bjdlzx

bjdlzx

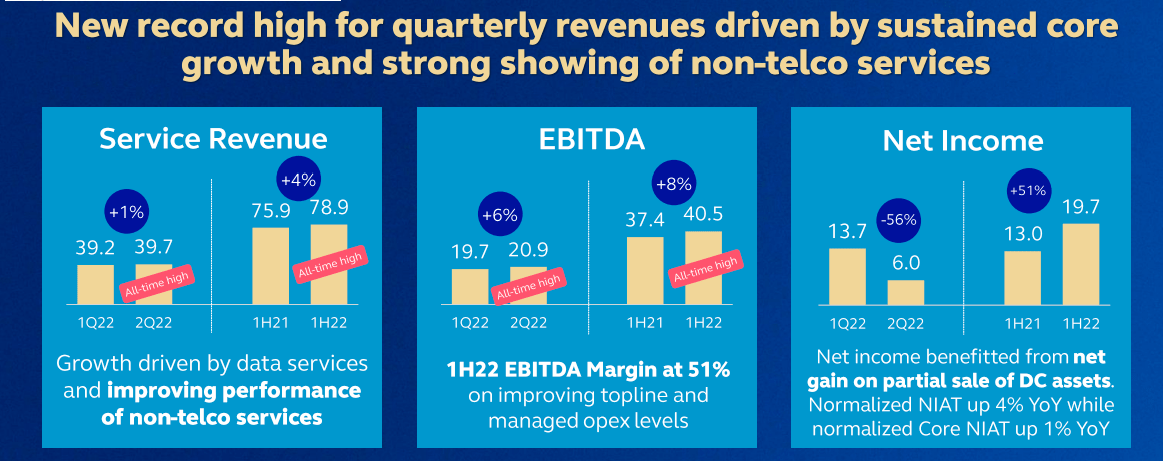

Globe Telecom (OTCPK:GTMEF) (OTCPK:GTMEY) is setting record revenues and continues to be profitable by maintaining its strong position in the telecommunications industry in the Philippines, with PLDT (PHI) being only its significant rival. They are expanding their growth opportunities through non-telco services, which can be sustainable in the future due to the increasing number of subscribers, better profitability, and good marketing efforts.

Globe Investor Presentation

Globe Investor Presentation

Globe closed the first half of 2022 with record service revenues of P78.9 billion, an increase of 4% from last year’s performance of P75.9 billion. The strong revenue performance was above the growth rates before the pandemic by contributing data-related products and services across mobile and corporate data, accumulating 81% of total service revenues, compared to last year’s performance of 79%.

The Mobile Business revenues had a slight year-over-year increase of 3%, reaching P54 billion from last year’s performance of P52.6 billion. The growth came from prepaid brands caused by the easing of pandemic-related restrictions in the country (I think online classes also played a role in increased mobile revenues). The mobile customer base grew 7% or 87.4 million compared to the previous year. On a quarter-on-quarter basis, mobile revenues rose by 1%.

However, the Home Broadband Business showed a 5% year-over-year decline from P14.5 billion in H1’21 to only P13.8 billion in H2’22 (it’s still up by 31% compared to pre-pandemic levels). This is caused by HPW (Home Prepaid Wi-fi) subscribers migrating to Fiber.

The Corporate Data service revenue grew 21% year-over-year from the P6.7 billion reported H1’21 (mostly from information and communication technology) [ICT] and international leased line services. On a quarterly basis, Corporate Data revenue increased by 8% compared to last quarter. Fixed line voice revenues showed a YoY and quarterly decrease of 14% and 8%, respectively. I think the reduction is caused by normalized phone usage for communications and lesser fixed-line voice usage.

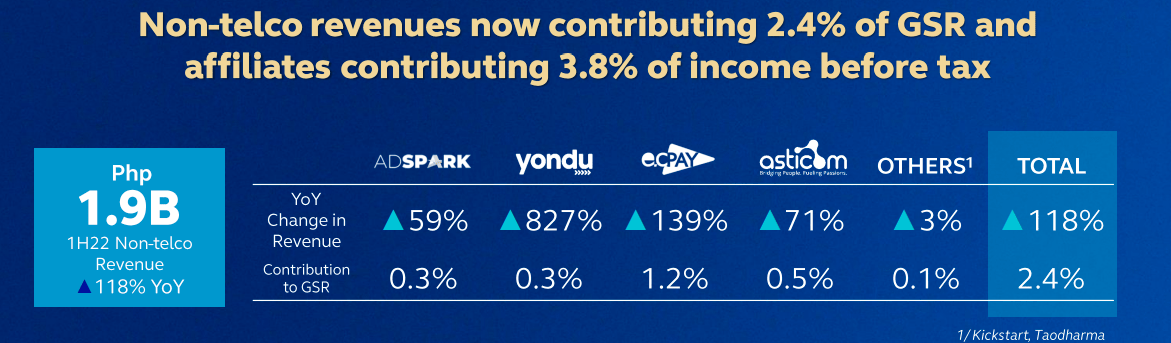

Globe Investor Presentation

Globe Investor Presentation

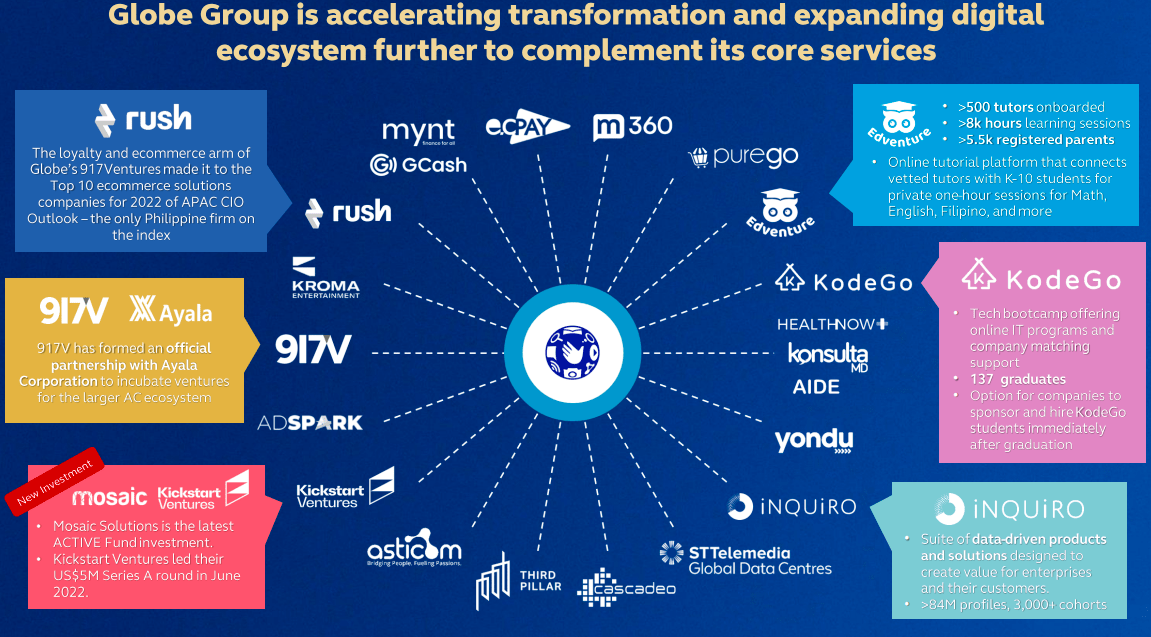

Globe also had tremendous growth in Non-Telco Businesses, with its revenue increasing by 118% or P1.9 billion in H1’22 compared to last year’s P853 million. The main growth drivers in their Non-Telco businesses are Adspark, Yondu, and Asticom (we’ll get to them later). On a quarterly basis, Non-Telco revenues grew by 37%.

Overall, I think that Globe has been a prominent player in the telecommunications industry. They are a mature business, so I don’t expect to see the company having a double-digit revenue increase. Instead, I think the company can further expand on digitalization, a growing market in the Philippines.

I think companies like Globe and PLDT will be the pioneers in improving the digital lifestyle of Filipinos while fairly implementing monetization strategies through their non-telco services. Considering that Globe is a prominent player in the communications sector, I think that they are taking a step in the right direction when it comes to improving its revenue mix by expanding growth opportunities in digitalization by offering various fintech, health tech, ad tech, and e-commerce services to Filipinos, capitalizing on rapid digital consumer digital adoption.

Globe has a lot of non-telco products and services that they currently offer to the Philippine masses. Globe offers diverse high-growth enterprises in fintech, health tech, ad tech, and e-commerce, which leads me to conclude that this will be the primary growth driver for Globe in the following years.

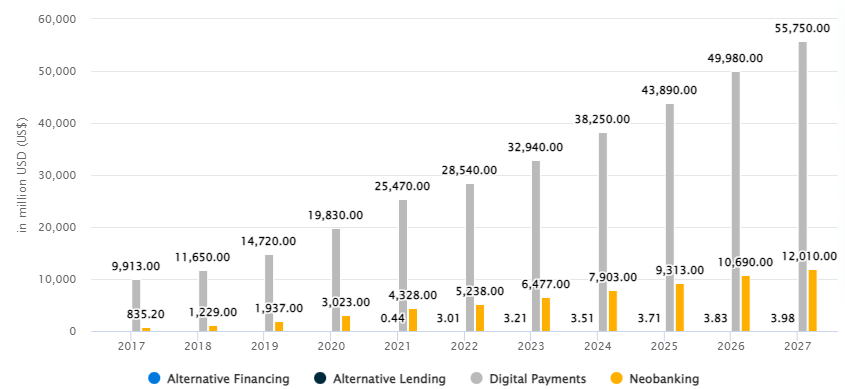

Fintech Transactions in the Philippines – Data by Statista

Fintech Transactions in the Philippines – Data by Statista

The digital market in the Philippines is still growing, and revenues in these markets are increasing. If the US has PayPal (PYPL), the Philippines has Gcash and PayMaya (PLDT’s counterpart for Gcash). In 2021 alone, FinTech transaction value in the Philippines was about $25.4 billion. Globe is making it easy for its subscribers by making its services available through its app, Gcash, or non-telco businesses.

I think Globe’s expansion to this non-telco will add more revenue for the company. I believe these diverse businesses will improve its revenue mix and give a better digital lifestyle for Filipinos and, more specifically, Globe users.

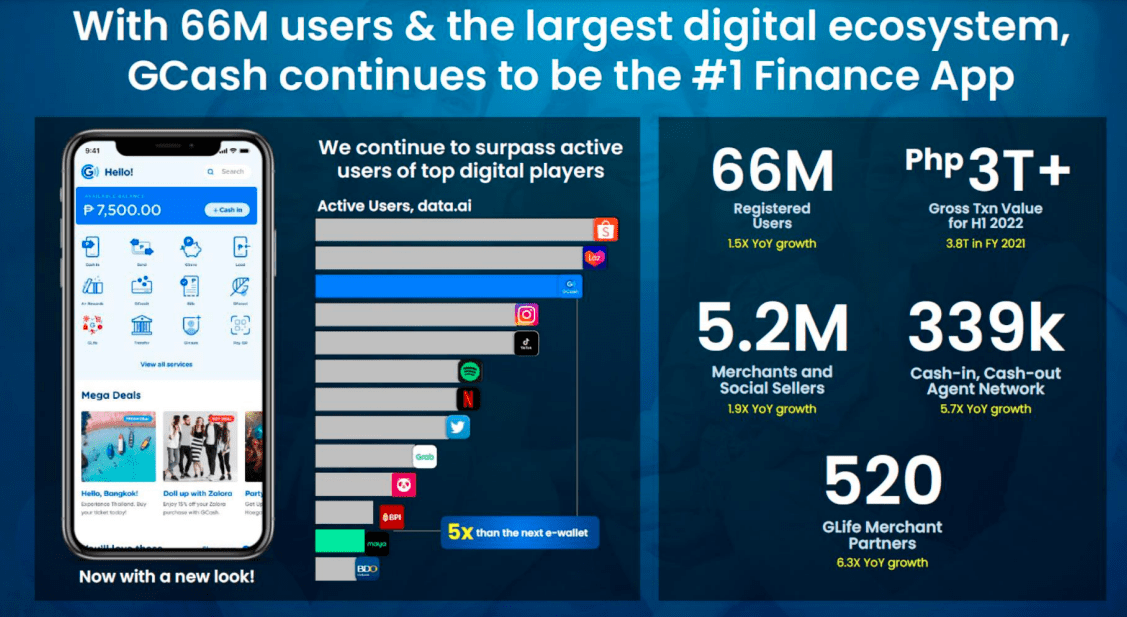

Globe Investor Presentation

Globe Investor Presentation

Globe has Gcash, the number 1 financial app in the Philippines. According to Globe, “customers can easily purchase prepaid airtime; pay bills nationwide; send and receive money anywhere in the Philippines, even to other bank accounts; purchase from their partner merchants and social sellers; and get access to savings, credit, insurance and invest money, all at the convenience of their smartphones.”

I think that Gcash makes digital payments much more accessible without needing credit cards. Gcash is under 917Ventures, Globe’s corporate venture builder that ideates, launches, accelerates, and scales new business ideas that have the potential to grow. These are the following services that Gcash offers, according to Globe:

Bank Transfer – experience easy, convenient, and secure fund transfers to over 40 banks instantly anytime, anywhere.

GCash Padala – Affordable, fast and easy way to send money even to non-GCash users.

GGives – Buy now, pay later in affordable installments with GGives. Shop up to Php 30,000 in our partnered merchants and enjoy flexible payments with low-interest rates.

GInsure – Stay protected and be financially covered with GInsure. Get affordable insurance in a few taps inside the GCash App.

GCash Pera Outlet – Be a GCash Partner Outlet

GCredit – Extend your budget with GCredit! Gain access to your own credit line.

GLoan – GCash Loan gives you pre-approved access to up to Php 25,000 cash loans instantly. No collateral needed and get the freedom to choose your payment terms.

Invest Money [GInvest] – Grow your money for as low as Php50. Invest in funds managed by our partner providers.

Save Money [GSave] – Save for your future wisely. Make your #IponGoals possible with GSave conveniently in your mobile phone. Open your account, deposit and withdraw all inside the GCash App.

Book Movies – No more lining up at the cinema. Choose your seats and buy tickets in real-time for movies showing at major cinemas.

Buy Load – Purchase regular airtime load or load combos anytime, anywhere.

Game Credits– Whether it’s for powering up or getting an extra life. Purchase Game Credits on GCash with no extra charges.

GForest – Collect green energy in GCash Forest by switching to green activities and reducing your carbon footprint.

GLife – Shop for everything you want and need from your favorite brands in one super life app, GLife.

KKB – Split any bill with friends whether they have GCash or not. Request, track, and send payments with ease.

Pay Bills – Skip the lines and pay your bills to over 400+ billers even on-the-go.

Pay QR – Shop and dine at over 70,000 stores nationwide with just your phone.

Request Money – Whether you’re short on cash or need payment from someone, collect any amount by requesting money from anyone on GCash.

Send Gift – Send “aguinaldo” (Filipino term for gift)to multiple people in one go. Give or set randomized amounts of money as your “pamasko” (Christmas gift) to your friends and family using Gcash.

Send Money – Transfer money securely to GCash users for free.

Send with a Clip – Send money and attach photos, videos, voice recordings, and themes for that personalized touch.

Shop Online – Experience the convenience of online shopping even without a credit card.

Globe Investor Presentation

Globe Investor Presentation

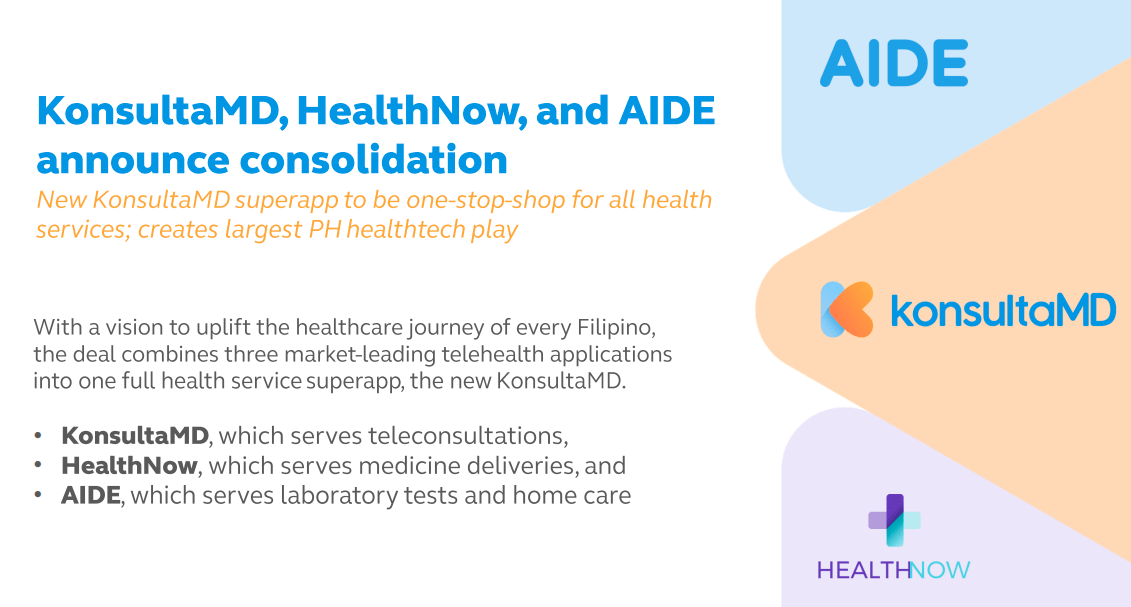

However, that was only Gcash, Globe’s financial app with over 66 million registered users and 5.2 million merchants and social sellers with around 520 GLife merchant partners. Gcash is an e-wallet with a full suite of financial services. They also have KonsultaMD, a telehealth company in the Philippines, providing affordable healthcare services to Filipinos for the last five years. KonsultaMD helps democratize health for all Filipinos everywhere.

The company’s non-telco services increased by 118%, and I think it’ll only continue to increase once the digital markets in the Philippines increase over time. I believe that the teleservices market will only continue to increase due to rapid growth in the adoption of digital media and better automation.

Globe Investor Presentation

Globe Investor Presentation

Here are some of the services that Globe offers aside from KonsultaMD and Gcash:

HealthNow – Primary care provider in the Philippines in collaboration between 917Ventures and ACHealth.

AdSpark – Largest locally-based ad agency in the Philippines.

RUSH – Leading SaaS providers in the Philippines.

PureGo – Affordable online grocery shopping made easy, a collaboration between 917Ventures and Puregold (OTCPK:PGCMF), one of the largest supermarket chains in the Philippines.

M360 – Advanced customer campaign solutions by boosting brand awareness.

Inquiro – Enriches customer data with online and offline attributes from over 80 million anonymized consumer profiles.

KodeGo – Study now, pay later tech school offering bootcamps on different IT courses to equip beginners and career shifters with critical and highly sought-after skills.

EdVenture – Online learning platform that provides support to parents, teachers, and school stakeholders.

Electronic Commerce Payments Inc. [ECPay] – Globe owns 77% equity interest in ECPay. ECPay helps stimulate growth for small business owners with a platform to offer more products and services.

Asticom Technology, Inc. – Staffing and managed services solutions company.

Kickstart Ventures, Inc. – Globe’s corporate venture capital arm has $255 million in aggregate assets under management and $2.4 million in 2012, funding 56 investments across 7 countries.

These companies could potentially increase Globe’s revenue stream even further while solidifying itself as one of the pioneers in improving the Philippines’ digital lifestyle. Currently, Maya and Gcash are the available financial apps in the Philippines, and if Globe successfully executes all its digital products and services, the company could match its revenues in the telecommunication industry.

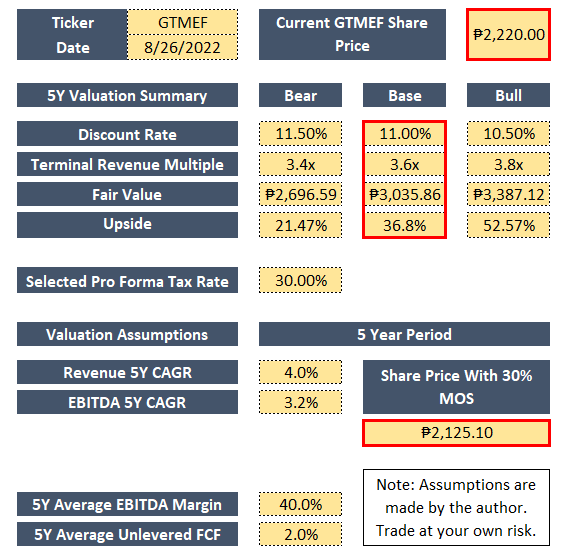

Author – 5Y DCF Revenue Exit

Author – 5Y DCF Revenue Exit

For the company’s valuation, I used the 5Y DCF Revenue Exit method in valuing Globe. I used 11% for the base case calculated from Globe’s WACC for the discount rate. I then used the terminal revenue multiple of 3.6x from the company’s historical performance. I used a pro forma tax rate of 30%, a 5Y Revenue CAGR of 4%, and a 5Y EBITDA CAGR of 3.2%, assuming that the company will continue to have an EBITDA margin of 40%. I think that Globe is a profitable stock and has a fair value of P3,035. Add a MOS of 30%; then we’d have a stock price of P2,125 which is relatively close to today’s share price of P2,220. I rate the stock as a Buy because of its growth opportunities in pursuing digitalization and the company’s potential to be one of the pioneers in digital lifestyle services in the Philippines.

I think risks that can affect Globe’s performance has something to do with a weaker Philippine Peso (involving foreign exchange) and its race with PLDT. PLDT, similar to Globe, has Maya (formerly known as PayMaya), another leading financial app in the Philippines. Although PLDT and Globe are a duopoly combination in the telecommunications market in the Philippines, I also think that their race to be the best financial lifestyle product, service, and solutions provider can affect Globe’s performance.

I think that Globe is in the right direction when pursuing digitalization and has a clear vision of improving Filipinos’ digital lifestyles. With the rapid growth in the digital markets and growth in the adoption of digitalization, Globe could easily be the number 1 digital product, service, and solutions provider. They are in an excellent position to advertise their services, and it will all come down to the company’s execution.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.