The Magic of Compound Interest: How Money Grows While You Sleep

Most people believe wealth is built by working harder or earning more. But the truly wealthy understand a quieter force: compound interest — money that earns money, which then earns even more money.

Compound interest is simple in concept but breathtaking in result. When your investment grows, future gains are calculated not only on your original amount, but also on all previous gains. Over time, this creates an exponential snowball effect.

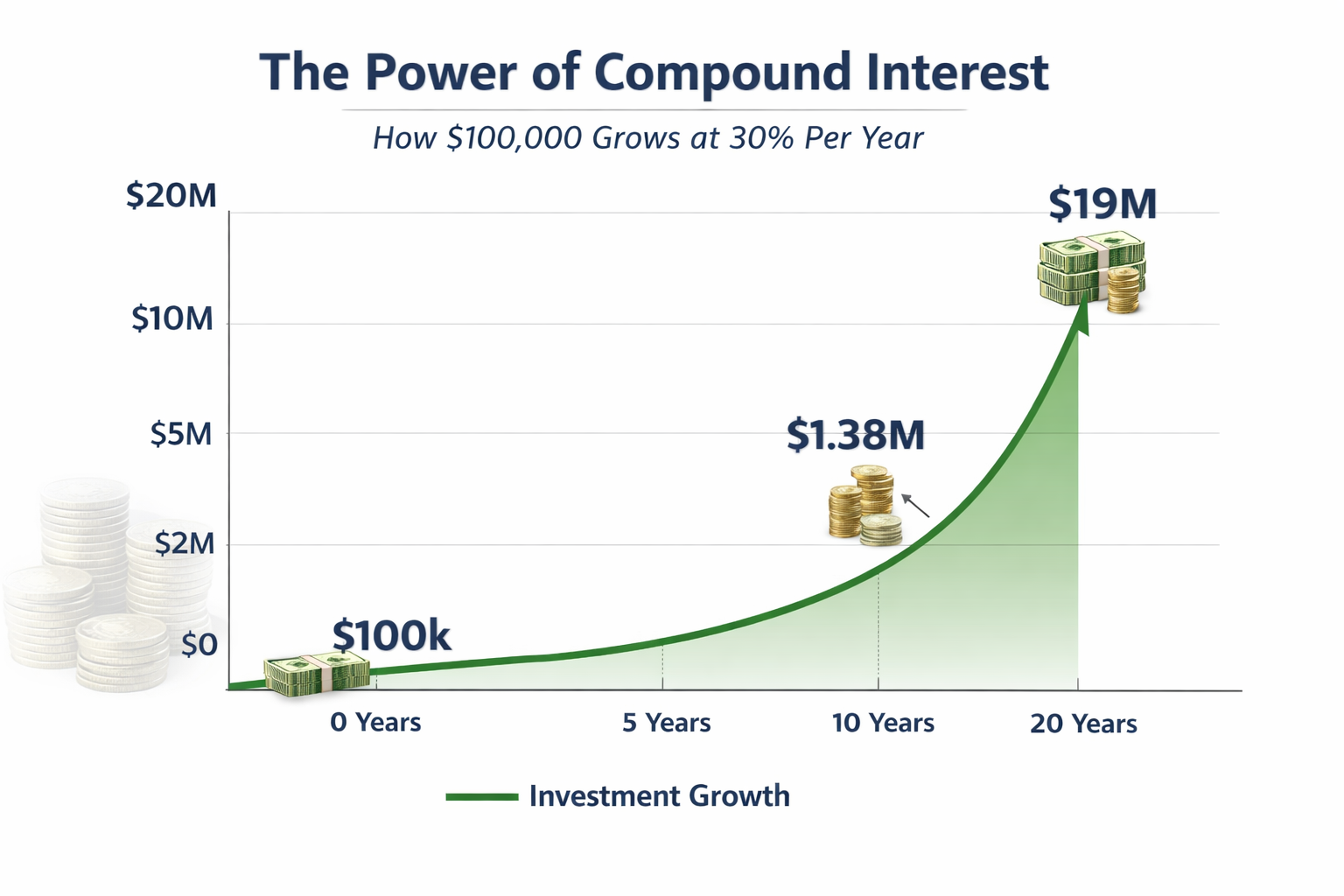

Let’s look at a real example.

Imagine you invest $100,000 into a high-growth market — for example, semiconductor ETFs, which have achieved average annual returns near 30% during strong cycles. Assume no additional contributions. Just time.

At 30% annual growth:

• After 10 years, $100,000 becomes $1.38 million

• After 20 years, that same $100,000 becomes $19 million

No extra deposits. No trading. No extra effort. Just patience.

In the early years, the growth feels slow. But after enough time passes, the curve turns nearly vertical. This is why time in the market beats timing the market.

Starting early matters more than starting big. A modest investment given enough time can outperform a large investment started late.

Albert Einstein reportedly called compound interest the “eighth wonder of the world.” Whether he said it or not, the math speaks for itself. The longer your money stays invested, the harder it works — silently compounding day after day.

Try It Yourself: Compound Interest Calculator

Use the calculator below to see how your own investment can grow over time.

Why WealthSanta Teaches This

Building wealth doesn’t require secret tricks. It requires understanding powerful principles and letting them work for you.

Compound interest is one of those principles.

And once you truly see it, you never look at money the same way again.