Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

The following is an extract from S&P Global Market Intelligence’s latest Week Ahead Economic Preview. For the full report, please click on the ‘Download Full Report’ link.

Download full report

A wealth of economic data will be released in the coming week with S&P Global Worldwide Manufacturing PMIs set to dominate headlines and the week closing off with US non-farm payrolls. In addition, Q2 GDP updates for India, South Korea, Italy, Canada, Poland and the Czech Republic will be watched for signs of slowdowns, as the global economy continues to face drawbacks from high inflation, growing uncertainty and rising interest rates. Industrial production data for Thailand, Japan and Brazil will be released, as well as a wealth of inflation data – which are expected to confirm the persistence of high price pressures.

Markets volatility has been intensified in recent weeks by rate hikes, energy market concerns and geopolitical tensions. Hence, PMI data – released towards the end of the week – will be watched with particular interest and will offer further updates on how economies are performing as recession fears grow. Flash data last week indicated a harder hit manufacturing sector where rates of inflation and the repercussions of supply disruption persist. Flash data pointed to outright contractions in the US, Eurozone and Japan, and additional colour on the global manufacturing outlook will be sought from the manufacturing PMIs for mainland China in particular.

US non-farm payroll data will likewise be highly anticipated by markets, notably as a key recession-risk indicator. While last month data exceeded forecasts, this week markets are expecting a sharp reduction in non-farm payroll growth, with August figures predicted to come in at 290K (July: 528K).

Second quarter GDP updates provide a clearer look in the rear-view mirror, with markets set to keep an especially close eye on growth trends in Canada, South Korea, India and Italy. Growth is expected across the board, though moderations in the rate of expansion are likely to be seen, particularly in Italy.

Elsewhere, inflation data flows thick and fast with Eurozone flash figures arguably the most significant. At 8.9% in July, inflation is expected to have remained high in August. South Korea inflation figures will also be released, and like the Eurozone, rates are likely to be high.

Global manufacturing PMIs are released in the week ahead, with the data coming on the heels of some disappointing flash PMI numbers. Looking across the four largest developed economies of the US, Eurozone, Japan and the UK (the ‘G4’), output contracted according to the preliminary flash PMI data to a degree that – excluding the initial pandemic lockdowns – was the steepest since the global financial crisis in 2009. Output contracted in both manufacturing and services for a second successive month, with rates of decline accelerating.

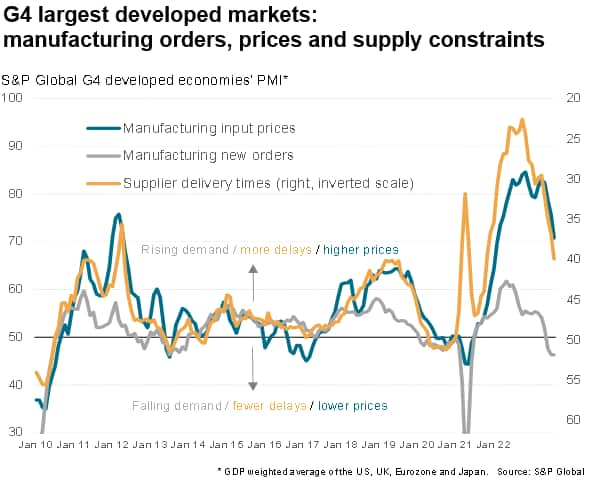

However, the surveys brought some tentative good news on the inflation front. Supply constraints, which have been a major driver of rising prices during the pandemic, showed signs of easing in August, with the number of supplier delivery delays across the G4 economies falling to the lowest since October 2020. At the same time, new orders for manufactured goods fell at one of the steepest rates seen over the past decade. This combination of falling demand-pull and supply-push inflation factors allowed industrial goods price inflation to cool sharply to an 18-month low.

The full worldwide release of PMIs will allow us to monitor these demand, supply and price developments further, with the inclusion of data for mainland China and developing APAC economies providing especially important new detail.

Monday 29 August

United Kingdom Market Holiday

Australia Retail Sales (Jul)

Japan Coincident Index Final (Jun), Unemployment rate (Jul)

Ireland Retail Sales (Jul)

Tuesday 30 August

Thailand Industrial Production (Jul)

Germany Import Prices (Jul), Inflation (Aug)

Czech Republic GDP (Q2)

Spain Inflation Rate (Aug), Business Confidence (Aug)

Switzerland KOF Leading Indicators (Aug)

United Kingdom Mortgage Approvals (Jul)

Eurozone Consumer Confidence Final (Aug)

US House Price Index (Jun),

US Conference Board Consumer Confidence (Aug)

Wednesday 31 August

South Korea Industrial Production (Jul)

Japan Industrial Production (Jul)

China NBS Manufacturing PMI (Aug)

France Inflation Rate (Aug)

Germany Unemployment Rate (Aug)

Poland GDP Growth Rate (Q2)

Hong Kong Retail Sales (Jul)

Eurozone Core Inflation Rate (Aug)

Italy Inflation Rate (Aug)

United States MBA Mortgage Applications (26 Aug),

United States ADP Employment Change (Jun)

India GDP (Q2)

Canada GDP (Q2)

Russia Unemployment Rate (Jul), GDP (Jul)

Thursday 1 September

S&P Worldwide Manufacturing PMIs*

South Korea GDP Growth Rate (Q2), Exports (Aug)

Japan Capital Spending (Q2)

Australia Home Loans (Jul)

Indonesia Inflation Rate (Aug)

Germany Retail Sales (Jul)

United Kingdom Nationwide Housing Prices (Aug)

Italy GDP Growth Rate (Q2), Unemployment Rate (Jul)

Eurozone Unemployment Rate (Jul)

Brazil GDP (Q2), Balance of Trade (Aug)

United States Jobless Claims (Aug)

Friday 2 September

South Korea Inflation (Aug)

Germany Balance of Trade (Jul)

Spain Unemployment Change (Aug)

Brazil Industrial Production (Jul)

India Balance of Trade (Jul)

United States Non-Farm Payrolls (Aug) Unemployment Rate (Aug), Factory Orders (Jul)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

** Includes Composite PMI

Worldwide Manufacturing PMIs

Following last week’s flash data – which revealed contractions in private sector activity across Australia, Japan, France, Germany and US, and a slowdown in the UK – worldwide manufacturing data will divulge further information on performance in the midst of growing economic uncertainty, falling demand, the global energy crisis and elevated price pressures. Manufacturers have been particularly hard hit by recent developments, with concerns over rising inventory levels having the potential to exacerbate any downturn in final demand.

Americas: US non-farm payrolls, factory orders and Canada Q2 GDP

In the US, the highlight of the week will be the monthly employment report. July data saw a higher than forecast rise in US non-farm payrolls, but jobs growth is expected to moderate sharply down from 528k in July to 290k in August. US factory orders will be released shortly after and add more colour as to how the manufacturing sector performed in July after worse-than-expected durable goods orders (which were flat, falling short of the consensus expectation of +0.5%). Also watch out for consumer confidence data form the Conference Board and house price data, both view to assessing the impact of rising interest rates.

Elsewhere in the region, Canada sees a Q2 GDP update which should signal growth.

Europe: Eurozone CPI, Italy and Poland Q2 GDP, Germany Inflation Retail Sales and Unemployment

A great deal of significant economic releases is scheduled for Europe this week, with Italy, Poland and Czech Republic all releasing Q2 GDP figures. Growth is expected to moderate in all three, though in the Czech Republic forecasters expect only a 0.2% expansion.

Inflation, retail sales and trade data for Europe’s largest economy – Germany – will shed further light on economic performance. Recent data has shown inflation and unemployment rates rising while retail sales contracted sharply. The eurozone also sees important updates to inflation and the unemployment rates.

Asia-Pacific: India and South Korea Q2 GDP, Japan Industrial Production and Indonesia Inflation

India and South Korea Q2 GDP updates will take centre stage this week. Inflation data will also shed light on the prices front in South Korea, where inflation figures have remained high. Indonesia also sees inflation figures released.

In Japan, unemployment figures, industrial production and consumer confidence data will all be released.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

RT @SPGlobalPMI: #Eurozone flash #PMI dropped to 49.2 in August (Jul: 49.9), signalling a reduction in business activity as the cost-of-liv…

Flash US #PMI Composite Output Index at 45.0 in August (July: 47.7), hit a 27-month low due to weakening customer… https://t.co/q0tIOT5GEZ

This has left the New Orders to Inventories Ratio at a level which has only been lower during the global financial… https://t.co/hmOoqcLFlh

Within the detail of the August flash data for the #eurozone, manufacturing #stocks of finished goods rose at a fre… https://t.co/YdQM58mGah