Joa_Souza/iStock Unreleased via Getty Images

Joa_Souza/iStock Unreleased via Getty Images

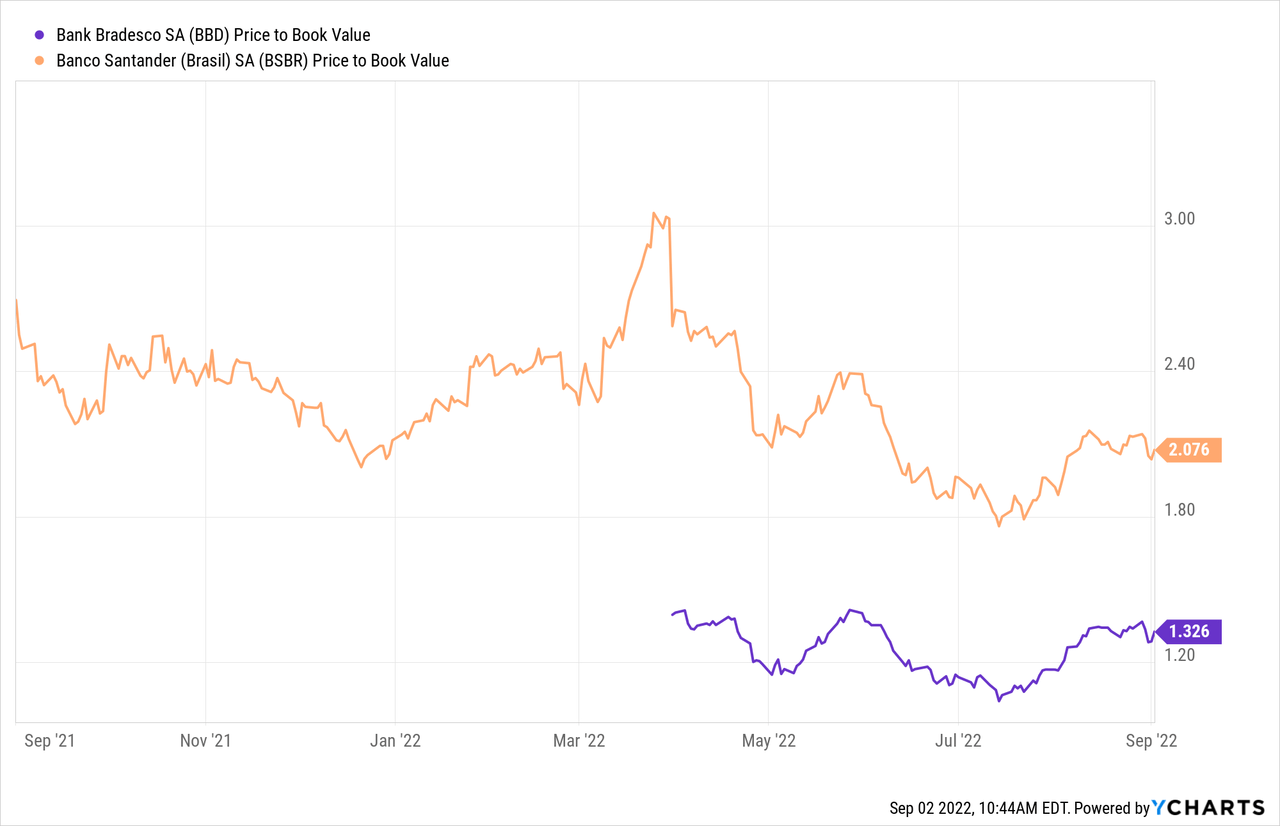

Banco Bradesco (NYSE:BBD), a leading Brazil-based private sector commercial bank, recently announced a strategic partnership with Banco BV to form an independent wealth management entity. While the notice contained no mention of the specific transaction value, the partnership strikes me as a strategic positive. Not only does it strengthen Bradesco’s competitiveness in the fast-growing private banking market, but structuring the pro-forma entity as an independent firm also reduces attrition, smoothing out the post-deal integration process. In the meantime, Bradesco’s reaffirmed full-year guidance points to a bright outlook – while delinquency could deteriorate, a stronger cost of risk outlook and optimism on the insurance side should more than compensate for any temporary asset quality headwinds. All in all, I am bullish on the stock at the current ~1.3x P/B valuation (a wide relative discount) and with Bradesco sustaining good earnings momentum heading into the back half of the year.

Bradesco published a pre-market notice on August 24 disclosing it had formed a strategic partnership with Banco BV to build out its independent wealth management business. For context, BV is the ninth largest bank in Brazil (by assets) and is jointly owned by Banco do Brasil S.A. (OTCPK:BDORY) and Votorantim Group, an investment holding company. Banco BV has a sizeable presence in the asset management vertical at >R$40bn under management, mostly in private equity funds, followed by fixed income and hedge funds. In addition, BV also adds ~R$22bn under custody in the private banking segment. By comparison, Bradesco has ~R$544bn in overall AUM, with ~R$380bn of assets under custody in the private banking segment (the second largest player in Brazil).

On balance, I view the deal as strategically positive – it not only strengthens Bradesco’s position in an attractive vertical (i.e., Brazil’s private banking segment) but has also been structured favorably via an independent firm, which should help massively with post-deal attrition. For context, Brazil’s ~R$1.7tn private banking industry is the most attractive expansion area today, coming in well above high-income retail and mass retail (~R$1.3tn and ~R$1.6tn, respectively). Per the deal terms, Bradesco will form an independent entity (with its own brand) via the acquisition of a 51% stake in the BV DTVM entity, which houses BV’s third-party fund management and private banking operations. The transaction remains subject to customary regulatory approvals.

Heading into Q3 2022, Bradesco’s fundamentals look surprisingly strong as well. The bank’s latest 90-day non-performing loan (NPL) formation (i.e., change in NPLs net of charge-offs) came in at a solid 4.7% – an ~18bps improvement from the prior quarter. Even including the renegotiated portfolio, the 90-day NPL would still have improved ~21bps QoQ at 5.3% – a notable step up from key peer Santander Brasil’s (BSBR) ~10bps improvement. In addition to the positive decline in NPL creation, Bradesco also delivered peer-leading provisions to NPL formation ratio of ~113% (or ~98%, including the renegotiated portfolio).

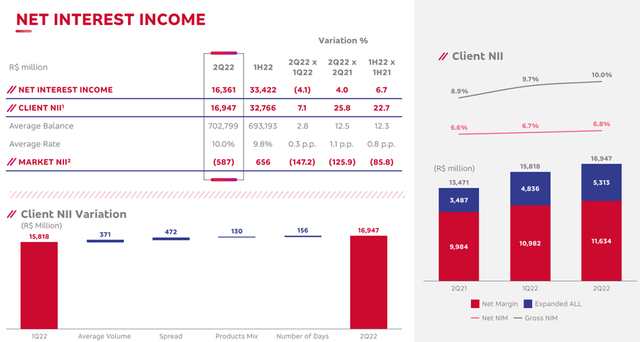

Building off the quarterly strength, Bradesco management has indicated it expects to deliver at the upper end of its cost of risk guidance. This seems ambitious at first glance as rates are on the rise globally, and thus, delinquency trends could still deteriorate. Plus, if we were to exclude the impact of impairment reversals this quarter, the cost of risk would already be running above guidance. That said, the bank is actively engaged in the sale of its credit portfolios in H2 2022, which should go a long way toward reducing provision coverage and hitting the guidance. Plus, the strength of the revenue performance in Q2 2022 (e.g., the favorable client net interest income trend) should boost the near-term outlook for risk-adjusted spreads. Hence, I feel comfortable underwriting management’s call for a cost of risk outperformance for the full year.

Bradesco

Bradesco

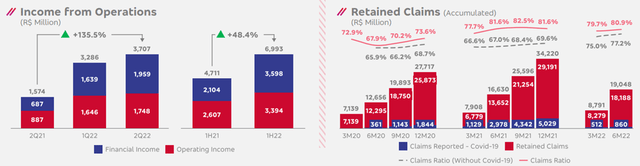

Insurance income has been a key highlight for Bradesco in recent times, reaching R$3.7bn in Q2 (a solid +12.8% QoQ or +135.5% YoY), despite a slightly higher 91.2% combined ratio (+70 bps QoQ). The strong insurance results were due to a combination of lower COVID claims and increased premiums, as well as a better fundamental backdrop. Per management commentary, the expectation is for these positive trends to extend into 2023 as well, although the lack of specific guidance for growth makes it hard to pencil in anything concrete. Still, Bradesco’s strong growth in earned premiums (+12% QoQ or up 22% YoY), which came from repricing activity and drove insurance results above Street estimates, point to a fairly easy beat relative to the 18-23% YoY guidance, in my view. Key hurdles to overcome in H2 2022 include inflation and YoY comps, which could decelerate insurance growth; given the fundamental strength, however, my base case remains for Bradesco to come in at the top of the guidance range.

Bradesco

Bradesco

Net, Bradesco’s recently disclosed strategic partnership with Banco BV is strategically positive, in my view. While the lack of financial disclosures makes it difficult to pinpoint the accretion/dilution, the deal should accelerate Bradesco’s scale and competitiveness in the private banking segment. Plus, creating an independent firm (vs. absorbing into the parentco) should help to smooth out the transition, reducing post-deal personnel turnover. Coupled with the better-than-expected earnings quality in Q2 2022, the near-term Bradesco setup looks compelling. The company has not only delivered broad-based revenue performance across net interest income, fees, and insurance but has also made progress in reducing NPL formation. With the guidance bar also relatively low, I see a clear path to a beat-and-raise quarter heading into Q3 2022. Bradesco trades at a discounted P/B valuation as well, so there remains ample re-rating potential heading into H2 2022.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.