Vertigo3d

Vertigo3d

It’s fairly obvious in today’s market that many stocks are on sale. For value investors, it can feel like being a kid in a candy store, with so many beaten-down stocks to choose from. It pays to be choosy, however, as investors seeking generational wealth many want to stick with those that have moat-worthy business models and a proven track record.

This brings me to Medtronic (NYSE:MDT), which is has gotten very cheap as of late. In this article, I highlight what makes MDT a strong buy at present for potentially great total returns, so let’s get started.

Medtronic is a medical device giant with a presence in over 150 countries. Its broad array of products includes pacemakers, stents and insulin pumps, treating 70 various health conditions. Its patent base and track record of medical innovation gives it pricing power and helps to insulate it from headwinds in any one particular product category or geography. MDT employs over 90K employees around the world, and in the trailing 12 months, generated $31 billion in total revenue.

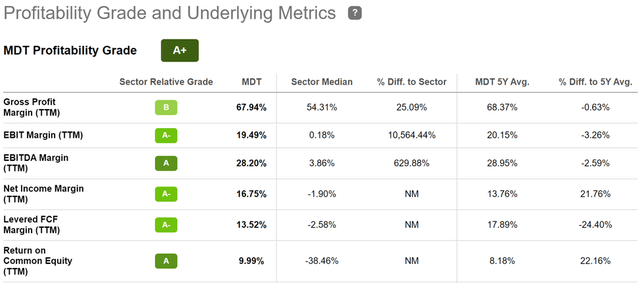

What sets Medtronic apart is its focus on chronic disease, or those health conditions that require ongoing treatment. This is a demographic tailwind as the world population continues to age. In addition, Medtronic’s patents and strong reputation and relationship with hospitals and health insurers give it an edge over the competition, insulating its profitability. As shown below, MDT scores an A+ grade for profitability, with sector leading EBITDA and Net Income margins of 28% and 17%, respectively.

MDT Profitability (Seeking Alpha)

MDT Profitability (Seeking Alpha)

Meanwhile, MDT hasn’t been immune to the current economic downturn, as adjusted EPS declined by 17% YoY to $1.13 and organic revenue declined by 4% YoY in its first quarter 2023 (ended on July 29th). These results, however, were better than expected as they exceeded analyst consensus expectations. Also, before investors run for the hills, it’s worth noting that a big part of the challenges is on the supply side (rather than demand) as microchip shortages have caused disruptions, and are expected to remain challenging through the remainder of this calendar year.

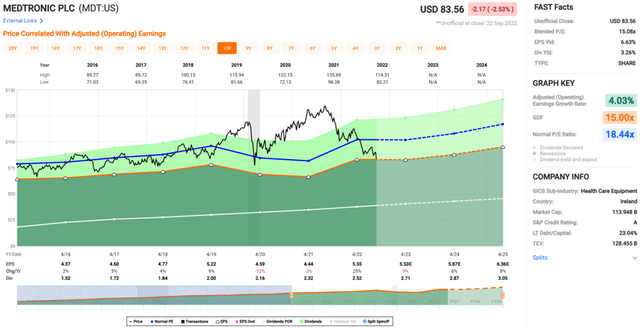

I view these concerns as being temporary in nature, as global semiconductor companies are seeking ways to ramp up capacity. This should be further boosted by the recent passage of the U.S. CHIPS Act last month, which provides $52.7 billion for American semiconductor research, development, and production. As such, I view the sell-off in MDT’s shares as being short-sighted in nature. At the current price of just $83.56, MDT carries a blended PE ratio of 15.1, sitting well below its normal PE of 18.4 over the past 8 years.

MDT Valuation (FAST Graphs)

MDT Valuation (FAST Graphs)

Moreover, MDT carries a strong A rated balance sheet, and the share price weakness has driven MDT’s dividend yield to 3.3%, which is its highest level in over a decade. The dividend is well-protected by a 48% payout ratio, and comes with a 5-year CAGR of 8%.

Looking forward, MDT continues to evolve as management positions it for ongoing healthcare reform. This was noted by Morningstar in its recent analyst report:

Medtronic has slightly shifted its strategy to include partnering more closely with its hospital clients by offering greater breadth of products and services to help hospitals operate more efficiently. By partnering more closely and integrating itself into more hospital operations, Medtronic is well positioned to take advantage of more business opportunities in the value-based reimbursement environment, in our view. In particular, Medtronic has been pioneering risk-based contracting around some of its cardiac and diabetes products, which we think is attractive to hospital clients and payers alike.

Morningstar has a $129 fair value estimate on Medtronic, and sell side analysts have a consensus Buy rating with an average price target of $107. Using the more conservative price target of $107, MDT could give a potential one-year total return of 31% including dividends.

Medtronic is a moat-worthy medical device company that is positioned to benefit from global demographic trends. While it has near-term challenges, I believe the market is overly-rotated on them, as if they are going to persist in perpetuity. Moreover, the share price weakness has driven MDT’s dividend to a decade-plus high. Given these considerations, I view MDT as being a strong buy for value-oriented total return investors.

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I’m a U.S. based financial writer with a BSc in Economics and an MBA in Finance. I have over 12 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.