If soaring prices scare you about the future of your savings, Mon Petit Placement offers you the opportunity to invest in a very concrete value: real estate.

Despite the two successive increases in its interest rate, the Livret A account fails to keep up with the rate of inflation, which rose to 5.8% in August 2022. It is therefore important to invest your savings in more profitable products, able to match or beat inflation.

With its experience in financial investments on life insurance, Mon Petit Placement has designed a new solution to help your savings. The FinTech company launches the Immo portfolio, which is dedicated to real estate investments. A concrete type of investment, since it is based on something very real and stable: the stone. Above all, Mon Petit Placement has made it accessible since all you need is an envelope of 500 euros to start investing. Likewise, thanks to the promo code FRANDROID30you benefit from a 30% discount on performance commissions during your first year at Mon Petit Placement.

By choosing the Immo portfolio, investors place their money in an SCI real estate fund. This one, managed by the company Novaxia, focuses on real estate projects that recycle vacant assets. We think for example of empty offices, due to the explosion of telecommuting, which are waiting to be transformed into housing.

Concretely, it is as if your money were used to participate in the acquisition and renovation of a few square meters of tertiary surface, in order to rent them. Enough to participate on its scale in urban recycling.

Finally, Novaxia, which can boast of its SRI (sustainability and responsibility) and Finansol (solidarity finance) labels, relies on several strategies to offer a return:

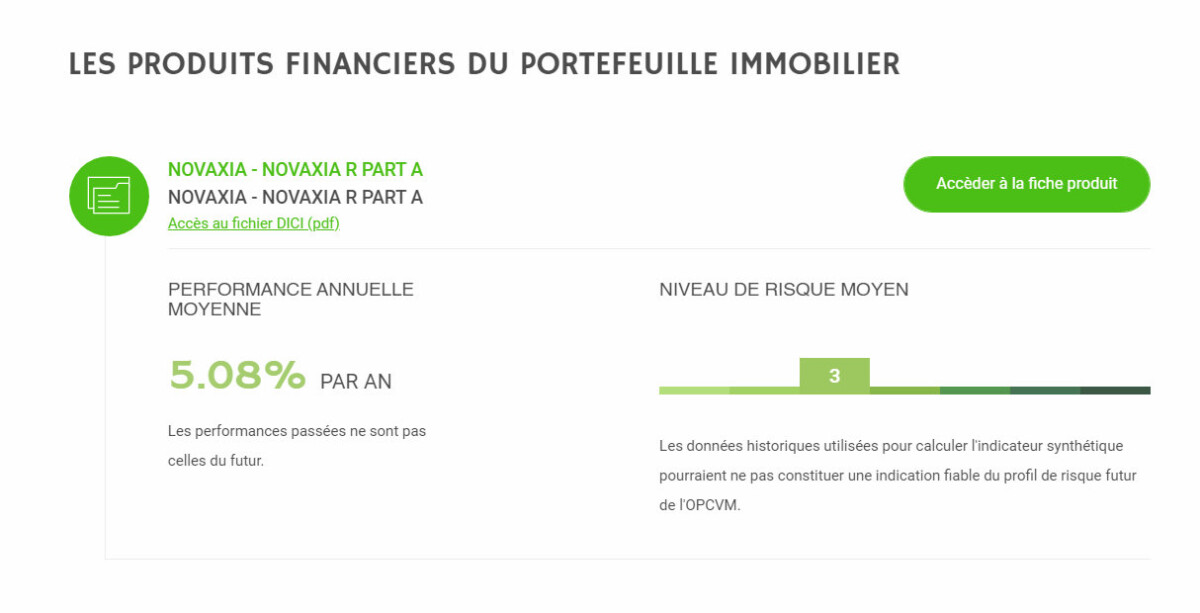

The Immo portfolio is positioned as a fund whose return is designed over the long term (from 6 to 8 years according to the advice of Mon Petit Placement). The company announces an expected annualized return of 5.08% over 8 years.

Unlike more daring investments, this portfolio represents medium risk. You can therefore invest with some peace of mind about the future of your savings.

Of course, past performance is no guarantee of future performance and such an investment presents a risk of loss of capital. It is also for this reason that Mon Petit Placement is only remunerated when your investment shows positive performance.

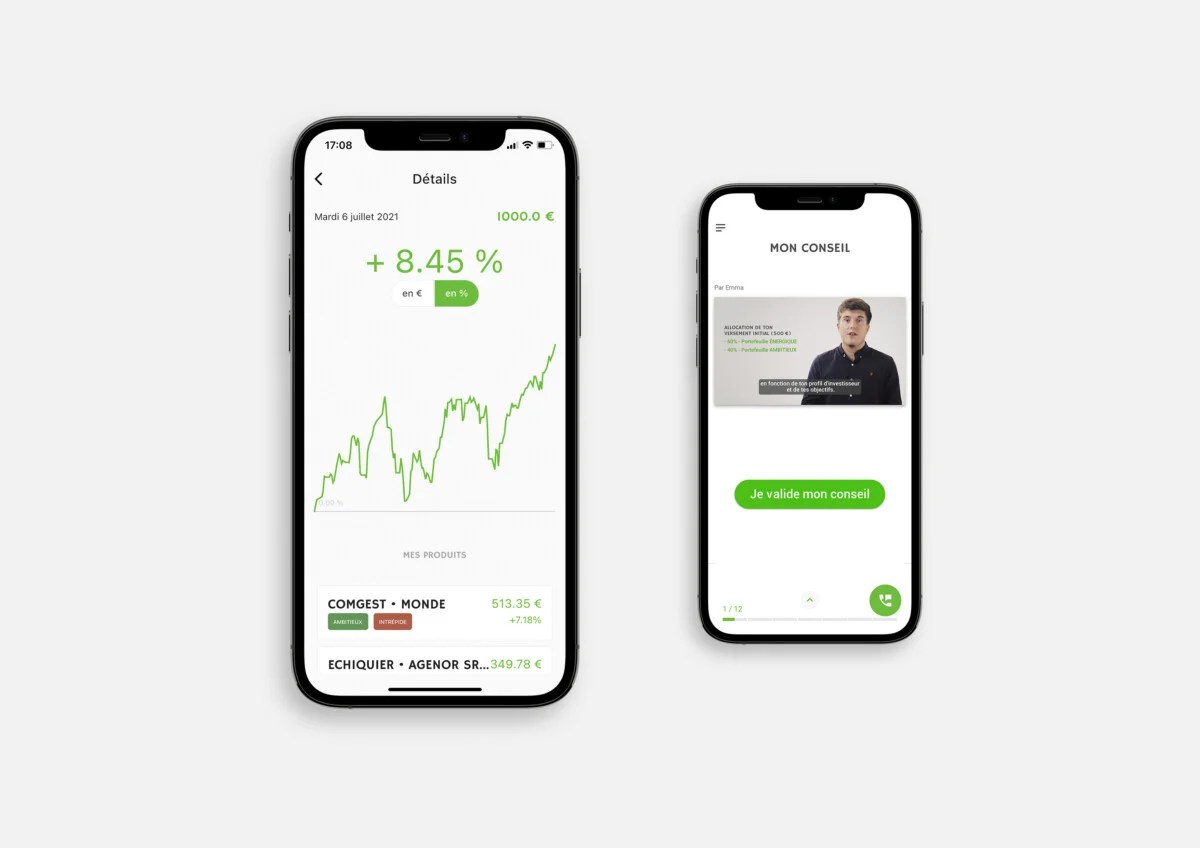

As with its classic offers, Mon Petit Placement has made the Immo portfolio a fully online service. It is accessible both on computer and on the official application (available on iOS and Android).

A choice that puts an end to the heaviness of banking administration. From now on, you will be able to consult in real time the return on your investments or contact your advisers via their chat, by email or by telephone. Finally, you can withdraw or deposit money whenever you want.

Similarly, Mon Petit Placement maintains its policy of making investment open to everyone. Thus, the Immo portfolio requires an initial investment of 500 euros, far from the thousands of euros of contribution often necessary in this type of project. Not to mention that you can benefit from 30% on performance commissions during the first year thanks to the promo code FRANDROID30.

In addition to the Immo offer, Mon Petit Placement offers its customers 4 other types of investment portfolios. They range from the most cautious to the most offensive. Understand by this that an offensive portfolio shows a potentially high return, but it is an investment that is more exposed to risk. Conversely, the most conservative portfolio has a lower return, but with a lower level of risk.

You can take advantage of products like JP Morgan or Lazard. These insurances are then placed by financial market experts. If you wish, you can also choose in areas of your choice: climate, health, new technologies, solidarity, etc.

Of course, Mon Petit Placement does not leave you alone. The company accompanies you from the moment of registration and will determine your investor profile with a questionnaire. It will then tell you which type of portfolio best suits your goals.

With rising inflation, it is normal to wonder. As for the answer, it is to the financial specialists that you must turn. That’s good, Mon Petit Placement is authorized to advise you and thus answer your doubts.

In concrete terms, Mon Petit Placement is intended as a medium- and long-term investment solution. It’s not so much the context that matters as the fact of starting as early as possible, investing gradually and regularly.

Despite being great rivals since the launch of Android, Apple and Google continue to have…

Technical characteristics of this WiFi Mesh This new WiFi Mesh system is aimed at users…

One of the features that Apple usually reserves when announcing new iPhone models is the…

Best programming languages for kids Next, we show you the best programming languages so that…

Type above and press Enter to search. Press Esc to cancel.