on

Photo courtesy of Daily Mirror

Increasing inequality is a political and economic issue affecting countries across the world and has been a pervasive feature of modern society. Inequality can be categorized into income and wealth inequality.This class/income divide fuels poverty and marginalization and creates a gap in access to opportunity. Often, lower income communities lack the structural privileges to climb the income ladder and further social mobility. Inequality is a highly complex issue and intersects with wealth, capital and power.

Unequal distribution of wealth

French economist Thomas Piketty has argued in his book, Capital in the 21st Century, that when the rate of return on capital (R) is greater than the rate of economic growth (G) over the long term, the result is a concentration of wealth. It is this unequal distribution of wealth that creates social and economic instability. Piketty proposes a global system of wealth tax, including progressive taxation of high income earners, to address inequality and avoid the vast majority of wealth being concentrated within a tiny minority.

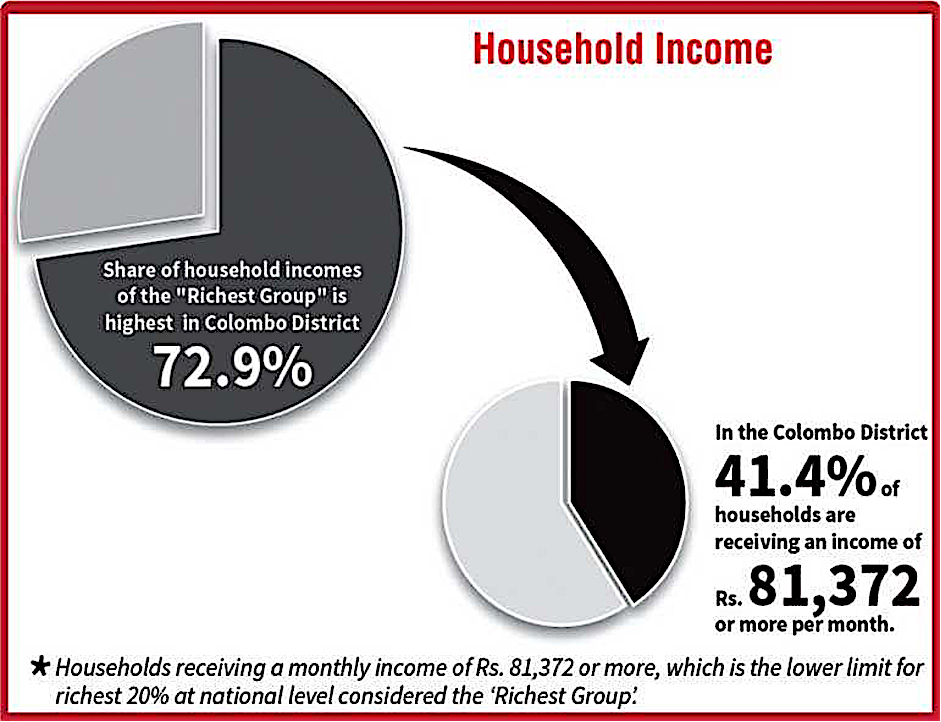

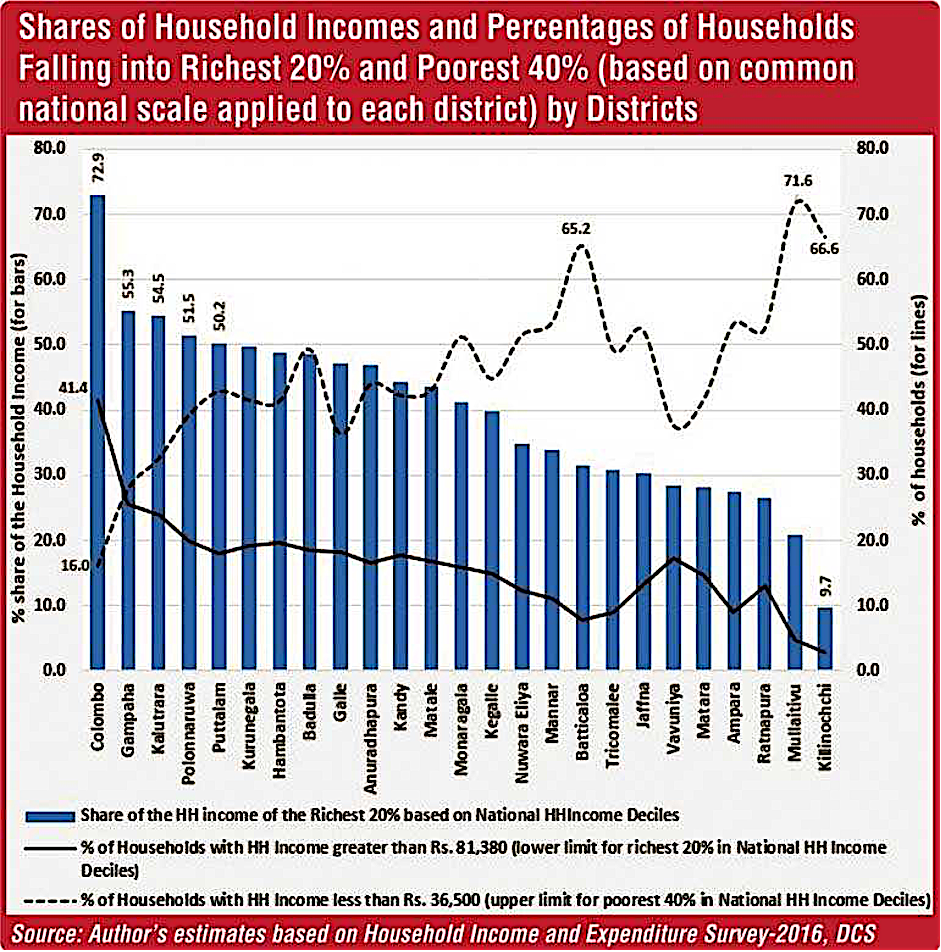

The figures show a clear trend where the percentage of households with an income less than Rs. 36,000 is rising steadily. They also show the share of household income and percentages of households falling into the richest 20% and poorest 40%. On one end of the spectrum, there is an affluent minority who possess inherited wealth and other forms of capital in the forms of rent, dividends, profits and shares. This wealth continues to multiply. This is a natural phenomenon in any society. Thus, in some ways, Sri Lanka’s situation fits in with Piketty’s thesis. Piketty argues that when the rate of growth is low, as it has been over the last three decades in Sri Lanka, wealth tends to accumulate more quickly and within the top 10% or top 1%, thereby increasing inequality.

The fundamental force driving this dynamic can be summed up in R > G. This extreme concentration of wealth in the hands of a small minority is seen in the context of people’s protests to fuel anger and frustration among the public. This can be connected, at least in part, to the economic and political crises Sri Lanka faces today. It is a crisis of inequality. More particularly, it is a crisis of wealth and income inequality.

How can Piketty’s proposals to address inequality be applied to Sri Lanka? For instance, a wealth tax is not an easy feat and is likely to be unpopular with the business elite. This is not a criticism of the business elite, most of whom have come up to the top through hard work and effort. Their talents and achievements must be celebrated and it is justified for the business community to be concerned about radical wealth and corporation taxes. There are no silver bullets in tackling inequality but rigorous economic analysis and targeted tax regimes are at least a starting point.

Power, wealth concentration and inequality

Why do extreme inequality and wealth concentration matter? Because of power – political power and private power. The net concentration of wealth in the hands of a small group of elite means that power is concentrated and the economically weaker majority group has little or no political decision making.

The next point is that the richest Sri Lankans who own and control the country’s largest companies influence the stock market in a significant manner and exert enormous personal and political power. They fund political candidates, parties and political campaigns and influence and shape Sri Lanka’s democracy. This is a natural feature of all democratic countries and there is a strong argument that people should be free to do whatever they want with their money. It is incorrect to criticize wealthy groups and individuals who have acquired and not inherited their wealth.

Conclusion

Inequality is an important and concerning issue. It impacts the economic, political and social realms. There needs to be a broadspectrum dialogue on a long term strategy to address inequality in Sri Lanka.

Copyright © 2016 Groundviews. All rights reserved. All content on this site is licensed under a Creative Commons Attribution-No Derivative Works 3.0 License.

Web Design & Development by SABERION