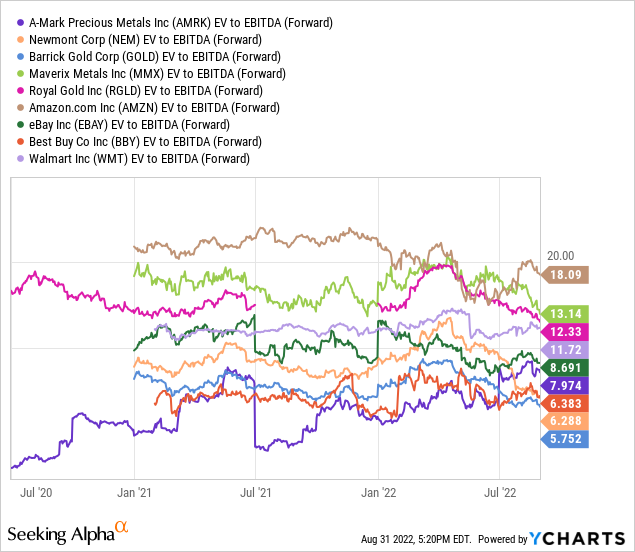

Lastly, using forward analyst estimates for EBITDA over the next year, Wall Street is projecting reduced profitability will increase this basic EV ratio closer to 8x, only a slight discount to the 9x median comparison average. Yet, if estimates of a slowdown in the underlying business prove off base, and earnings start to climb in 2023, AMRK is again selling far cheaper than one would expect at $31 per share today.

YCharts, AMRK vs. Comparison Group – EV to Forward EBITDA

YCharts, AMRK vs. Comparison Group – EV to Forward EBITDA

The quarterly report for Q4 out yesterday has been the excuse for widespread selling today (Thursday, August 31st), with about 1 in 20 outstanding shares trading hands. Revenues slightly missed expectations, almost entirely caused by the continued short-term drop in metals pricing this summer. Earnings actually beat expectations by a large degree. However, investors are blindly selling anything having to do with precious metals in August. Fear of Fed tightening and falling liquidity in the markets is the reason. I get it. Yet, for investors looking 6-12 months down the road, an economic recession in 2022 will almost surely “require” an incredible new cycle of easing soon, or we get a deep recession/depression next year. Who wants to sign up for that? I can guarantee Fed governors would prefer high inflation rates to 15% unemployment in America, with that final choice approaching fast.

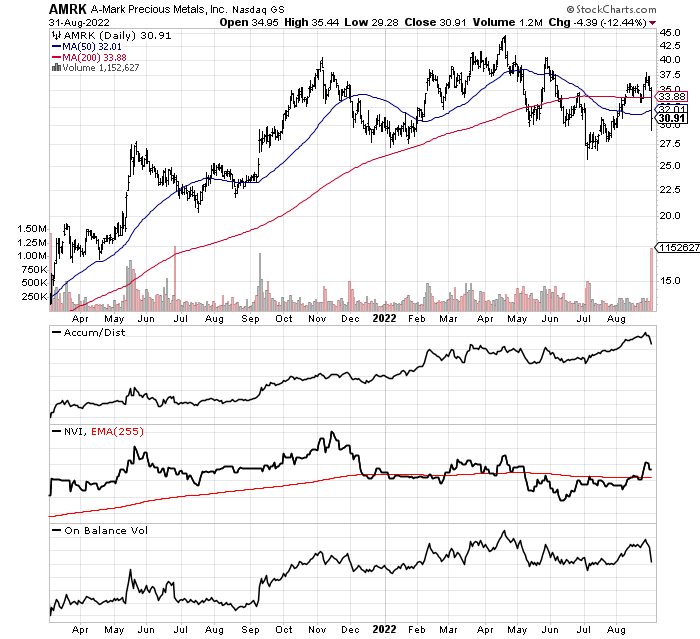

Technically speaking, August momentum signals for AMRK were actually quite positive going into the earnings release. And, I would categorize intermediate-term momentum as relatively bullish. On the 18-month chart below you can see the fairly healthy and constructive zigzags in indicators like the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume. I rate the momentum picture at least a B+ score vs. other equities during 2022’s bear market decline. So, a rising gold/silver market could easily ignite oversized buying interest in the stock from its ultra-low valuation today.

StockCharts.com, AMRK – 18 Months of Daily Changes

StockCharts.com, AMRK – 18 Months of Daily Changes

Management declared a forward $0.20 quarterly dividend and a special $1.00 per share payout after another strong fiscal year ended in June. The $1.80 rate annually works out to about 6% for a forward yield if you buy the stock now.

If you have a precious metals portfolio or are searching for long-term hedges against insane levels of currency debasement since 2020, I suggest you consider buying a stake in A-Mark Precious Metals. In effect, you can sit on the dealer’s side of the table when customers of all kinds show up wanting to invest in physical bullion and coins. Expanding metals pricing, leveraged with lower-cost inventories, alongside rising margins on each sale when times are good, could generate a double and triple in the AMRK stock quote over the next few years. If we get an honest boom in metals with gold rising 5x in price ($10,000 an ounce) and silver 10x ($200 an ounce) over the coming decade, AMRK has the potential to 10x or 20x your investment from a purchase in August-September 2022. I have moved my A-Mark rating to Strong Buy.

If the CyberMetals idea becomes a hit in the near future, Wall Street will reverse course, and start to put a premium growth valuation on the business, instead of today’s discount multiples. Current analyst pessimism is built on the assumption gold/silver/platinum/palladium will fall in price, as small coin collectors/bullion investors become less interested. What if the opposite is unfolding into the end of 2022? Under a bullish precious metals trend scenario, the new and exciting CyberMetals marketplace for serious investors wanting physical metal trading 24/7 at low cost could be a supercharged growth catalyst not available in other gold/silver asset alternatives.

What are the downside risks of an investment in AMRK? Two main variables come to mind. Basically, declining interest in precious metals by small retail buyers of physical, and sliding precious metals quotes, in general, could deflate the bullish AMRK proposition. If you believe such is the future, from an economy stabilized and growing without inflation, I understand you may want to avoid A-Mark.

However, with the U.S. sitting on a record aggregate debt to GDP number today, the Fed restricting loan origination with rising interest rates, and inflation at a 40-year high, do you really want to gamble in your portfolio that the economic world won’t blow up? The Fed is driving the economy close to the edge of a cliff, hoping and praying like the rest of us that no new bearish reason to sell or panic is around the corner. Trump could be indicted and some citizens could violently revolt in protest, a financial crisis implosion in stocks or bonds could happen in September-October as recession hits harder, and new wars appear somewhat likely soon.

To me, gold/silver hedges against calamity and inflation, which have proven great stores of wealth during past periods of economic destruction (like the 1970s stagflation years), may be the most valuable assets to buy/own today. If you want to stay invested in regular stocks and bonds, you need to have intelligent hedges. Ignoring the real potential for trouble in our world may be the worst financial stance you can take. You will not get a do-over if our economic world falls apart. (Yes, I am trying to scare you into action.) Weak gold/silver prices currently are a long-term gift for smart investors, with valuations vs. other asset classes, U.S. money supply, and Treasury debt extremely low. What’s not to like about A-Mark, if a major precious metals bottom is forming, and sales/income are set to improve markedly next year?

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.