Thomas Lohnes

Thomas Lohnes

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 2nd.

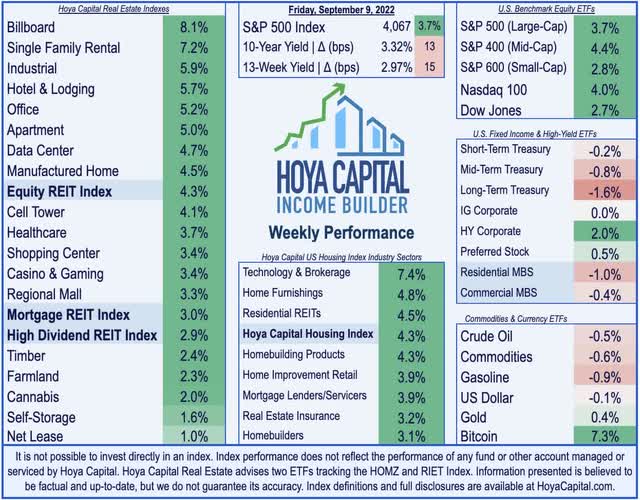

U.S. equity markets snapped a three-week skid with broad-based gains this week as domestic inflation expectations receded sharply amid a further deterioration in the demand outlook for Europe and Asia. Stuck between a rock and a hard place, the European Central Bank delivered a “jumbo” interest rate hike while slashing its forecast for the region’s economic growth amid a crippling energy crisis while China doubled down on its ‘COVID-zero’ policy with another wave of lockdowns. With persistent inflation seen as the most acute threat to U.S. markets, buyers re-emerged ahead of a critical CPI report expected to show month-over-month deflation for a second-straight month.

Hoya Capital

Hoya Capital

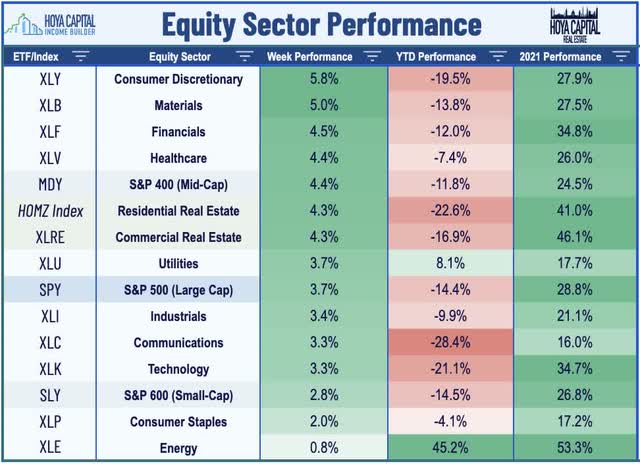

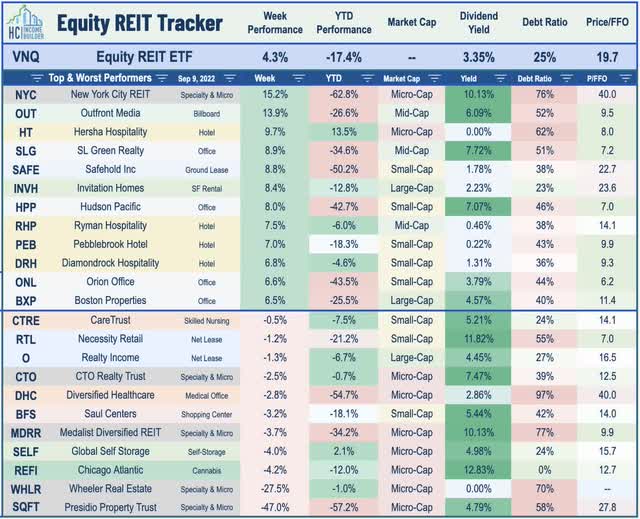

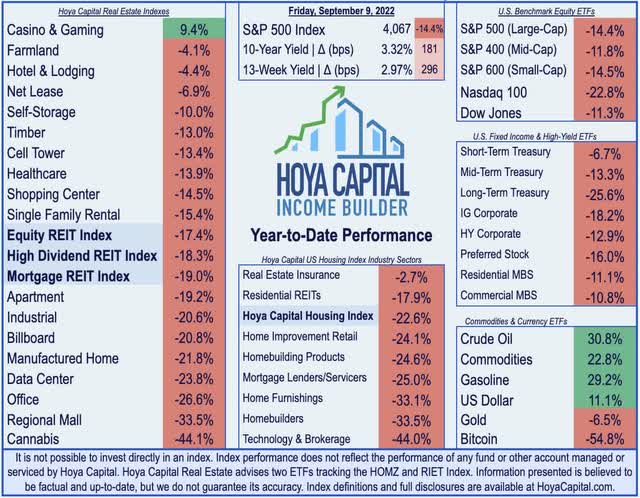

Rebounding after a three-week selloff that had erased much of the market rebound from mid-June to mid-August, the S&P 500 rallied 3.7% on the week, trimming its year-to-date declines to back under 15%. The Mid-Cap 400 rallied 4.4% while the tech-heavy Nasdaq 100 advanced 4.0%. Real estate equities were among the upside standouts of the week with the Equity REIT Index finishing higher by 4.3% on the week with all 18 property sectors in positive territory while the Mortgage REIT Index gained 3.0%. Residential REITs sparked a rebound in the broader Hoya Capital Housing Index after upbeat reports from apartment operators and signs of a potential plateau in the recent rate-driven slump in homebuyer demand.

Hoya Capital

Hoya Capital

Bond investors weren’t fully buying the positive rate outlook, however, as the 10-Year Treasury Yield jumped 13 basis points to close at 3.32% – its second highest end-of-week closing level since 2007 – as market-implied odds of another “jumbo” 75-basis-point rate hike jumped above 90% from below 50% last week. Crude Oil dipped to eight-month lows following the China lockdown reports, but pared the declines after Russia threatened to further halt oil and gas exports to Europe. Stateside, the US Dollar Index remained near two-decade highs after decent jobless claims data showing that initial unemployment claims retreated to the lowest levels since June. All eleven GICS equity sectors finished higher on the week with Consumer Discretionary (XLY) and Materials (XLB) stocks leading the advance.

Hoya Capital

Hoya Capital

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

Hoya Capital

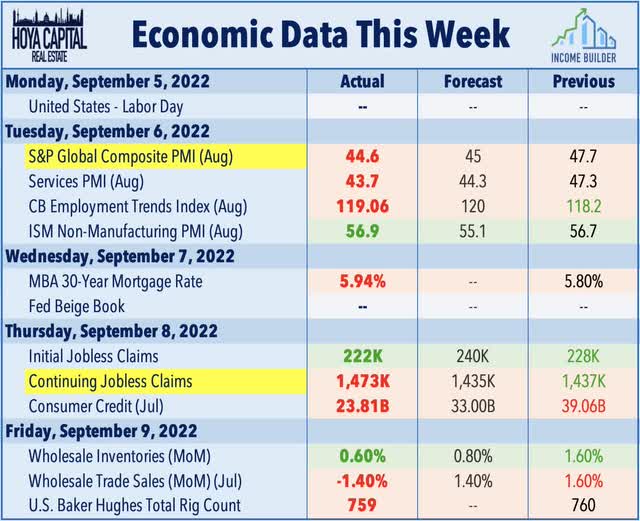

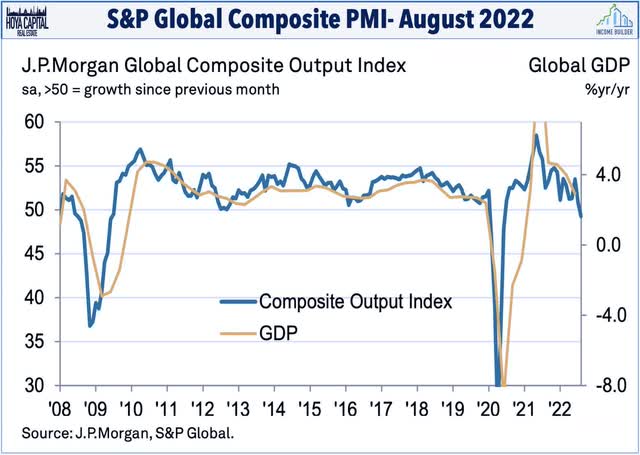

A mixed slate of PMI data highlighted a relatively quiet week of economic data. S&P Global reported this week that August saw global economic activity contract for the first time since June 2020 “as new order inflows declined, international trade volumes fell and signs of excess capacity grew.” The JPMorgan Global Composite PMI fell to 49.3 in August from 50.8 in July with output contracting in both the manufacturing and service sectors, the first time both categories have been in concurrent downturns since June 2020. S&P’s U.S. PMI report, meanwhile, showed that U.S. Services PMI Business Activity Index fell to 43.7 in August, worse than the initial “flash” estimate of 44.1 and a reading of 47.3 in July. Interestingly, a separate survey from ISM – which tends to lag the S&P metrics by 2-3 months – showed that U.S. services sector activity rose in August to the highest level since April. Given that respondents reported higher diesel and gasoline prices in the month, however, the survey period appears to reflect conditions before early July.

Hoya Capital

Hoya Capital

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

Hoya Capital

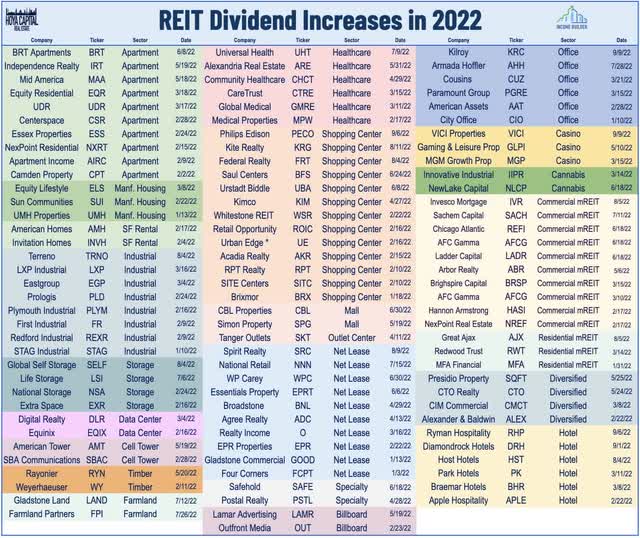

Another week, another wave of REIT dividend increases. Four more REITs raised their dividends this week, bringing the full-year total across the real estate sector to 105. Casino REIT VICI Properties (VICI) boosted its quarterly dividend by 8% to $0.39/share – following its recent pattern of hiking its dividend in the third quarter of each year since its IPO. Office REIT Kilroy Realty (KRC) raised its quarterly payout by 4% to $0.54/share – the sixth office REIT to raise its payout this year while fellow office REIT Equity Commonwealth (EQC) declared a $1.00/share special dividend. Shopping center REIT Phillips Edison (PECO) – the newest shopping center REIT that went public in 2021 – also hiked its monthly dividend by 4% to $0.0933/share. Elsewhere, Ryman Hospitality (RHP) reinstated its quarterly dividend – which had been suspended since March 2020 – at $0.10/share, the sixth hotel REIT to reinstate its dividend. Also of note, NexPoint Diversified (NXDT) – which recently converted to a REIT from a closed-end fund – announced that it is switching from a monthly to a quarterly distribution frequency.

Hoya Capital

Hoya Capital

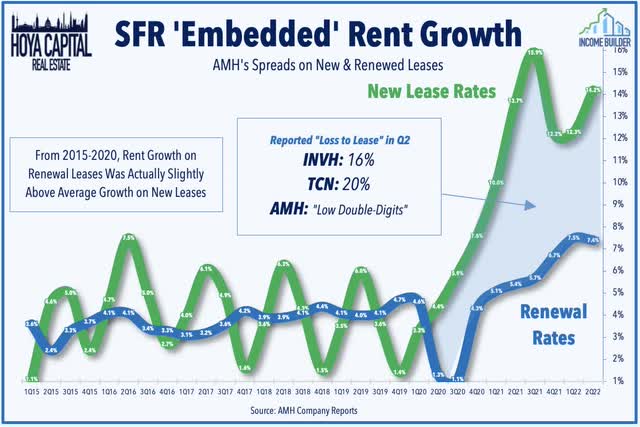

Single-Family Rentals: Invitation Homes (INVH) – which is one of our largest holdings in the REIT Dividend Growth Portfolio – rallied more than 8% on the week after S&P announced that INVH will be added to the S&P 500 Index in its upcoming quarterly rebalance alongside real estate data firm CoStar Group (CSGP). INVH – which is the nation’s largest owner of single-family rental homes. This week, we published Single Family Rental REITs: Renting the American Dream. One of the best-performing property sectors over the past quarter, SFR REITs have been beneficiaries of surging mortgage rates, which has made renting single-family homes a relative bargain. Single-family rents rose at the fastest pace on record through mid-2022, an elevated pace that has staying-power given the significant ’embedded’ rent growth resulting from below-market renewal offers as SFR REITs have “throttled” rent hikes on existing tenants. Additionally, cooling home price appreciation and tightening credit conditions have prompted many smaller SFR investors to pull back, providing a more favorable external growth environment for SFR REITs.

Hoya Capital

Hoya Capital

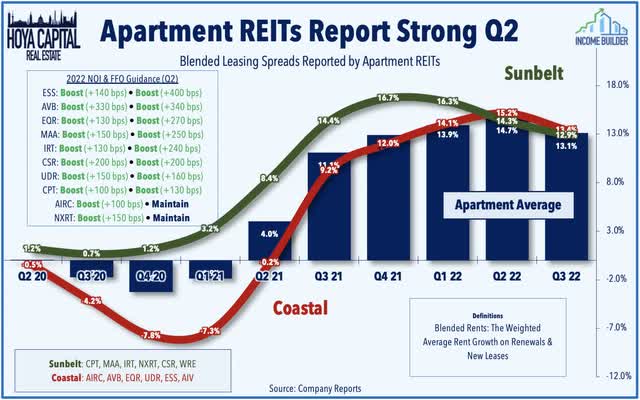

Apartment: A pair of REITs provided business updates ahead of the Bank of America Securities 2022 Global Real Estate Conference next week which showed that rent growth remains in the low-double digits despite the broader housing industry cool-down. Sunbelt-focused Camden Property (CPT) rallied more than 6% on the week after it noted that it has achieved blended rent growth of roughly 12.4% so far in Q3 – moderating from the 15.2% rate in Q2 – comprised of new lease spreads of 12.8% and renewal spreads of 11.9%. UDR (UDR) advanced nearly 6% after announcing that it achieved blended rent growth of 15.7% in July and 13.5% in August – moderating from the 17.4% achieved in Q2. Elsewhere, Equity Residential (EQR) announced plans with Toll Brothers (TOL) to develop three new luxury multifamily rental communities totaling 1,053 units in the Dallas/Ft. Worth area. EQR will invest 75% of the equity while Toll Brothers will invest 25%.

Hoya Capital

Hoya Capital

Shopping Center: Urstadt Biddle (UBA) – which we own in the REIT Focused Income Portfolio – advanced about 1% on the week reporting solid third-quarter earnings results highlighted by a 7.1% increase in renewal spreads and a 20 basis point increase in its occupancy rate to 92.1%. The company noted that its “earnings and FFO have returned to pre-pandemic levels and there is still room to grow as we fill our vacancies,” while highlighting that 87% of its properties are anchored by grocery stores, wholesale clubs or pharmacies. As noted in our recent Shopping Center REIT report Winning The Last Mile, fundamentals are now as strong – if not stronger – in the strip center sector than before the pandemic as occupancy rates climbed to the highest level since early 2015 in the most recent quarter while rental rates continue to accelerate.

Hoya Capital

Hoya Capital

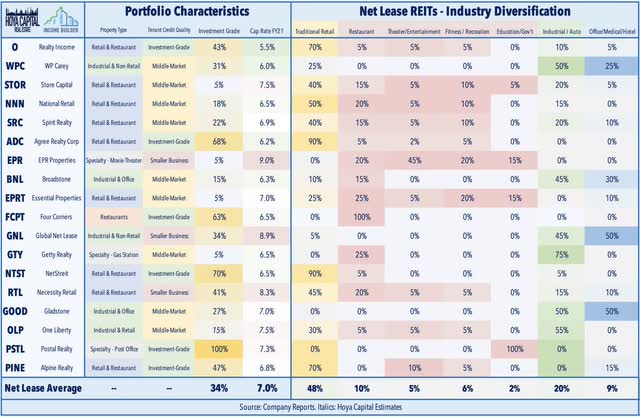

Net Lease: EPR Properties (EPR) was higher by about 4% on the week after movie theater owner Cineworld – the global No. 2 movie-theater chain and owner of Regal Cinemas – officially filed for bankruptcy in the United States. The filing comes after reports last month that the operator was struggling financially as recent box office revenues have slowed following an early summer rebound. Cineworld noted that it anticipates emerging from bankruptcy protection in early 2023, and is “confident that a comprehensive financial restructuring is in the best interests of the Group and its stakeholders, taken as a whole, in the long term.” Cineworld accounted for roughly 13% of EPR’s rents through the first half of 2022, but analysts expect the operator to continue paying rent during the proceedings, but negotiate a “haircut” of between 10% and 25%. A handful of other net lease REITs have between 1.5% and 5% of their rents coming from movie theater tenants including Realty Income (O), STORE Capital (STOR), National Retail (NNN), Essential Properties (EPRT), Spirit Realty (SRC), and Alpine Income Property (PINE).

Hoya Capital

Hoya Capital

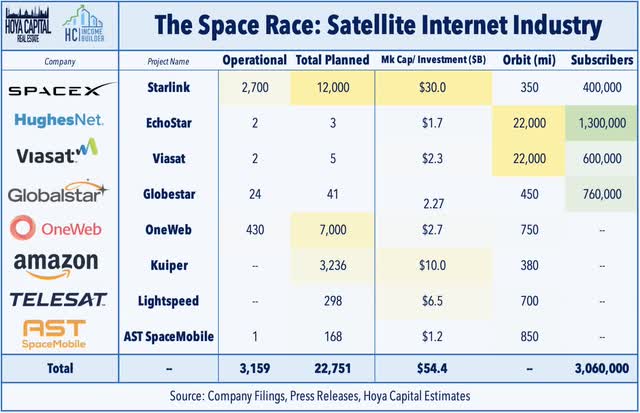

Cell Tower: Apple (AAPL) announced that its new iPhone 14 will be capable of using satellites to send emergency messages when out of cellular range utilizing the Globalstar (GSAT) network of low-earth orbit (“LEO”) satellites – a feature that had been rumored for several years. Given the power consumption requirements of satellite communications, the feature will be capable of only low-bandwidth applications for a limited amount of time and users will need to physically aim the phone at the satellite. We continue to monitor – and be impressed by – the pace of Low Earth Orbit satellite service deployment, led by Starlink and OneWeb. While there is some risk of disintermediation to towers if the mobility and power efficiency of satellite connections improves, we see a higher likelihood that LEO networks will be “customers” rather than “competitors” to tower REITs. Cell Tower REITs – American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) – were each REIT higher by about 4% on the week.

Hoya Capital

Hoya Capital

Land REITs: This week, we published Land REITs: Hedge Inflation – And Chaos. While still outperforming the REIT Index this year, timber and farmland REITs have pulled back amid cooling inflation expectations, slumping global commodity demand, and regional weather complications. As the Russia-Ukraine conflict drags on, significant global market share gains are accruing to North American producers of the disrupted agricultural products – notably lumber and grains – supporting land values. “Feast or famine” has been a theme in the farmland sector of late. Despite severe drought conditions in the West, a productive growing season in the Midwest and South has raised aggregating U.S. farm incomes to near-record highs this year. For timber REITs, lumber prices have moderated back towards pre-pandemic levels as slumping home construction demand resulting from rising rates follows a record year of profitability. The rate-driven cool-down, however, simply defers the longer-term need for increased single-family home production.

Hoya Capital

Hoya Capital

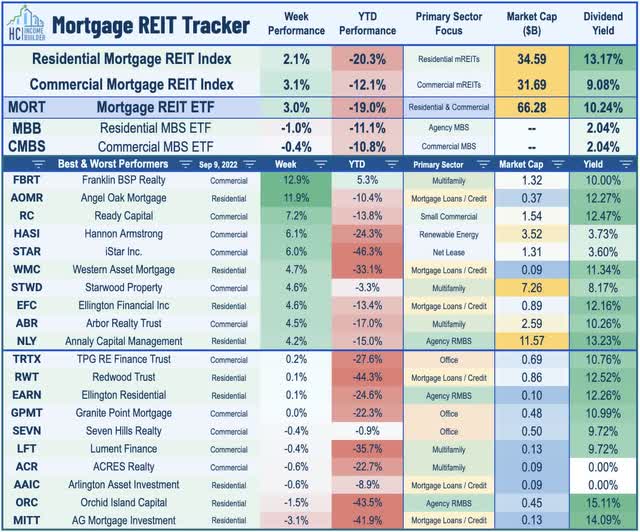

Mortgage REITs also rebounded this week despite continued pressure on mortgage-backed bond (MBB) valuations given the recent hawkish Fed commentary and the leg higher in longer-term interest rates this week. Annaly Capital (NLY) advanced about 1% on the week after S&P announced that it will be added to the S&P Mid-Cap 400 Index in its quarterly rebalance on September 19th – becoming the only mortgage REIT in the S&P Mid-Cap 400 Index. Annaly also announced that it will implement a reverse stock split of its common stock at a ratio of 1-for-4, to make its number of common shares more in line with companies of a similar market capitalization. The reverse stock split is expected to take effect after the close of business on Sept. 23, 2022. NLY also maintained its quarterly dividend of $0.88/share, consistent with the $0.22/share rate before the reverse stock split.

Hoya Capital

Hoya Capital

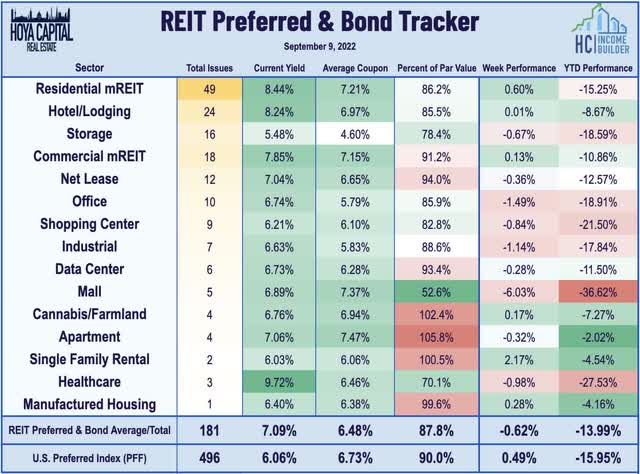

REIT Capital Raising & REIT Preferreds

The Hoya Capital REIT Preferred Index finished lower by 2.7% this week – slightly underperforming the broader iShares Preferred ETF (PFF) which declined 2.0% – and pushing its year-to-date declines back to roughly 13% on a price return basis. This week, AGNC Investment (AGNC) announced a new preferred issuance today – pricing $150M of 7.75% Series G Fixed-Rate Cumulative Redeemable Preferred Stock that will trade on Nasdaq under the symbol AGNCL beginning next week. AGNC intends to use the net proceeds to expand its portfolio and general corporate purposes which it noted may include the redemption of its 7.000% Series C (AGNCM) Fixed-to-Floating Preferred.

Hoya Capital

Hoya Capital

Nearing the end of the third quarter, Equity REITs are now lower by 17.4% on a price return basis for the year while Mortgage REITs have slipped 19.0%. This compares with the 14.4% decline on the S&P 500 and the 11.8% decline on the S&P Mid-Cap 400. Within the real estate sector, casino REITs are now the lone property sector in positive territory for the year while eight REIT sectors are lower by at least 20%. At 3.32%, the 10-Year Treasury Yield has climbed 181 basis points since the start of the year and is back within shouting distance of its recent June intra-day highs of 3.50% and above its prior post-GFC-highs of 3.25% seen back in late 2018.

Hoya Capital

Hoya Capital

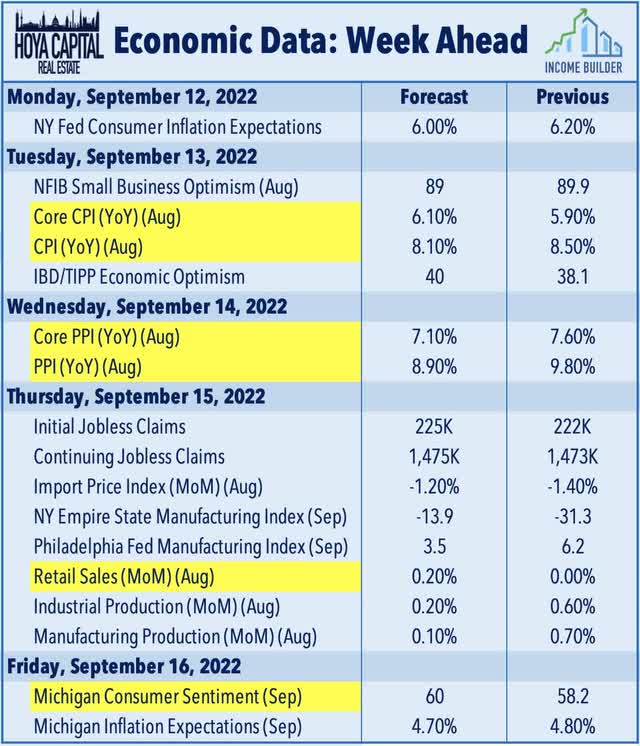

Inflation data highlight a busy week of economic data in the week ahead of the Fed’s September meeting in the following week. On Tuesday, the BLS will report the Consumer Price Index which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to decline on a month-over-month basis for a second-straight month, pulling the annual increase back down to 8.1% from the four-decade-high set in June as the effects of declining gasoline prices filter into the data. Gas prices have declined about 26% since their peak on June 13th at over $5 per gallon nationally. The following day we’ll see the Producer Price Index for August which is expected to exhibit similar trends of peaking price pressures. On Friday, we’ll get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations.

Hoya Capital

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Hoya Capital

Amid the historic market volatility – and persistent inflation – our focus at Income Builder is on real income-producing asset classes that offer the opportunity for reliable income, diversification, and inflation hedging. Get started today with a Free Two-Week Trial and you can take a look at our top ideas – including our new Landowner Portfolio – and see what we’re investing in to help build sustainable portfolio income.

Subscribers gain complete access to our investment research and our suite of trackers and income-focused portfolios targeting premium dividend yields up to 10% across real income-producing asset classes.

This article was written by

Real Estate • High Yield • Dividend Growth.

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate (“Hoya Capital”), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Hoya Capital Real Estate (“Hoya Capital”) is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, STOR, NLY, AGNC, SRC, BXMT, UBA, GTY, MGP, ACC, NNN, STWD, HIW, CCI, SPG, SBRA, DOC, ILPT, SUI, INVH, AMT, REG, DRE, CUBE, IIPR, ARE, FR, CPT, EQIX, APLE, MAA, PCH, PLD, DLR, LAMR, MDC, KRG, STAG, GLPI , NRZ, ABR, UMH, GMRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.