JHVEPhoto

JHVEPhoto

Citigroup Inc. (NYSE:C) stock has given back all its August gains as the market pulled back from its August highs. We believe the market has de-rated C to account for its ongoing business transformation risks. However, Citigroup’s robust Q2 earnings release corroborated that interest revenue tailwinds should continue to drive its net interest income, even though the trends should normalize.

Moreover, the subsequent recovery from its non-interest revenue should help mitigate the normalization as investment banking and wealth management recovers from its current downturn, given our assessment of the market bottoming in June/July.

Therefore, we remain confident that C has likely bottomed out on its long-term chart. Coupled with a well-battered valuation, we are satisfied that the downside in C seems limited over the medium term.

Therefore, we rate C as a Buy and encourage investors to use the pullback to add more positions.

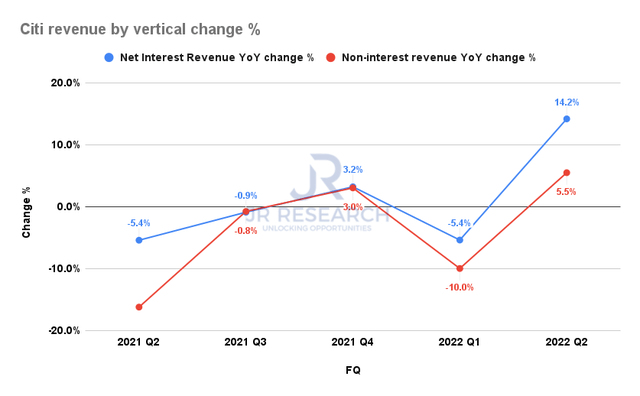

Citigroup revenue by vertical change % (Company filings)

Citigroup revenue by vertical change % (Company filings)

As seen above, Citigroup reported a robust Q2, as net interest revenue and non-interest revenue recovered from the nadir in Q1. Notably, the bank posted an increase of 14.2% in net interest revenue, as it benefited from the current heightened rate environment.

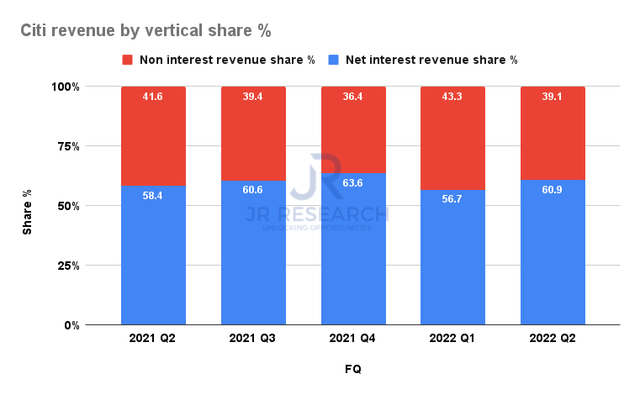

Citigroup revenue by vertical share % (Company filings)

Citigroup revenue by vertical share % (Company filings)

Given Citigroup’s exposure to net interest revenue (60.9% in Q2), it also helped mitigate the weakness in investment banking and wealth management, given the extent of the bear market.

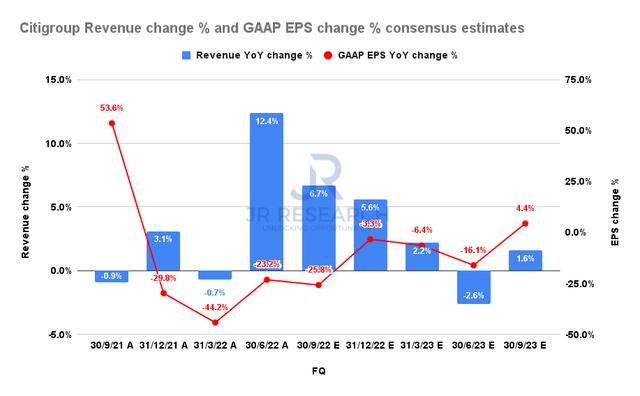

Citigroup revenue change % and GAAP EPS change % consensus estimates (S&P Cap IQ)

Citigroup revenue change % and GAAP EPS change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (bullish) suggest that Citigroup’s revenue growth should normalize further through FY23. Therefore, the boost from its net interest revenue should moderate. However, the Street remains confident that its EPS recovery cadence should remain robust with its ongoing divestitures and rationalization.

As a result, we are confident that its earnings growth should help support its current valuation, given the pummeling through July. Therefore, we believe it should help limit further significant downside volatility, even as C pulls back from its August highs.

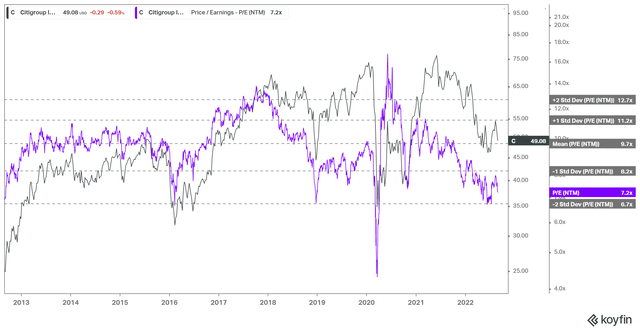

C NTM normalized PE valuation trend (koyfin)

C NTM normalized PE valuation trend (koyfin)

C traded at the two standard deviation zones below its 10Y NTM normalized PE means at its July lows. Note the zone has robustly supported C’s valuations over the past ten years, including the sharp reversal in March 2020. Therefore, while the market de-rated C markedly given its execution and regulatory risks, we are confident that its valuation has been sufficiently de-risked.

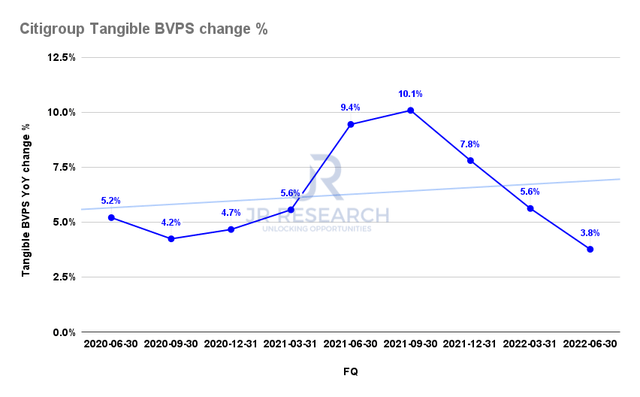

Citigroup tangible book value per share change % (S&P Cap IQ)

Citigroup tangible book value per share change % (S&P Cap IQ)

Also, Citigroup’s underlying strength has been reflected in its tangible book value per share (TBVPS), as it exceeded $80 in Q2. However, its growth momentum has also been slowing markedly, which aligns with the slowdown in its EPS growth. Therefore, we believe the market adjusted astutely to this slowdown from June 2021, as it assessed that Citigroup’s TBVPS above-trend growth was unsustainable.

Notwithstanding, the bank registered a second consecutive quarter of below-trend growth since Q1. Therefore, we are confident its TBVPS growth should normalize moving forward as it laps less challenging comps.

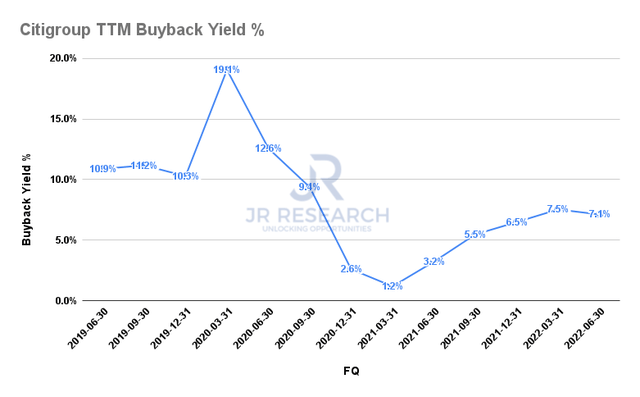

Citigroup TTM buyback yield % (S&P Cap IQ)

Citigroup TTM buyback yield % (S&P Cap IQ)

Citigroup may have paused its stock repurchase program but continued to commit to its dividend payout. The bank sees the need to build its CET1 capital buffer to 13%, given the regulatory requirements and management prudence. However, the bank’s medium-term CET1 target remains between 11.5% and 12%.

Therefore, we are confident that Citigroup should resume its buybacks to support its conviction of a depressed stock valuation and return value to shareholders. Furthermore, its TTM buyback yield of 7.1% suggests that management sees tremendous value, corroborating our thesis of a well-battered valuation.

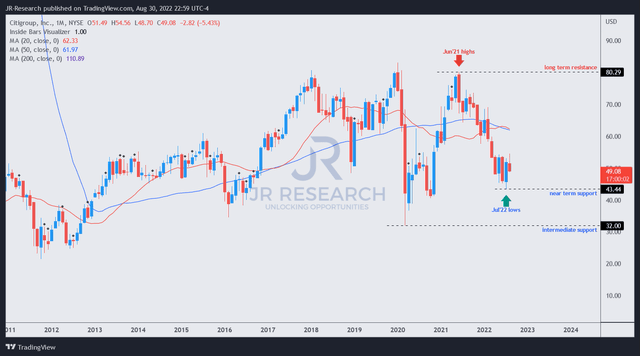

C price chart (monthly) (TradingView)

C price chart (monthly) (TradingView)

In addition, we gleaned that C has likely staged its long-term bottom in July, as seen above. Therefore, the pullback from its August highs represents another fantastic opportunity for investors to add more positions if they missed its July lows.

As such, we rate C as a Buy.

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

I’m Jere Wang, the lead writer and founder of JR Research and Ultimate Growth Investing Marketplace service. Our team is committed to bringing more clarity to investors in their investment decisions.

Our marketplace service focuses on a price-action-based approach to growth and technology stocks, supported by fundamental analysis. In addition, our general SA site discusses stocks from various sectors and industries.

Our discussion mainly focuses on a short- to medium-term thesis. While we hold stocks for the long-term, we also use appropriate opportunities to benefit from short- to medium-term swings, leveraging long (directionally bullish) or short (directionally bearish) set-ups.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.