A global pandemic, historic economic change and an unprecedented shift in the housing market have been hallmarks of the past year. But while these large-scale changes have shifted the landscape and have the potential to reshape buyers’ preferences over the longer term, many behaviors and attitudes remain the same.

The 2022 Consumer Housing Trends Report (CHTR) provides a snapshot of what housing consumers are thinking and doing in mid-2022. In this report, we take a deeper look at buyers (household decision makers that own their primary residence and moved to a home they purchased in the past year); In other reports, we examine renters, sellers, and new construction buyers more closely. Information about who buyers are in 2022 can equip consumers with the tools they need to make informed decisions in this transforming housing market landscape.

The median US buyer is 44 years old, partnered or married, has at least some college education, and is most likely to buy a home in the South. Demographic change tends to play out over a long time: Most of these characteristics have not changed substantially, if at all, over the last few years.

Most buyers – about three out of every four –purchased a single-family detached house (77%). Townhouses and rowhouses make up about one in ten purchased homes (9%).

Like last year the typical buyer reported submitting two offers, up from one offer over the preceding three (2018 – 2020). At the same time, the number of first-time buyers increased since last year. After falling to 37% of buyers surveyed in 2021, the share of first-time buyers appears to have rebounded – reaching 45%. In previous years, a competitive, low-inventory market likely contributed to the historic falling share of first-time buyers; however, recent increases in the cost of acquiring a mortgage, coupled with economic uncertainty, may explain would-be repeat buyers staying put. These tenured homeowners are likely to have favorable mortgage rates that they would lose if they moved, while first-time buyers are far less likely to consider such a trade-off.

When asked if they agreed with a series of statements about their desire for 3D and Virtual home tour technology, buyers tended to at least somewhat agree that such tools would be helpful. Majorities of buyers somewhat or completely agreed that 3D tours would give them a better feel for the space than static photos (66%) and that unlocking properties on their phone and tour them in-person on their own time would be easier (64%). Most agreed at least somewhat that they wished that more listings had 3D tours (61%) and preferred to schedule in-person tours online (62%).

In order to gain a comprehensive understanding of U.S. buyers, Zillow Group Population Science conducted a nationally representative survey of more than 4,900 buyers. The study was fielded between March and July 2022. Wherever possible, survey questions from previous years were asked in the same manner this year to allow for the measurement of year-to-year trends in key areas of business interest. This year was the first year that ZG Population Science designed, fielded and analyzed the survey entirely in-house.

For the purpose of this study, “buyers” refers to household decision makers 18 years of age or older who moved to a new primary residence that they purchased in the past two years. Most buyers in this sample (62%) purchased within the past year.

Results from this survey are nationally representative of buyers. To achieve representativeness, ZG Population Science used a two-prong approach. First, the initial recruitment to the sample was balanced to all buyers from the U.S. Census Bureau, 2019 American Community Survey (ACS) on the basis of age, relationship status, income, ethnicity/race, education, region and sex. Additional targeted subgroups were sampled based on all key household demographic characteristics. Second, statistical raking was used to create calibration weights to ensure that the distribution of survey respondents matched the U.S. population with respect to a number of key demographic characteristics obtained from analyses of the 2019 and U.S. Census Bureau, 2021 Current Population Survey Annual Social and Economic Supplement (CPS ASEC).

To reduce response bias, survey respondents did not know that Zillow Group was conducting the survey. Several additional quality control measures were also taken to ensure data accuracy:

Unless otherwise specified, estimates in this report come from the Consumer Housing Trends Report (CHTR) 2022, and year-over-year comparisons also use data from CHTR 2018, CHTR 2019, CHTR 2020 and CHTR 2021. To provide a fuller picture of the state of home rentals and buyers’ characteristics, preferences and behaviors, we also analyzed data from other sources:

In this section, we provide a high-level overview of key buyer info and what their homes look like. According to the Census Bureau American Community Survey (ACS), 5% of adults in the country are recent buyers. Throughout this section, information about buyers comes from CHTR, and information about other groups comes from ZG Population Science analyses using ACS data.

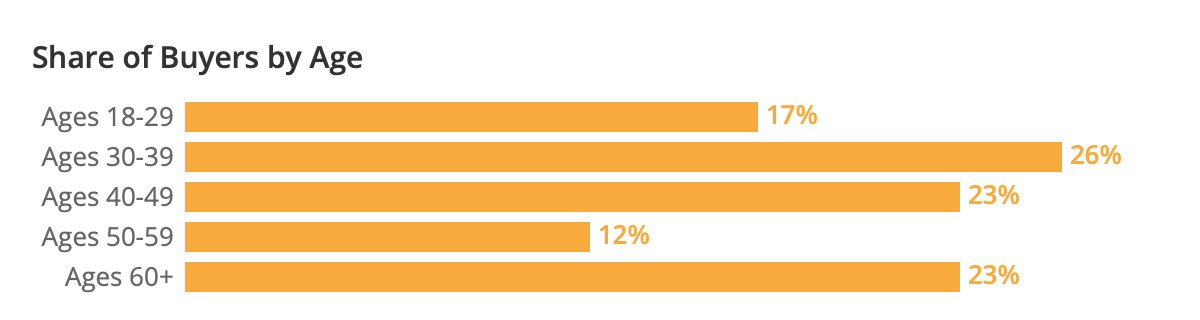

The median age of U.S. buyers is 44, while the average skews higher (46 years old). About half (53%) of buyers were born before 1980; almost one in five buyers (17%) are in their twenties or younger, while roughly a quarter (23%) are in their sixties or older. In other words, the age distribution of buyers represents somewhat of a middle ground when it comes to the U.S. population: they are typically younger than tenured homeowners (those who have not moved in the past year), but older than renters.

Consistent with age, the largest generational group of buyers is between 27 and 41 years old in 2021 — the group colloquially known as “Millennials.” About 37% of buyers are Millennials.

Note: Household decision maker and US adult estimates in this table come from the U.S. Census Bureau, 2019 American Community Survey

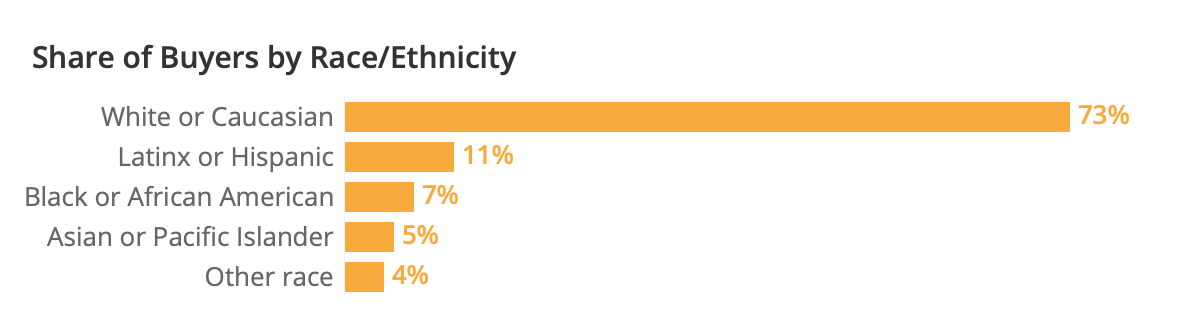

About three quarters of buyers are non-Hispanic white or Caucasian (73%), higher than the overall share of the U.S. adult population that is white (63%). At the same time, 16% of U.S. adults identify as non-Hispanic Black or African American, but just 7% of buyers are Black.

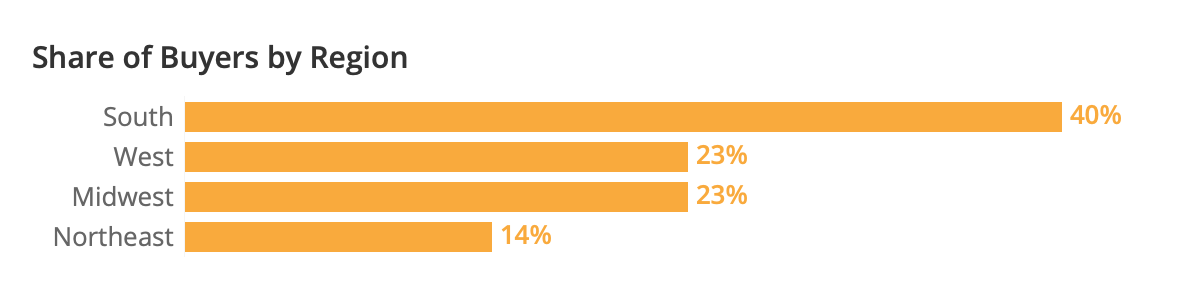

The largest share of buyers live in the South (40%), followed by the West (23%) and Midwest (23%). The smallest share lives in the Northeast (15%). Buyers largely follow the distribution of US adults, with a slightly higher concentration in the South and Midwest — likely because these regions have more for-sale inventory.

Note: Share of For Sale Housing Inventory comes from Zillow’s listings data as of June 29th, 2022.

The percentage of buyers identifying as LGBTQ+ has been on a stable and slight upward trend over the last few years. About one in fourteen (7%) buyers identified as LGBTQ+ in 2019, the first year CHTR asked about sexual orientation and gender identity, then 9% in 2020.[3] This likely represents the growing share of buyers, many of whom were born in more recent years, who may be more likely to feel comfortable self-identifying as LGBTQ+.

Buyers tend to have higher household incomes than the U.S. population overall. The annual median household income among buyers is approximately $86,000, compared to the overall national median (2020) of $65,700.[4]

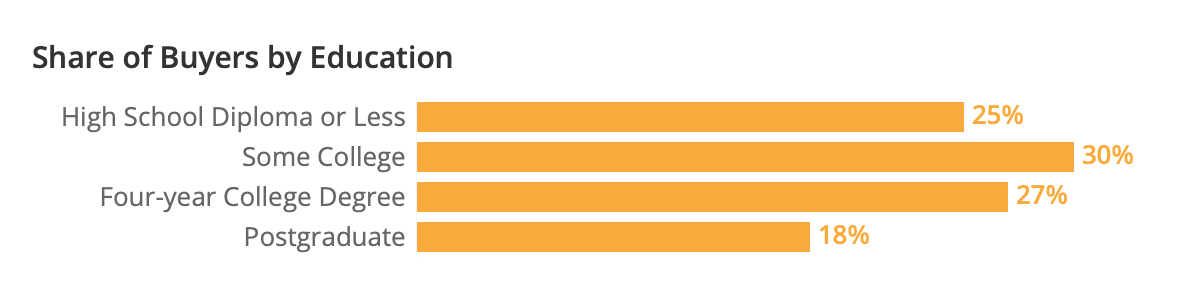

Buyers tend to be more educated than the overall population of U.S. household decision makers: 45% of buyers have at least a four-year degree, higher than 34% of overall U.S. household decision makers.

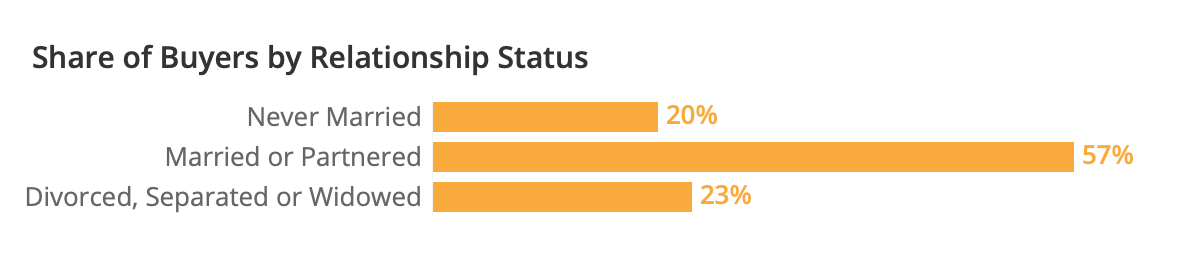

Prior research has shown that the purchase of a home is often tied to family formation or other life events, like a divorce or separation. This relationship between homeownership and family formation helps explain why over half of buyers are currently married/partnered (57%) and almost a quarter (23%) have been married in the past.

Between 2018 and 2021, the share of buyers that purchased a home for the first time trended slightly downward (46% in 2018, down to 37% in 2021). In 2022, however, the downward trend rebounded: 45% of buyers were first-timers. This shift is likely explained by a cooling market and rising rates. Since many would-be repeat buyers had locked in a more favorable rate than they could secure on a new home, this discrepancy may help explain why a larger share chose to stay in place.

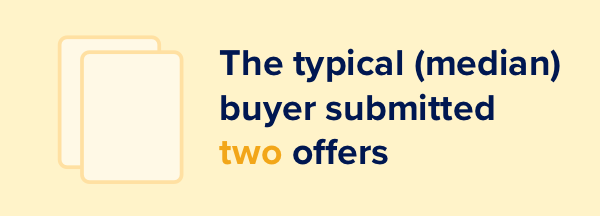

About one in four (24%) of first-time buyers said that they had to buy a home quickly — compared to a smaller share (11%) of repeat buyers. Conversely, repeat buyers were more likely to describe their timeline for home shopping as “relaxed.” About half (47%) of repeat buyers said that they were able to take their time and explore their options, compared to about a third (37%) of first-time buyers. The typical buyer submitted two offers — matching the median in 2021 and up from the single offer that typical buyers consistently reported over the previous three years (2018 – 2020). The share of buyers that made only one offer remained similar as well (39% in 2022, similar to 36% in 2021 and down from 48% in 2020, 49% in 2019, and 52% in 2018). Conversely, the share that made two or more stayed higher: Over half (56%) of buyers reported making two or more offers — similar to 59% in 2021 and up significantly from roughly two in five in years past (42% in 2020, 40% in 2019, and 38% in 2018). [6]

The typical buyer submitted two offers — matching the median in 2021 and up from the single offer that typical buyers consistently reported over the previous three years (2018 – 2020). The share of buyers that made only one offer remained similar as well (39% in 2022, similar to 36% in 2021 and down from 48% in 2020, 49% in 2019, and 52% in 2018). Conversely, the share that made two or more stayed higher: Over half (56%) of buyers reported making two or more offers — similar to 59% in 2021 and up significantly from roughly two in five in years past (42% in 2020, 40% in 2019, and 38% in 2018). [6]

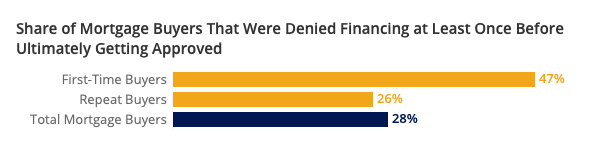

First-time buyers were more likely to report that they made two or more offers: About three in five (59%) made at least two during their home buying process — higher than about half (53%) of repeat buyers. The younger age skew of first-time buyers (median: 35 years old) means that they tend to be less experienced with home buying, have fewer years to save, and are generally unable to tap equity from a previous home sale (except in rarer cases where they acquire a home through circumstances like inheritance or marriage).

Given rising costs of financing with a mortgage, it comes as an unexpected surprise to see that about one in five (22%) of buyers paid for their home without a mortgage – down from 32% in 2021. This year’s finding is similar to 2018, when 23% of buyers paid for their home without a mortgage.

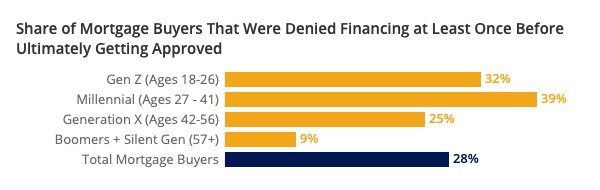

Consistent with a greater share of buyers purchasing with a mortgage, along with a greater share of first-time buyers, the share of buyers that reported at least one mortgage denial before getting approved fell from from 34% in 2021 to 28% in 2022. [7]

Younger mortgage buyers are significantly more likely to report being denied financing at least once, compared with their older counterparts. For example, 27% of buyers under 30 years old reported at least one mortgage denial, whereas only 9% buyers in their fifties did.[8] Thinking about this trend in terms of generations: Only one in ten (9%) of Baby Boomer and Silent Generation mortgage borrowers reported being denied financing — much lower than 25% of Gen X, 39% of Millennial and 32% of Gen Z mortgage buyers.

Mortgage buyers of color are more likely to experience a mortgage denial before ultimately being approved: About two in five (41%) mortgage buyers of color reported at least one denial — higher than about a fifth of white mortgage buyers (22%).[9] Households of color can be less likely to benefit from intergenerational wealth, and Black and Latinx households also typically have lower household wealth. And even for households of color that do become homeowners, many of the inequalities rooted in segregation and redlining persist today. Less money in the bank and lower home values can translate to less ability to offer a competitive down payment. Beyond the challenges that mortgage buyers of color face in regards to wealth, people of color more generally can face discrimination on the basis of race. The Zillow Housing Aspirations Report — a survey of households in 20 major metropolitan areas — found that households of color were significantly more likely to say that they were treated differently in their search for housing — the case for 19% of Asian, 26% of Black, 16% of Latinx households, compared to just 3% of white households.

It is likely that the younger age skew of first-time buyers (typically age 35) and buyers who identify as people of color (typically age 37) contributes to the fact that each is more likely to report at least one mortgage denial when applying for financing. Each of these groups trends younger than the typical buyer, whose age has remained between 43 and 44 years old over the last few years. In this case, age is more than just a number — it’s largely indicative of how long someone has had to grow their savings, build their credit, and potentially pay off student loans. In 2021, half (50%) of buyers with a mortgage said saving up enough for a down payment influenced their decision to move. And two thirds (67%) of mortgage buyers said they financed at least part of their down payment with money they had saved up over time. Given this dependence on savings, more time to save can often translate to a more ironclad mortgage application.

Just over half (58%) of mortgage buyers reported putting down less than 20% on the home they purchased – with the median mortgage buyer putting down 10-19% of the final purchase price.

Consistent with the past three years, buyers in 2022 didn’t budge significantly when it came to forgoing inspections: About one in nine (13%) said that they did not get an inspection on the property they bought prior to purchasing it — insignificantly different from past years (12% in 2021, 13% in 2020, 13% in 2019, and 11% in 2018).  Consistent with results over the past two years, majorities of buyers surveyed in 2022 continue to agree at least somewhat with a series of statements on their desire for floor plans. While buyers continue to agree that they’re more likely to view a home if the listing includes a floor plan they like (80%), they are also similarly likely to agree that the only way to really understand the layout of a home is to see it in person (76%). The high agreement with both statements likely shows that most buyers want all the information they can get when searching for a home: Floor plans to help decide which homes to tour and an in-person visit for the homes with floor plans that fit their preferences.

Consistent with results over the past two years, majorities of buyers surveyed in 2022 continue to agree at least somewhat with a series of statements on their desire for floor plans. While buyers continue to agree that they’re more likely to view a home if the listing includes a floor plan they like (80%), they are also similarly likely to agree that the only way to really understand the layout of a home is to see it in person (76%). The high agreement with both statements likely shows that most buyers want all the information they can get when searching for a home: Floor plans to help decide which homes to tour and an in-person visit for the homes with floor plans that fit their preferences.

Buyers surveyed in 2022 remained similarly likely to agree somewhat or completely with most statements on their preference for 3D and virtual tours. The only exception was the share that agreed that they prefer 3D tours over in-person viewings, which peaked in 2021. In 2022, the share of buyers that agreed fell to 32% – still higher than its pre-pandemic 26% in 2019.

About half (54%) of buyers said they would be at least somewhat confident making an offer on a home after seeing a 360/virtual tour, but not an in-person viewing. This finding is similar to 2020, when 55% of buyers said the same – falling slightly from its peak (58%) in 2021. The share that says they would be very or extremely confident has stayed around a third — 32% in 2020, 34% in 2021 and 31% in 2022.

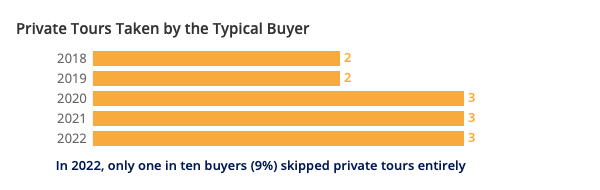

Despite the pandemic, the typical buyers surveyed between 2020 and 2022 went on three private tours — one more than the typical buyer in 2018 and 2019. And in 2022, only one in ten buyers (9%) skipped private tours entirely

About half of buyers (47%) attended zero open houses and only one in ten (9%) attended 5 or more. Across 2018-2022, the median number of open houses remained only one tour.

Most buyers reported using an agent among the resources they used to shop, search, or purchase their home (89%). Among buyers that used an agent, 78% say they hired their agent to help shop for and purchase their home. About one in six (16%) hired an agent to finalize their home purchase, but shopped on their own. And a small 6% said they consulted with an agent, but did not end up hiring one.

Consistent with previous years, the top characteristic that buyers with an agent are most likely to consider highly important is a trustworthy initial impression (83%) – similar to 81% about a responsive initial impression.

[1] Zillow Group Population Science calculates estimates for “Household Decision Makers” when utilizing ACS data by averaging the characteristics of heads of household and their spouses and/or partners within a household. For renter households, this definition also includes roommates/housemates.

[2] Zillow Group Population Science defines Gen Z as those born between 1995 and 2003, Millennials between 1980 and 1994, Gen X between 1965 and 1979, Baby Boomers between 1945 and 1964, and Silent Generation in 1944 and earlier.

[3] LGBTQ+ buyers are those who identified as gay, lesbian, bisexual, transgender, gender non-conforming/non-binary, intersex, or with another sexual orientation (other than straight) or gender identity (e.g. gender fluid, gender queer, gender neutral).

[4] National median income is from US Census Bureau, Current Population Survey Annual Social and Economic Supplement.

[5] These estimates come from CHTR 2021 and the 2019 American Community Survey.

[6] About one in twenty (6%) buyers made zero offers. These buyers are more likely to purchase mobile or manufactured homes, transact without an agent, and consider the area where they purchased as rural.

[7] Self-reported mortgage denials appear to skew much higher than denials in Home Mortgage Disclosure Act (HMDA) data (34% of successful mortgage buyers self-reporting in 2021 vs. 9% of all applicants in the most recent HMDA data from 2021). HMDA data includes all mortgage applicants — not just successful mortgage buyers. It is also possible that survey respondents overreport cases where hurdles like providing relevant documents or poor communication/customer service from a lender caused financing to fall through — without receiving a formal denial.

[8] To increase sample size for estimates of mortgage denials for black and AAPI buyers, results combine data from CHTR 2021 and CHTR 2022.

[9] For additional Zillow research on mortgage denials and race/ethnicity, see this blog post.

Zillow expects home value growth…

Zillow expects home value growth to slow…

Lack of affordability drives…

Lack of affordability drives further price…

While interest rates continue to…

While interest rates continue to be volatile…

The share of contract…

The share of contract cancellations —…

Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please let us know.

Zillow, Inc. holds real estate brokerage licenses in multiple states. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces.

§ 442-H New York Standard Operating Procedures

§ New York Fair Housing Notice

TREC: Information about brokerage services, Consumer protection notice

California DRE #1522444Contact Zillow, Inc. Brokerage

For listings in Canada, the trademarks REALTOR®, REALTORS®, and the REALTOR® logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by CREA and identify the quality of services provided by real estate professionals who are members of CREA. Used under license.