How much of your paycheck should you save? Although various experts will quote a percentage, asking how much you should save is like asking, “How much should I eat?”

The answer to the food question really depends on how hungry you are. (Although you should never say no to tacos and pizza.) Finances work the same way: once you know what sort of financial life you want to live, you’ll have a better idea of what you need to do to get there.

Although saving a percentage of your paycheck is a starting point, there’s much more to find the answer that works best for you.

Before you know how much you should be saving, getting a clear picture of your expenses is critical.

Rules of thumb, such as “put 10% of your paycheck away every month,” are too “one size fits all” for most people. In fact, if you put away anything, you’re already doing better than over 25% of American workers.

The reality is that someone who’s paying off large student loans is in a very different financial position from someone who has no debt and is making six figures.

So before you focus on how much to save, you should really get a handle on every aspect of your budget first. And if “budget” is the “B-word” to you, you may be surprised at how much fun (really!) it can be.

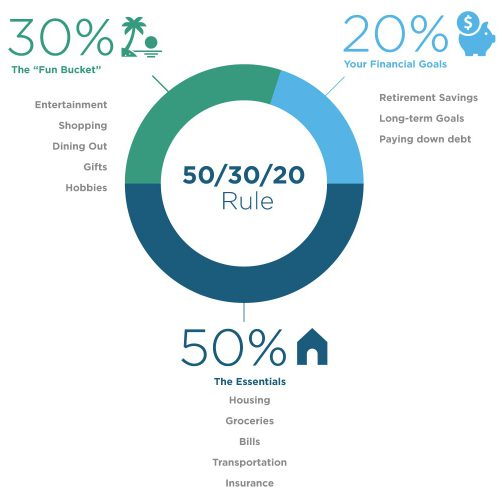

Where should you start? With the 50-30-20 Rule.

No matter how much you make and what debt and expenses you have, many experts, including the CFP® professionals at Facet Wealth, recommend allocating your income using the 50-30-20 Rule as a starting point.

Consider these as a good rule of thumb or guidelines, not rigid rules. For example, if you have no emergency savings, building an emergency fund might be a more immediate need than paying off more debt.

Once you have three months of emergency savings, then it might make more sense to save a little less and allocate more of your income towards paying off debt.

Your budget is dynamic, so you’ll probably tweak it as your circumstances and priorities change.

One of the best ways to gain peace of mind is to have a healthy emergency fund so that when a tire blows out or the roof starts leaking, the unexpected expense is annoying rather than devastating.

A recent study showed that roughly half of Americans don’t have an emergency fund that could cover a $400 expense. So, you’re ahead of the pack if you have only that much in savings—but obviously, more is always better.

For most people, a solid emergency fund should have enough to cover 3-6 months of expenses. That rule of thumb will vary, though.

If someone else in the household also provides income, you may need less in your emergency fund. On the other hand, if you’re responsible financially for someone else, such as a child, or work in a volatile industry or for a company with high turnover, you may want to set aside more.

Of course, covering unexpected financial emergencies is only part of your financial life. For example, if you’re saving for a house, investing for retirement, have an income that fluctuates and need to build a financial trust for a special needs child, you may want to save and invest more than 20% of your income (if that’s possible).

Of course, if you’re financially secure, have no debt, and a pension and Social Security will fund your retirement, you can most likely save less.

One easy calculation is determining how much of your paycheck should go into your employer’s retirement plan, such as a 401(k).

If your employer matches employee contributions up to a certain percentage, at a minimum, you should have that much deducted and invested on your behalf. Otherwise, you’re leaving “free money” from your employer on the table.

Keep in mind that very few people complain that they have too much money put away for the future. But many retirees regret that they saved too little.

Once you know how much you need to save, the next decision is where to put it.

One rule of thumb that should be religiously followed is where you save and invest.

Investing in stock-based funds is for money you won’t need for at least five years. Anything short-term, such as building an emergency fund or saving to buy a car in two years, should be in an account that pays interest.

Interest rates may be relatively low at the moment, but you need assurance that if a sudden financial need arises, you have access to the money you need.

There are five ways to earn interest that make sense for money you’ll need within the next five years.

Here’s more information on things to consider before choosing an account or savings vehicle that pays interest.

Deciding how much to save and invest while balancing your other financial needs and wants can be complicated. A CFP® professional from Facet Wealth can help you make the financial decisions that will help you live the life you want to enjoy today and tomorrow.

To learn more, schedule a free introductory call today.

Facet Wealth, Inc. is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal or tax advice. Past performance is not a guarantee of future performance.

To schedule a free consultation with a Facet expert, fill out the form below and we will contact you within 24 hours.

Learn more about the 50/30/20 Rule as a recommended starting point and savings strategy.

Here’s what you need to know about the Fed’s recent interest rate hike.

Here’s what you need to know about the inverted yield curve and what it means for you.

© Facet Wealth 2022

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.

Testimonials were provided by current clients of Facet Wealth, Inc. Clients were not compensated, nor are there material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other clients, and do not provide a guarantee of future performance success or similar services.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The client satisfaction survey was conducted over a four month period from January 2021 to April 2021 and was sent to all new clients after one and three months of service. The survey solicited client’s level of agreement that Facet is delivering on expectations outlined. Satisfaction is not an indication of current or future performance results nor is it a guarantee of similar experience.

Nerdwallet receives cash compensation for referring potential clients to Facet Wealth, Inc. The views of Nerdwallet are based on independent valuation of Facet’s services. Nerdwallet’s opinions are their own.